6月25日,比特币市场经历了显著的波动,价格出现大幅下滑。在全球数字货币市场的密切关注下,这一跌势引发了广泛的讨论和猜测。投资者、分析师以及加密货币爱好者都在探寻背后的原因,并试图预测这一趋势的未来发展。本文将为您带来比特币今日的最新行情以及大跌背后的相关消息,助您更好地理解市场动态。

Investors, analysts, and cryptographers are looking for the reasons behind this and trying to predict the future of this trend. This paper will bring you the latest developments in Bitcoin today and the relevant information behind the fall to help you better understand the dynamics of the market.

据最新的行情数据显示,比特币当前的行情价格为:$61,272.70,当前在24小时内其价格跌幅:-2.56%,约跌幅美元价格:-$1,609.79,当前24小时最高价格:$63,010.10,24小时最低价格为:$58,749.78。

According to the latest trend data, the current price of Bitcoin is $61,272.70, and its current price falls in 24 hours: -2.56 per cent, about a dollar price drop: -$1,609.79, and the current 24-hour maximum price is $63,010.10, and the 24-hour minimum price is $58,749.78.

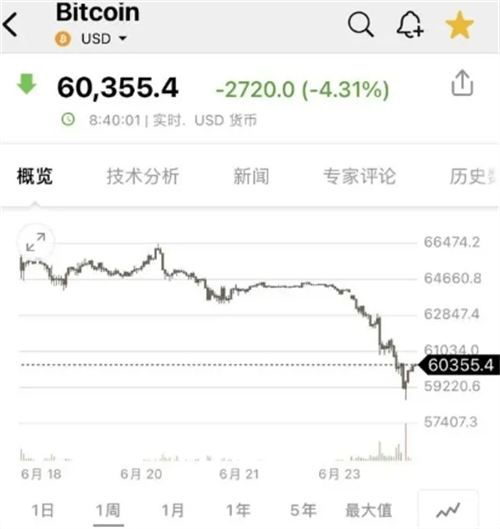

比特币在6月23日自64,602美元的高点滑落,暗示了市场空头力量的增强,他们正努力将该价位塑造为一个新的阻力区域。这一动态不仅反映了短期内市场情绪的转变,也可能预示着更深层次的趋势反转。

Bitcoin slipped from a high of $64,602 on 23 June, implying an increase in the market’s empty power, and they are trying to shape the price into a new resistance area. This dynamic not only reflects a shift in market sentiment in the short term, but may also portend a deeper reversal of the trend.

从技术指标来看,移动平均线已经形成看跌交叉,这是市场转向的一个重要信号。同时,相对强弱指数(RSI)进入超卖区域,进一步确认了空头的强势和市场可能的下行趋势。在这样的技术背景下,我们可以合理推测,比特币可能继续其下跌趋势,测试下方的支撑位。

At the same time, the relatively strong and weak index (RSI) has entered the overselling area, further confirming the strength of the empty and the likely downward trend in the market. Against this technological background, we can reasonably assume that Bitcoin may continue its downward trend and test its underlying position.

BTC/USDT货币对下一步可能会触及60,000美元这一关键支撑水平。此价位在历史上曾多次证明其稳固性,因此有望吸引多头资金的介入,从而引发一轮反弹。然而,任何由此产生的反弹都可能在面对20日均线(当前位于65,687美元附近)时遭遇阻力,若无法有效突破,价格可能再次回落。

The BTC/USDT currency is likely to reach the key support level of $60,000 for the next step. This price has proved to be solid on many occasions in history, and is therefore expected to attract a multiplicity of funds to intervene, thus triggering a rebound. However, any resulting rebound may encounter resistance in the face of the 20-day average (currently around $65,687) and prices may fall again if they do not make an effective breakthrough.

如果比特币价格从20日均线处再次受阻并下跌,那么市场可能会进一步下探至56,552美元甚至更低。这种情况下,空头将继续掌控市场节奏,投资者应警惕可能的进一步下跌风险。

If the price of bitcoin is again blocked and falling from the 20-day average, the market is likely to go further down to $56,552 or even lower. In such cases, the market rhythm will continue to be controlled by empty positions, and investors should be wary of possible further downside risks.

当然,市场总是充满变数。一个值得关注的强势信号是比特币能否突破并稳定收盘于移动平均线上方。若能实现这一点,可能预示着市场情绪的转变,多头有望重新掌握主动权,推动BTC/USDT货币对向70,000美元甚至72,000美元的高点迈进。

Of course, the market is always variable. A strong sign of concern is whether Bitcoins can break through and stabilize the close above the moving mean line. If this happens, it may signal a shift in market sentiment, with many hoping to regain ownership and push the BTC/USDT currency up to $70,000, or even $72,000.

1.Mt. Gox 和德国政府加大比特币抛售力度

1. Mt. Gox and the German government increase their sales of bitcoin

6月24日,随着已破产的加密货币交易所Mt. Gox宣布计划向2014年黑客事件的受害者返还超过14万个BTC,并从7月开始执行,比特币(BTC)价格继续经历调整。这一消息引发了市场的看跌情绪,投资者对比特币的未来走势持谨慎态度。

On June 24, with the planned return of more than 140,000 BTCs to the victims of the hacking in 2014, announced by Mt. Gox, the bankrupt currency exchange, which began in July, the prices of Bitcoin (BTC) continued to be adjusted. The news triggered market perceptions, and investors were cautious about the future of Bitcoin.

据了解,Mt. Gox约有12.7万名债权人,他们因黑客攻击而损失了价值超过94亿美元的比特币。这些债权人已经等待了十多年,才有望收回他们的资金。然而,由于比特币的价格自2014年以来已经飙升了超过8000%,因此,一旦这些债权人收到返还的BTC,他们可能会选择在当前高位套现,这无疑会给市场带来巨大的抛售压力。

It is understood that Mt. Gox has about 127,000 creditors who have lost over $9.4 billion in bitcoins as a result of hacking attacks. These creditors have waited for more than a decade to recover their funds. However, since the price of Bitcoins has soared by over 8,000% since 2014, these creditors may have chosen to sell at the current height once they have received the returned BTC, which will undoubtedly put enormous pressure on the market.

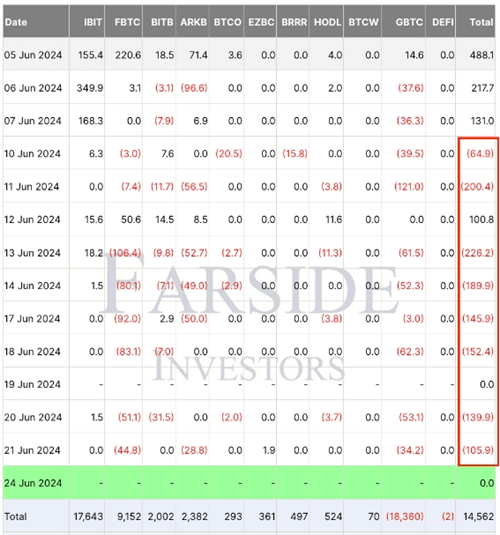

彭博社的高级ETF分析师Eric Balchunas对此表示担忧,他认为这一返还计划可能会对市场造成显著影响,甚至可能抵消大量的ETF流入。他在社交媒体平台上写道:“这就像是超过一半的ETF流入量一下子被抵消了,情况不容乐观。”

Eric Balchunas, a senior ETF analyst at Bloomberg, expressed concern that the return plan could have a significant impact on the market and could even offset a large influx of ETFs. He wrote on social media platforms: "It's like more than half of the ETF inflows have been reversed, and the situation is not encouraging."

同时,知名交易员Daan Crypto Trades也持类似观点,认为Mt. Gox的偿还计划将对BTC价格产生深远影响。此外,根据Arkham Intelligence的情报,德国政府的一个钱包在6月19日转移了近6500个BTC,这可能进一步加剧市场的抛售压力。自2024年2月以来,该钱包已持有近5万个BTC,按当前市场价格计算,价值超过30亿美元。

At the same time, the well-known trader, Daan Crypto Trades, shares the view that Mt. Gox’s repayment plan will have far-reaching implications for BTC prices. Moreover, according to Arkham Intelligence, a German government purse transferred nearly 6,500 BTCs on 19 June, which could further exacerbate market sales pressure. Since February 2024, the wallet has held nearly 50,000 BTCs, valued at more than $3 billion at current market prices.

综上所述,Mt. Gox的BTC返还计划以及德国政府的大规模转移,都可能对BTC市场产生重大影响。投资者应密切关注市场动态,以便做出明智的投资决策。

In summary, Mt. Gox’s BTC return plan, as well as large-scale transfers by the German government, could have a significant impact on the BTC market. Investors should pay close attention to market dynamics in order to make informed investment decisions.

2.现货比特币 ETF 资金流出持续第二周

2. Current Bitcoin ETF funds flow for the second week

在6月24日比特币(BTC)价格下跌的先兆中,美国现货比特币交易所交易基金(ETF)已经连续多日遭遇资金撤离。令人瞩目的是,这些投资工具在过去两周内资金流出额累计近11.2亿美元。

In the early signs of a fall in the prices of Bitcoin (BTC) on 24 June, the United States Current Bitcoin Exchange Trading Fund (ETF) has faced several consecutive withdrawals. It is remarkable that these investment instruments have accumulated nearly $1.12 billion in outflows over the past two weeks.

根据CoinShares的数据进一步揭示,6月17日至21日这短短几天内,比特币投资产品就有高达6.3亿美元的资金撤离,这一数字清晰地反映出“市场正在经历一场深刻的调整”。

According to CoinShares, it was further revealed that in the short few days of 17 to 21 June, an investment product of up to $630 million in Bitcoin had been withdrawn, a figure that clearly reflected “a profound restructuring of the market”.

这些ETF的资金流出与美元相对于一篮子主要外币的升值趋势不谋而合,这一现象折射出投资者避险意愿的升温。

These ETF outflows coincide with the upward trend of the United States dollar vis-à-vis a basket of major foreign currencies, a phenomenon that mirrors the rising willingness of investors to avoid risk.

美元指数(DXY),这一衡量美元对全球主要货币强弱的指标,自6月7日的103.35低点攀升至6月21日的105.5高点,累计上涨了2.07%。

The United States dollar index (DXY), an indicator of the strength of the dollar against major global currencies, climbed from a low of 103.35 on 7 June to a high of 105.5 on 21 June, a cumulative increase of 2.07 per cent.

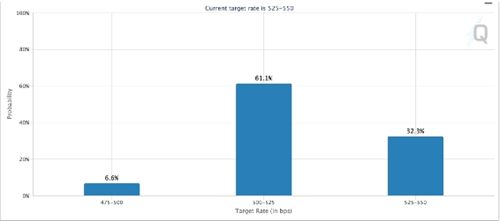

与此同时,美国和美联储发布的宏观经济数据喜忧参半,导致市场对2024年降息的预期从四次大幅下调至一次。

At the same time, macroeconomic data released by the United States and the Federal Reserve were mixed, leading to a sharp downward adjustment of market expectations for interest reductions in 2024 from four times.

芝加哥商品交易所集团(CME Group)的FedWatch工具最新数据表明,市场预期美联储将在9月而非更早时间开始降息。这一时间点对于加密货币和其他风险资产而言,具有举足轻重的意义。

The latest data from the CME Group's Fedwatch tool show that the market expects the Fed to start cutting interest rates in September rather than earlier. This point in time is important for encrypted currency and other risky assets.

在较高利率环境的预期下,持有加密货币等风险资产的吸引力降低,这种市场情绪在近期给比特币价格带来了不小的下行压力。

In anticipation of a higher interest rate environment, the attractiveness of holding risky assets, such as encrypted currencies, has been reduced, and this market sentiment has put considerable downward pressure on Bitcoin prices in the near future.

3.超过1.19亿美元的比特币多头被清算

More than $119 million in bitcoin has been liquidated

根据Coinglass的最新数据显示,在过去的24小时内,比特币衍生品市场经历了大规模的清算,总金额高达11.2891亿美元,其中多头仓位清算额达到了1.1901亿美元。在整个加密货币市场,总清算额更是攀升至2.5亿美元,而多头清算占据了其中的1.73亿美元。这一数据清晰地反映出多头仓位相对于空头仓位经历了更为广泛的清算,这无疑加剧了比特币在今日市场的疲软表现。

According to recent Coinglass data, in the last 24 hours, the Bitcoin derivatives market has undergone large-scale liquidations, amounting to $1,128.9 million, with multiple warehouse clearances amounting to $119.1 million. Throughout the crypto-currency market, total liquidations have risen to $250 million, of which multiple liquidations have accounted for $173 million. This data clearly reflects a broader liquidation of multiple warehouses compared to empty ones, which undoubtedly exacerbates Bitcoin’s weakness in today’s market today.

通常,当交易资产的价格出现急剧下跌时,多头清算就会随之发生。这是因为那些对该资产持有乐观态度并建立了多头仓位的交易者,会由于市场走势的不利而面临损失。当前比特币市场的状况正是如此,多头仓位的大规模清算进一步揭示了市场情绪的低迷。

Often, when the price of traded assets falls sharply, multiple liquidations follow. This is because traders who are optimistic about the assets and have established multiple warehouses face losses because of market movements.

此外,根据区块链数据和情报平台CryptoQuant提供的数据,6月13日,交易所中的比特币储备量出现了显著的增长。这一增长趋势表明,市场的抛售压力正在上升。

In addition, on 13 June, according to data provided by block chain data and intelligence platform CryptoQuant, there was a marked increase in Bitcoin reserves on the exchange. This trend indicates that market sales pressure is on the rise.

随着知名交易所钱包中存储的比特币数量持续增加,投资者似乎正在利用当前的价格水平进行获利了结。这一现象为比特币当前价格的下跌提供了合理的解释。在抛售压力和市场清算的双重打击下,比特币的价格表现受到了严重影响。

As the number of bitcoins stored in well-known exchanges’ wallets continues to increase, investors appear to be taking advantage of the current price levels to settle. This phenomenon provides a reasonable explanation for the current price decline in bitcoins.

6月25日上午消息,比特币兑美元汇率近日持续下滑,一度逼近6万美元关口。在过去的24小时内,比特币价格大跌超过5000美元,跌幅超过7%,甚至一度跌破59000美元,为自5月3日以来的首次。仅过去一周,比特币就累计下跌了近11%。

According to news in the morning of 25 June, the Bitcoin exchange rate against the United States dollar has continued to decline in recent days, at a close to $60,000. Over the last 24 hours, Bitcoin prices have fallen by more than $5,000, by more than 7 per cent, or even $59,000, for the first time since May 3. In the past week alone, Bitcoin has fallen by almost 11 per cent cumulatively.

这一剧烈波动再次凸显了虚拟货币炒作的高风险和高杠杆性,许多投机者因此遭受了严重损失。据Coinglass数据显示,全网加密货币在过去24小时内共有90573人爆仓,总金额高达3.75亿美元,折合人民币约27.3亿元。

This volatility has once again highlighted the high risk and leverage of virtual currency manipulation, which has caused many speculators to suffer serious losses. According to Coinglass, a total of 9,0573 Internet-wide encrypted currencies have exploded in the last 24 hours, amounting to $375 million, equivalent to approximately 2.73 billion yuan.

比特币近期的抛售压力部分来源于收入锐减的加密采矿公司。据IntoTheBlock数据显示,矿工持有的比特币数量已降至14年来最低,本月已迅速售出价值超过20亿美元的比特币。今年4月比特币挖矿奖励“减半”后,矿工收入大幅减少,许多矿工不得不停止活动。为了弥补成本,采矿公司加速了比特币的销售,这被视为导致比特币价格下跌的主要因素。

Bitcoin’s recent selling pressure is partly due to a sharp decline in revenue from encrypted mining companies. According to Into TheBlock data, miners hold the lowest number of bitcoins in 14 years, and sold quickly this month worth more than $2 billion.

同时,由于矿工活动减少,比特币的难度和哈希率均有所下降。据报道,采矿收入自奖励减半后,已从每天的平均1.07亿美元锐减至3000万美元。

At the same time, both the difficulty of Bitcoin and the Hashi rate have declined as a result of the reduction in miner activity, and mining revenues have reportedly been drastically reduced from an average of $107 million per day, after halving the incentives.

此外,据CoinShares数据显示,加密投资产品连续第二周出现资金流出,全球交易量也创下新低。研究主管James Butterfill表示,过去两周已有12亿美元的加密货币ETF资金流出,这与联邦公开市场委员会会议后的市场情绪有关。他认为,美联储对降息次数的悲观态度正在影响加密货币市场。

Moreover, according to CoinShares, funds flow from encrypted investment products for the second week in a row, and global transactions are at a new low. James Butterhill, research manager, said that $1.2 billion of encrypted currency ETF funds had flowed over the past two weeks, which was linked to market sentiment following the meeting of the Federal Open Market Committee. He argued that the Fed’s pessimistic attitude to the number of interest cuts was affecting the cryptographic currency market.

自比特币诞生以来,其价格就充满了波动性。例如,今年5月24日,比特币价格突然暴跌,接连跌破多个重要关口,给投资者带来了巨大的损失。这也再次提醒了市场,虚拟货币的风险不容忽视。

For example, on 24 May of this year, Bitcoin prices suddenly plunged and successively broke several important points, causing huge losses to investors. This reminds the market once again that the risk of virtual currency cannot be ignored.

鲸鱼游戏如何影响比特币价格

6月25日,比特币价格七周内首次失守60,000美元关口,引发广泛关注。分析人士揭露了一种被称为“鲸鱼游戏”的市场现象,指出大型投资者通过操控流动性来影响价格动态。在比特币订单簿中,近距离卖价流动性显得异常薄弱,使得价格容易被操控。

[点击阅读新闻详细内容]

双顶形态显现,比特币面临大幅下滑风险?

据6月25日消息,加密货币分析师Markus Thielen在最新报告中提出警示,从技术图表来看,比特币可能正在构筑“双顶形态”。这种技术形态往往预示着价格可能大幅下滑,跌幅可能等同于峰值与颈线间的差距,令市场参与者倍感忧虑。

[点击阅读新闻详细内容]

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论