2.注册之后需要进行身份验证,您可以通过【用户中心】-【身份认证】进行身份认证,在该页面可以查看当前认证级别,它决定了您的账户在币安的交易限额。如需提升额度,请依次完成各个级别的身份认证。

If you need to increase the amount, you can complete the identification at all levels.

3.完成身份验证之后,在首页点击【一键买币】进入交易页面

3. After authentication is completed, click on the front page to enter the transaction page

4.然后选择【自选区】,根据需求选择合适的商家,点击【购买USDT】。根据弹窗提示向卖家付款,点击“我已付款”等待卖家放币即可。

Select [from your constituency], select the right vendor on the basis of demand, click [to buy USDT]. Pay the seller on the basis of a window tip, click “I have paid” and wait for the seller to give the money.

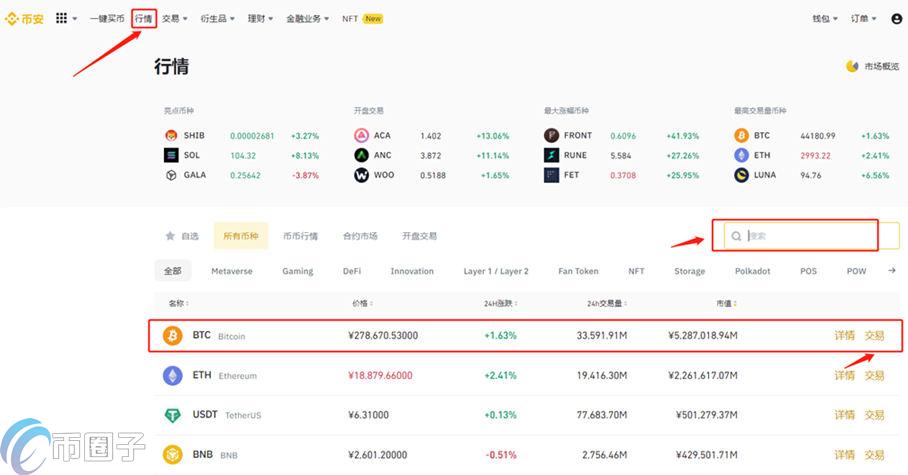

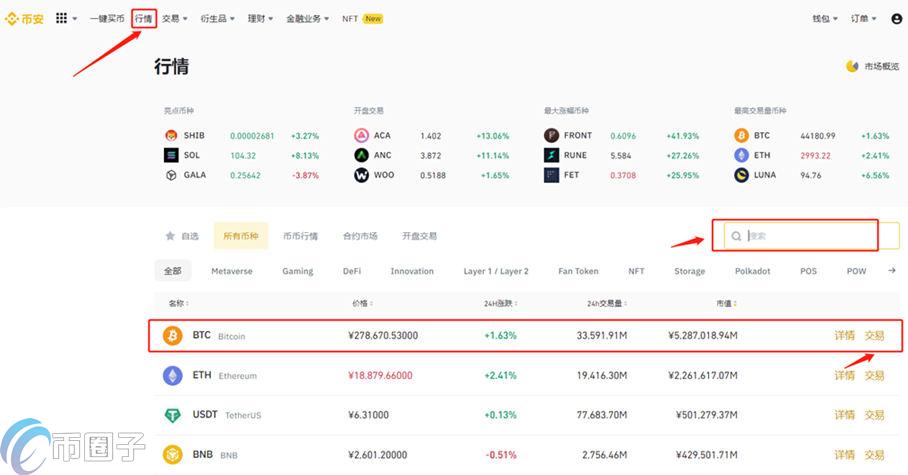

5.点击行情进入币种页面,搜索比特币英文简称BTC。

Click to enter the currency page as appropriate and search for Bitcoin English acronym BTC.

6.点击BTC/USDT交易对,进入购买页面

Click on BTC/USDT transaction pair to enter the purchase page

7.填写购买数量,点击买入,若是卖出,填写卖出数量,点击卖出即可。

7. Fill in the purchase volume, click on the purchase, and in the case of sale, click on the sale volume.

投资者问比特币今后走势到底会怎么样?首先我们一定要认清这个市场的投资者构成。目前这个市场投资者主要是大资本的市场,就是像马斯克这类世界富豪,大资本进入到了加密数字货币市场。在这样一个情况下,比特币价格今后它跌也不会跌到哪里去,如果比特币暴跌,大资本就会被套牢,他们一定会靠资本实力左右市场走势,但大涨也有局限性。

Investors ask what will happen to Bitcoin in the future? First of all, we must recognize the composition of investors in this market.

因为现在全球央行包括监管部门对比特币越来越趋向于加强监管,防止比特币过度投机炒作,特别是防止比特币逃避各个国家的外汇管制,进行洗钱,跨境转移资产,把钱洗白,防止比特币充当这种手段,所以说在这种情况下,大资本不断进入要托盘;监管部门不断给比特币泼冷水让他冷静下来,比特币价格可能会大跌,大跌以后可能会报复性反弹;报复性反弹,又遇到监管强力监管,又会大跌,又会报复性反弹。

Given that the global central bank, including the regulatory sector, Bitcoin, is increasingly moving towards stronger regulation to prevent excessive speculation by Bitcoin, in particular by preventing Bitcoin from evading foreign exchange controls in various countries, money-laundering, cross-border transfers of assets, laundering of money, and preventing Bitcoin from being used as a tool, it is said that, in such a situation, large capital is constantly entering the tray; the regulatory authorities are pouring cold water on Bitcoin to calm him down; Bitcoin prices may fall and retaliate in the event of a fall; and retaliatory retaliation, with strong regulatory controls, will fall again and retaliate.

一般投资者能不能投资比特币?我是坚决反对,特别在中国。如果央行把出入金这个渠道卡死,包括你线下交易卡死的话,首先,你在监管政策过程就面临着很大的一个风险。我不知道现在已经在线下交易这一块,我们叫线下市场这一块,出入金现在是否正常?你以前进到这个账户里的资金,现在取出来会是个怎么样?持有比特币的,想把它卖掉变现能不能变现,现在都有疑问。这一块风险比较大,所以中国现在基本上对比特币在监管上会越来越趋紧。

I wonder if ordinary investors can invest in bitcoin? I'm strongly opposed, especially in China. If the central bank locks the access money down, including your offline transactions, first of all, you face a great risk in the regulatory policy process.

投资者在中国投资比特币,首先考虑到是否违法违规,第二个就是我说的这个监管政策,这种风险一定要考虑。

Investors invest in bitcoin in China, first considering whether or not they are in violation of the law, and second, the regulatory policy that I refer to, the risk of which must be taken into account.

本质上来说,比特币不是这种工薪阶层,这种小资本投资的市场,在那里一夜暴富觉得很难,因为他是大资本的市场,目前这种行情基本上就是可以说是大资本在左右着。这样的话,小资本进去以后,成为虾米被大鱼大资本吃掉可能性很大。这里提醒投资者一定要注意。

In essence, Bitcoin is not such a wage-earner, a market for small capital investments, where it is hard to be rich overnight, because he is a market for big capital, and this is basically the case with big capital. In this case, when small capital goes in, it is very likely that it will be eaten by big fish. This reminds investors.

另外一个就是我们说加密数字货币,她是完全以区块链为技术,是个去中心化分布式账本和全员信用背书的,它的生命力就在这个地方。所以中本聪设计之初,比特币实质上是为了防止主权货币过度贬值,无形中掠过老百姓的财富,实质上它是冲着国际货币-美元去的。如果沿着这个目标走下去,我觉得比特币的前景还是有的,并且前景还非常广大。一时半会儿这种加密货币市场还消失不了。我们知道有个大空头叫达里奥,他是桥水基金的一个创始人,董事长,他以前竭力反对比特币,而现在也开始力挺比特币,也准备投资比特币,这个转变当然对投资者应该会有一个启发。

The other is that we are talking about encrypted digital money, which is fully technologyd by block chains, a decentralised distribution book and full credit endorsement, and whose life force is in this place. So, when China was designed, Bitcoin was essentially designed to prevent the excessive depreciation of sovereign currencies, invisiblely plundered the wealth of the population, and in essence went against the international currency-dollar. If we go along with this goal, I think that bitcoin is still a prospect, and that it is a very large one-and-a-half of the time. We know that there is a big blank named Dario, a founder of the Bridgewater Fund, a director, who tried hard to oppose bitcoin and is now ready to invest in bitcoins, and this shift should have an inspiration for investors.

不过,小众投资者不是说一点机会没有,如果在合法合规情况下,因为比特币的大起大落跟随着它能把握这个节奏,踏准这个点的话,一旦监监管之剑一出鞘的话,比特币大跌,你跟进,然后大资本开始托盘一上涨你就卖掉,还是有一点机会的,但这个机会很难把握,关键还是政策风险包括监管政策风险。

However, small investors are not saying that there is no opportunity, but if, in the case of legitimate compliance, the big ups and downs of Bitcoins follow it to take control of the rhythm and set the point, once the sword of supervision comes out, bitcoins drops, you follow it, then the big capital starts to raise the tray and you sell it, but the opportunity is hard to grasp, and the key policy risks include regulatory policy risks.

综上所述,就是币圈子小编对于现在比特币怎么买这一问题的回答,希望币圈子小编的这篇关于BTC比特币买入和交易教程图解的文章能够帮助各位还不清楚怎么买入比特币的投资者更加快速的掌握比特币交易方法。币圈子小编在这里提醒各位投资者,尽管比特币已经走过了11年,但是依旧还有很多人对于比特币不清楚不了解,甚至还有人不知道有比特币的存在,比特币的成长空间还是很大的,前景也是十分广阔的,不妨让我们一起等到下一个十年,再来看看比特币会到达怎样的高度。

In conclusion, it is the response of the Little Editor of the Currency Circle to the question of how bitcoin is now bought, and it is hoped that the article by the Little Editor of the Currency Circle on BTC bitcoin buying and trading a curriculum map will help you to understand how to buy bitcoin more quickly. The Little Editor of the Currency is here to remind investors that, despite the fact that Bitcoin has been gone for 11 years, there are still many people who are not aware of bitcoin, even those who do not know that bitcoin exists, that bitcoin is still growing in space and prospects are wide, and that we should wait for the next decade to see how high bitcoin is.

美化布局示例

币安(Binance)最新版本

币安交易所app【遇到注册下载问题请加文章最下面的客服微信】永久享受返佣20%手续费!

APP下载

官网地址

火币HTX最新版本

火币老牌交易所【遇到注册下载问题请加文章最下面的客服微信】永久享受返佣20%手续费!

APP下载

官网地址

发表评论