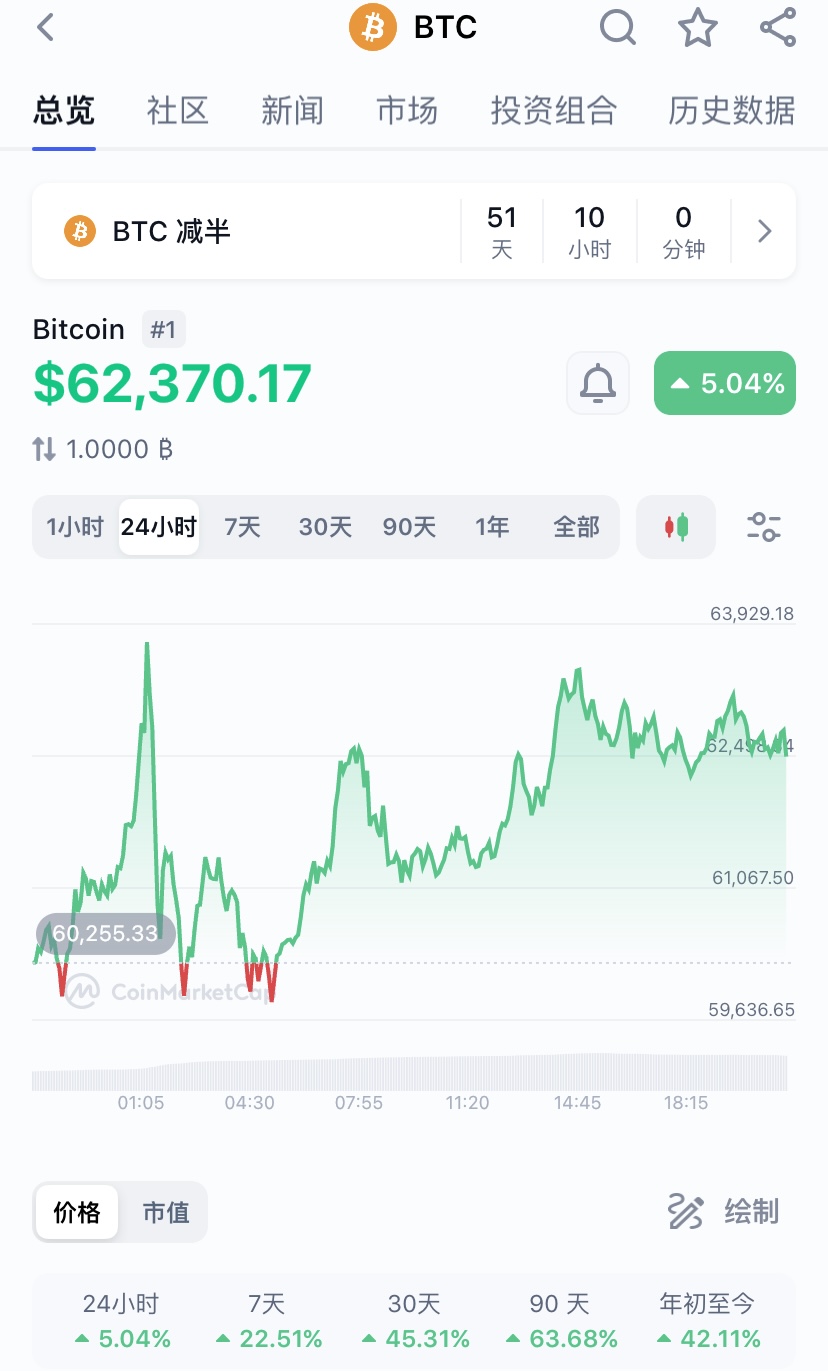

北京时间2月29日凌晨,比特币(BTC)价格一度突破64000美元,续刷2021年11月以来新高,本月迄今涨超50%,比特币总市值一度接近1.3万亿美元。截至发稿前,比特币价格有所下跌,徘徊在62000美元左右。

In the early morning hours of 29 February Beijing time, the price of Bitcoin (BTC) was once over $64,000, rising by more than 50% since November 2021, and the total market value of Bitcoin was once close to $1.3 trillion. By the time of publication, Bitcoin prices had fallen, hovering around $62,000.

图片来自CoinMarketCap

比特币历史最高点发生在2021年11月10日,当时逼近6.9万美元。此后,比特币一路下滑,2022年11月跌破1.6万美元,创出这一轮下跌的最低点。此后,比特币价格有所反弹,一直在3万美元左右浮动,直至2023年12月,价格再次突破4万美元关口。2月中旬以来,比特币价格加速上涨,距历史最高点仅一步之遥。

Bitcoin’s historic peak, which occurred on 10 November 2021, was close to US$ 69,000. After that, Bitcoin fell all the way, falling by US$ 16,000 in November 2022, creating the lowest point in this round. After that, Bitcoin prices rebounded and remained floating at around US$ 30,000 until December 2023, when prices broke out again at US$ 40,000.

比特币价格能否突破历史最高点?

Can the price of the bitcoin break past the highest point in history?

“在当前市场环境下,我个人认为比特币近期突破历史最高点并不算难。”中国通信工业协会区块链专委会共同主席,香港区块链协会荣誉主席于佳宁向澎湃新闻(www.thepaper.cn)表示,比特币此轮上涨行情的强劲动能主要受到两大因素的推动。

“In the current market environment, I personally believe that it will not be difficult for

首先,1月份比特币现货ETF的批准为市场注入了新的活力,吸引了大量主流和机构投资者的资金,这在短期内显著增加了比特币的购买需求,推高了价格。数据显示,贝莱德旗下现货比特币ETF在2月28日的交易量为13.5亿美元,创历史新高。比特币现货ETF总资产净值也已超400亿美元,灰度(Grayscale)的比特币现货ETF,即GBTC,单日净流出2237万美元,连续四个交易日净流出减少并创下历史新低。

First, Bitcoin spot ETF approvals in January injected new dynamism into the market and attracted large amounts of capital from mainstream and institutional investors, which in the short term significantly increased Bitcoin’s demand for purchases and pushed prices up. The data show that Bitcoin spot ETF transactions under the Belede flag reached a record high of $1.35 billion on 28 February.

于佳宁认为,比特币ETF的出现不仅为机构投资者提供了参与比特币投资的便利通道,还提升了比特币在传统金融市场中的可接受性,这一点对于吸引长期投资和稳定资金流入比特币市场至关重要。

The emergence of bitcoinETF not only provides institutional investors with easy access to Bitcoin investments, but also enhances the acceptability of bitcoin in traditional financial markets , which is essential to attract long-term investment and stabilize capital inflows into the Bitcoin market.

其次,比特币即将在4月发生的减半事件进一步刺激了市场的乐观情绪。比特币减半是一个预定的事件,每四年发生一次,通过减少挖矿奖励来降低新比特币的供应速度。从历史经验来看,减半事件往往会在其前后推动比特币价格上涨,原因在于市场普遍预期比特币供应的减少将导致其价格上升。

Second, the upcoming halving of Bitcoin in April further boosts market optimism

再者,全球宏观经济环境下,尽管存在不确定性,但在当前低利率和流动性充足的环境下,投资者倾向于寻找非传统资产以获取更高的回报。

Moreover, in the global macroeconomic environment, despite uncertainty, investors tend to look for non-traditional assets for higher returns in the current environment of low interest rates and sufficient liquidity.

于佳宁表示,总的来看,比特币此轮上涨行情具有较强的市场支撑,有可能在近期突破历史最高点。但投资者也应关注市场的潜在风险,包括宏观经济变化、监管政策调整等,这些因素都可能对比特币价格产生重要影响。在高度波动和不确定的数字资产市场中,投资者应保持谨慎,合理分配资产,避免过度集中投资于单一资产。

But investors should also be concerned about potential market risks, including macroeconomic changes, regulatory policy adjustments, and so on. In highly volatile and uncertain digital asset markets, investors should be cautious and rational in allocating assets and avoiding excessive concentration of investment in a single asset.

OKX研究院高级研究员赵伟向澎湃新闻(www.thepaper.cn)表示,比特币现货ETF正吸引更多资金入场,加上美联储降息预期和比特币减半等利好因素,推动比特币价格上涨。据Farside Investors数据,自1月11日推出以来,比特币现货ETF历史累计净流入超67亿美元(除Invesco和Galaxy的现货比特币BTCO昨日流入/流出资金)。

Jo Wei, a senior researcher at the OkX Institute, told News News (www.thepaper.cn) that Bitco’s spot ETF is attracting more money, and that, together with such positive factors as the Fed’s interest-reduction expectations and the halving of Bitco’s prices, the price of Bitco’s prices have increased. According to Farside Investors, since its launch on 11 January, Bitco’s spot ETF has accumulated a net inflow of over $6.7 billion (with the exception of Bitco’s and Galaxy’s spot BTCO inflows/exit funds yesterday).

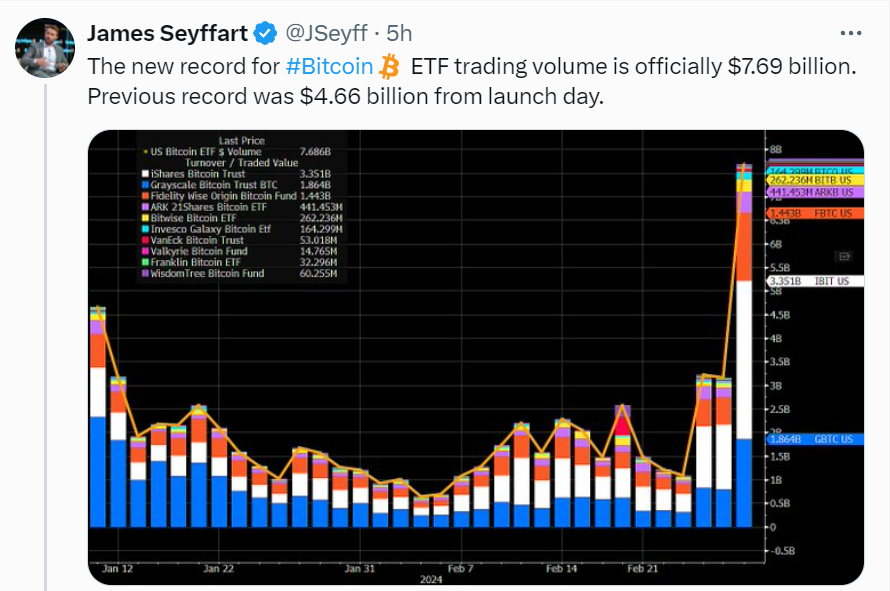

当地时间2月28日晚,彭博资讯(Bloomberg Intelligence)ETF分析师James Seyffart在社交平台上分享的数据显示,10只现货比特币ETF的交易量总计近77亿美元,打破了1月11日首个交易日以来47亿美元的历史记录。

On the evening of 28 February, local time, data shared on social platforms by Bloomberg Intelligence ETF analysts, James Seyffart, showed that 10 spot Bitcoin ETF transactions totalled nearly $7.7 billion, breaking the historical record of $4.7 billion since the first transaction on 11 January.

图片来自X(原推特)

业内主流观点认为,随着比特币现货ETF市场日益成熟,越来越多投资者将比特币与传统投资组合融合,这些ETF发行人正在进行系列营销活动以支撑比特币价格。此外,6月美联储FOMC会议后两周,届时美联储可能会首次降息,以及年底的美国总统大选都将对比特币未来的价格产生影响。

The mainstream view within the industry is that, as the Bitcoin spot ETF market matures, and more and more investors integrate bitcoins with traditional portfolios, these ETF issuers are running a series of marketing activities to support bitcoin prices. Moreover, two weeks after the Federal Reserve’s FOMC meeting in June, the Fed will likely reduce interest rates for the first time, and the US presidential election at the end of the year will have an impact on the future prices of bitcoin.

Hectic Labs首席执行官Bryan Legend强调,“FOMO”(害怕错过)现象推动了因预期减半事件而增加的购买活动。虽然投资者预计供应减少将推动价格上涨,但他仍建议谨慎行事,并指出减半前的反弹是短期上涨的合适时机。

Hectic Labs CEO Bryan Legend stressed that the “FOMO” phenomenon had contributed to the increase in purchasing activity as a result of the expected halved event. While investors expected a reduction in supply to drive price increases, he advised caution, noting that a rebound before halving was the right time for a short-term rise.

据CoinMarketCap显示,截至北京时间2月29日晚间,距离比特币减半还有51天。

According to CoinMarketCap, as of the evening of 29 February Beijing time, there were 51 days left before Bitcoin was halved.

比特币行情对于整个加密市场的影响几何?

How does the bitcoin affect the entire encryption market?

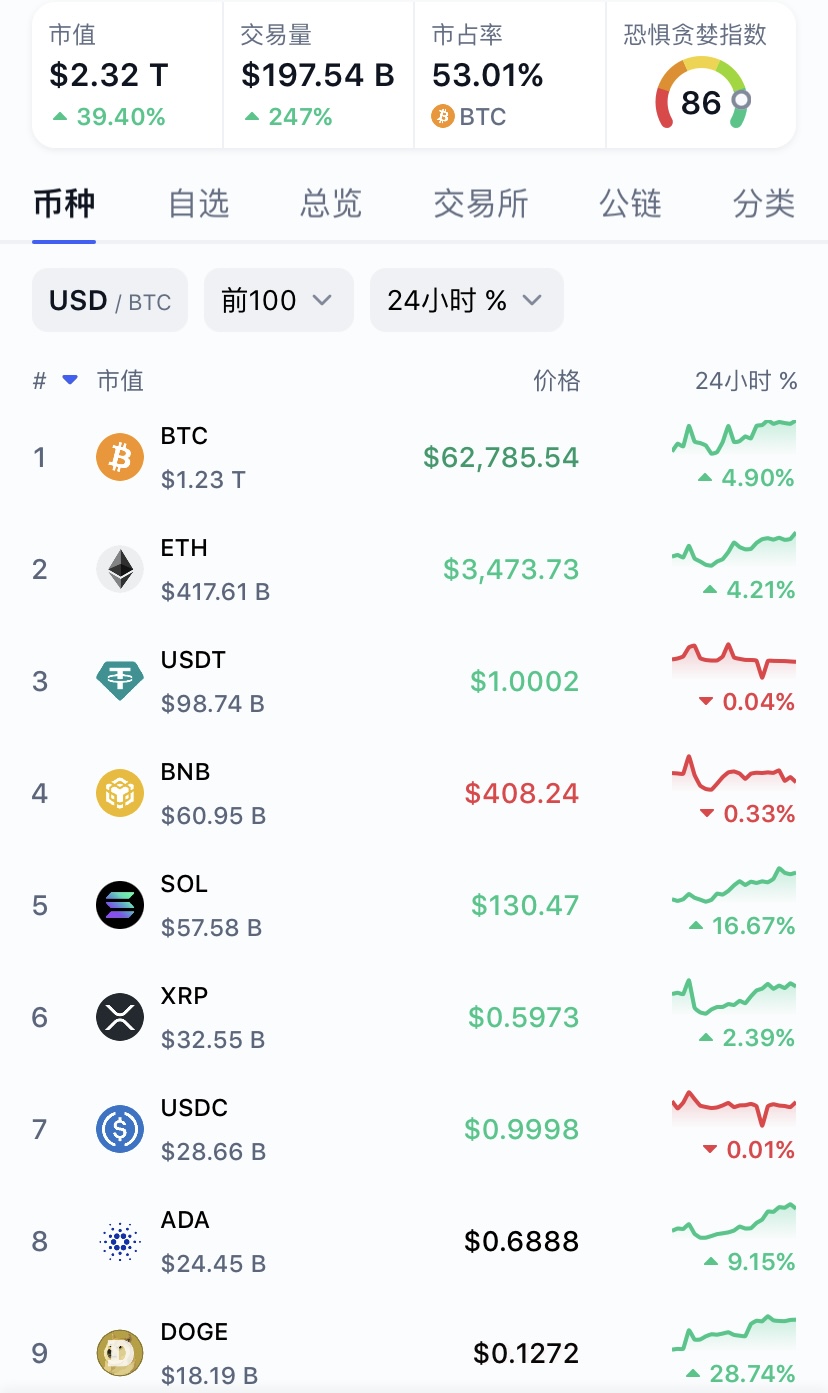

北京时间2月28日以来,比特币一路上涨的同时,以太坊(Ethereum)、狗狗币(DOGE)等加密资产同期上涨。

Since 28 February Beijing time, the price of Bitcoin has risen along the same lines as encrypted assets such as Etheeum and Doge.

截至发稿前,比特币24小时内涨超4.9%,以太坊24小时内涨超4.2%。

By the time of submission, Bitcoin had risen by more than 4.9 per cent in 24 hours and by 4.2 per cent in 24 hours.

图片来自CoinMarketCap

在比特币上涨的推动下,狗狗币价格飙升,过去24小时内大幅涨超28%,这一涨幅使狗狗币成为主要数字资产中百分比涨幅领先的表现者。狗狗币是第九大加密货币,其市值目前在180亿美元左右。截至发稿前,狗狗币的交易价格为0.1268美元,创下2022年11月以来最高水平。

Thanks to the surge in bitcoin, the price of dog coins rose sharply, by 28% over the last 24 hours, making the doggie coins the number-one mark of the percentage increase in key digital assets. The doggie coin, the ninth largest encrypted currency, is now worth about $18 billion. As of November 2022, the trade price of the doggie coins was 0.1268 dollars, the highest since.

于佳宁分析称,比特币作为数字资产市场的“领头羊”,其价格波动往往对整个数字资产市场产生显著影响。一方面,比特币价格的上涨往往会带来市场信心的增强。当比特币价格上涨时,投资者普遍认为数字资产市场正处于牛市之中,这种积极的市场情绪会吸引更多的投资者参与到数字资产市场,增加市场的流动性。随着更多资金的涌入,其他数字资产也可能会受益,实现价格上涨。

When the price of Bitcoin rises, investors generally agree that the digital asset market is in the cattle market, and this positive market sentiment attracts more investors to participate in the digital asset market and increases market liquidity. As more money inflows, other digital assets are likely to benefit from higher prices.

其次,比特币价格的上涨可能会引发资金的重新配置。一些投资者可能会将比特币的部分收益转移到其他潜力较大的数字资产上,寻求更高的回报。

Second, increases in bitcoin prices may trigger a re-allocation of funds. Some investors may shift some of the gains from bitcoin to other potentially larger digital assets in search of higher returns.

此外,比特币价格的上涨也可能促进数字资产市场的创新和发展。在牛市中,项目方更容易筹集到资金,进而加速新技术和新应用的研发与推广。市场整体活跃度的提升有助于数字资产技术的迭代升级和生态系统的繁荣发展。

In the cattle market, it is easier for the project side to raise funds, thereby accelerating the development and diffusion of new technologies and applications. The overall increase in market activity has contributed to the upgrading of digital asset technologies and the prosperity of ecosystems.

最后,比特币价格的上涨对于整个数字资产市场的监管环境也可能产生影响。价格的持续上涨可能会引起监管机构的关注,从而加快监管政策的制定和实施。虽然短期内可能会给市场带来不确定性,但从长远来看,明确的监管框架对于市场的健康发展是有益的。

Finally, the rise in Bitcoin prices may also have an impact on the regulatory environment of the entire digital asset market. The continued rise in prices at

不过,赵伟强调,需要注意的是,比特币价格受到供需关系、政策法规、全球经济周期、科技发展和投资者情绪等多重因素影响,不应该依赖单一指标或信号进行决策,而是从长期角度全面观察市场动态,选择适合自己的投资策略和标的。

However, Zhao Wei stressed that it is important to note that the price of `strong' bitcoin is influenced by multiple factors such as supply-demand relationships, policy regulations, global economic cycles, technological developments and investor sentiment and should not rely on a single indicator or signal for decision-making, but rather on a comprehensive view of market dynamics in the long term and the choice of investment strategies and targets appropriate to them.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论