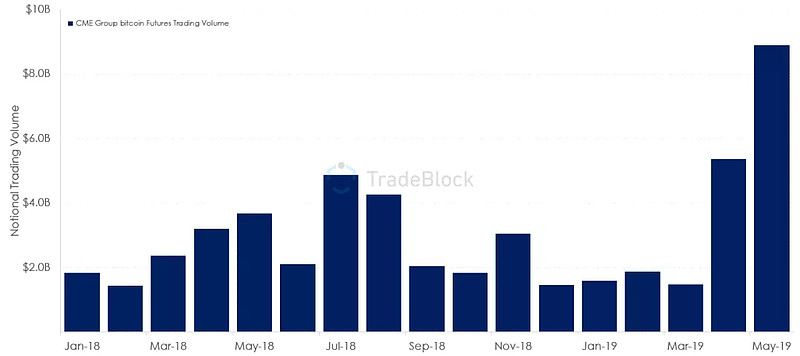

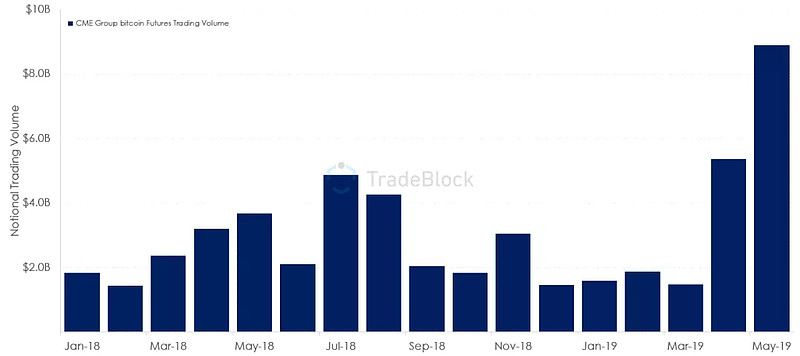

其中,在5月13日那天,更是以 33,677 份合约创下了单日最高交易量的新记录,共计16.8万个比特币,约等于13 亿美元的名义值。

Of these, on 13 May, 33,677 contracts created a new record of the highest volume of transactions on a single day, totalling 168,000 bitcoins, or about $1.3 billion in nominal terms.

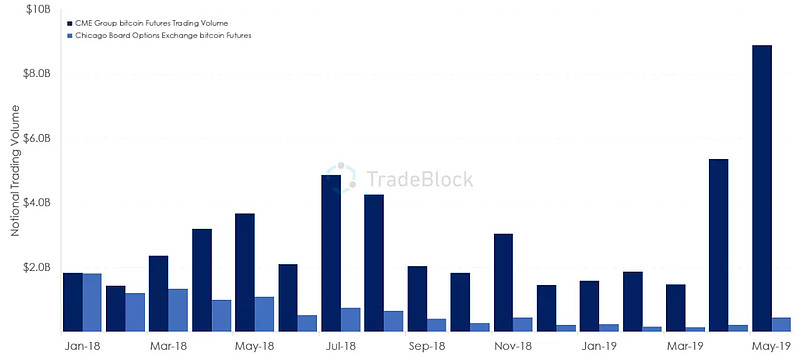

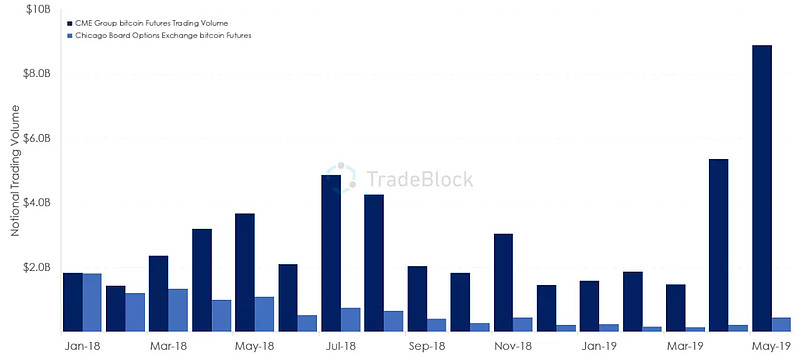

对比之下,CBOE的交易量显得格外寒酸。

By contrast, the volume of CBOE transactions appears to be particularly chilly.

上线初,两大交易所交易量平分秋色,此后CBOE的比特币期货交易量呈阶梯状萎缩,在同样的市场环境中,与CME的交易量差距越来越大。

At the beginning of the line, the two major exchanges split equally, and then CBOE’s Bitcoin futures volume shrunk in step, with a growing gap with the CME in the same market environment.

根据tradeblock.com的图表数据,如今,COBE的比特币期货交易量不到CME的十分之一。

According to chart data from tradeblock.com, COBE now traded less than one tenth of CME's bitcoin futures.

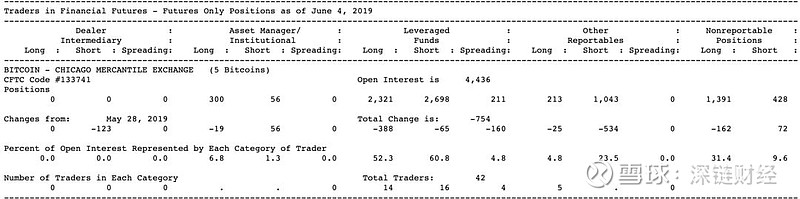

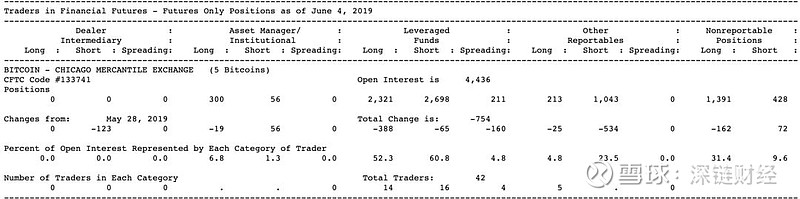

在CME的比特币期货玩家,可以划分为五类,分别是:经纪商、资产管理公司/机构、杠杆基金、报告用户(做对冲交易的中型交易者)、非报告持仓头寸(小型交易者)。

The Bitcoin futures player in CME can be divided into five categories: brokers, asset management firms/agencies, leverage funds, reporting users (medium traders in hedge transactions), non-reporting warehouse positions (small traders).

其中杠杆基金是交易的绝对主力,占到了总持仓席位的60.38%,表明CME已经成为华尔街专业机构交易员交易的主场。

Leverage funds are the absolute backbone of transactions, accounting for 60.38 per cent of the total warehouse seats, indicating that CME has become the home for deals by traders in Wall Street professional institutions.

CME与COBE的比特币期货合约均采用现金结算,对于传统的华尔街对冲基金来说是一种比较友好的结算方式,同时也埋下了隐患。

CME's Bitcoin futures contracts with COBE are cash settlements, which are a more friendly settlement for the traditional Wall Street hedge fund, while also burying the pitfalls.

现金结算意味着场内的玩家不必购买BTC实物资产,买入卖出都以美元现金结算。

Cash settlements mean that in-the-ground players are not required to purchase BTC physical assets and that both purchases and sales are made in United States dollars.

这种结算方式有利于大型投资公司(包括机构、对冲基金和合格投资者)快速参与到比特币期货中来,无需面临实际持有比特币的价格风险。

This settlement facilitates the rapid participation of large investment companies (including institutions, hedge funds and qualified investors) in bitcoin futures without the risk of actually holding bitcoin.

但这种结算方式也存在重大弊端。

but there are also significant weaknesses in this manner of settlement.

所有的交易、结算过程都不涉及BTC的买卖,对BTC实物的流通并没有任何实际的促进作用。

All transactions, settlement processes do not involve the BTC's sale, and there is no real contribution to the BTC's physical flow.

CME和CBOE比特币期货不同之处在于,COBE XBT合约每个只包含一个比特币,而CME BTC合约每个包含5个比特币;XBT价格最小变动为10美元/比特币,BTC价格最小变动为5美元/比特币。

The difference between CME and CBOE bitcoin futures is that the COBE XBT contract contains only one bitcoins each, while the CME BTC contract contains five bitcoins each; the minimum change in the XBT price is USD 10/bitcoin and the minimum change in the BTC price is USD 5/bitcoin.

在价格指标上,CME使用各大交易所的价格指数来进行定价和结算,CBOE以Gemini交易所结算日美东时间下午4点的成交价格作为结算价进行计算交割,这给期货定价带来了一定的不确定因素。

In terms of price indicators, CME uses price indices from major exchanges for pricing and settlement, and CBOE uses the transaction price at 4 p.m. Gemini Exchange to settle the settlement price as a settlement price, which brings some uncertainty to futures pricing.

在杠杆倍数上,CBOE XBT要求44%初始保证金,最大杠杆倍数仅为2.27倍;CME BTC要求35%初始保证金,即2.86倍杠杆。

In terms of leverage multiples, CBOE XBT requires an initial bond of 44 per cent, with a maximum leverage multiple of only 2.27 times; CME BTC requires an initial bond of 35 per cent, or 2.86 times leverage.

专家们认为,这些事实使CME的比特币合约对投资者更具吸引力,因为它们提供了维持主导地位所需的重要交易量以及杠杆倍数。

These facts, in the view of the experts, made CME's bitcoin contracts more attractive to investors, as they provided the significant volume of transactions and leverage required to maintain dominance.

其次,CBOE并未将重心全部放在比特币期货上,CBOE联合资产管理公司VanEck曾多次向美国证券交易委员会(SEC)提交比特币 ETF 的申请,次次受挫,迟迟未获批准。

Second, CBOE did not focus exclusively on the Bitcoin futures, and Van Eckk, a joint CBOE asset management firm, submitted several times to the United States Securities and Exchange Commission (SEC) its application for Bitcoin ETF, which was repeatedly frustrated and delayed.

关于CBOE停止比特币期货一事,在Reddit以及推特的相关讨论中,大多数人认为这并不会对市场产生重大影响。

With regard to the CBOE cessation of Bitcoin futures, in the relevant discussions in Reddit and Twitter, most people believe that this does not have a significant impact on the market.

相比CME和Bitmex,CBOE的比特币期货交易量占比太小,期货下线对于整个市场的成交量以及比特币价格都不会有太大影响。

Compared to CME and Bitmex, CBOE's Bitcoin futures trading volume is too small, and the downlink of futures will have little impact on the overall market turnover and on Bitcoin prices.

与此同时,也有一些投资者对CBOE暂停比特币期货表示兴奋。

At the same time, some investors were excited about CBOE's suspension of Bitcoin futures.

加密货币分析师CryptoMento表示,这是一个好消息,因为它们(CBOE)过去常常搅乱整个市场。

CryptoMento, an encrypted currency analyst, said that this was good news because they had often disturbed the entire market in the past.

BitPay的联合创始人Tony Gallippi也在推特中表示,CBOE的比特币期货在6月份结束后可能会迎来下一轮牛市。

Tony Gallippi, a co-founder of Bitpay, also tweets that the CBOE’s Bitcoin futures may be in the next round of cattle by the end of June.

2017年年底,CBOE比特币期货开盘三个月后,比特币暴跌50%以上。

At the end of 2017, three months after the opening of the CBOE bitcoin futures, Bitcoin fell by more than 50 per cent.

比特币期货,熊市制造者?

Bitcoin futures, Bear City Maker?

在推出比特币期货时,CME名誉主席利奥?梅拉梅德对路透社表示,比特币期货市场将“驯服”比特币。他说道:

When the Bitcoin futures were launched, CME Honorary Chairman Leo Melamed said to Reuters that the Bitcoin futures market would “ tame” Bitcoin. He said:

“我们将进行监管,让比特币不再狂野,也不会变得更狂野。我们将把它驯服成一种有规则的常规交易工具。”

"We will regulate that Bitcoin will not be wilder or more wilder. We will tame it as a regular, rule-based transactional tool."

在不少投资者看来,正是CBOE和CME比特币期货的推出导致了2018年比特币熊市。

In the view of many investors, it was the introduction of CBOE and CME bitcoin futures that led to the 2018 Bitcoin Bear Market.

不仅Tony Gallippi这样认为,华尔街证券研究公司Fundstrat的研究主管汤姆-李(Tom Lee)在研究简报中,也表达了同样的观点。

Not only does Tony Gallippi believe that Tom Lee, research director of the Wall Street Securities Research Company Fundstrat, expressed the same view in the research brief.

在研究简报中,他写道:“去年(2017年)12月,CBOE比特币期货推出,在比特币期货合约到期前,比特币的价格一直在下跌。”

In his research brief, he wrote: “In December of last year (2017), the CBOE bitcoin futures were launched, and the price of the bitcoins had been falling until the end of the Bitcoin futures contract”.

“在Cboe比特币期货合约到期前,比特币的价格下跌幅度很大。Raptor Group咨询公司的贾斯汀 萨斯劳也指出了这一点。我们整理了一些数据,发现事实确实如此。”汤姆-李写道,“一般来说,在CBOE比特币期货合约到期前的10天里,比特币的价格会下跌18%。”

“The price of Bitcoin fell considerably before the Cboe bitcoin futures contract expired. As Justin Saslow of Raptor Group Consulting also pointed out. We collated some data and found it to be so.” Tom-Li wrote, “In general, in the 10 days before the CBOE futures contract expired, the price of Bitcoins fell by 18 percent.”

对于汤姆-李的指责,CBOE全球市场总裁克里斯-康坎农回应说,“有人说,比特币期货严重影响了比特币的价格。这种说法夸大了比特币期货的影响,忽视了其他重要的影响因子。我们发现,比特币价格下跌用其他因素来解释更合理,例如全球管制机构的审查、税务机构采取的措施、其他加密货币的崛起以及媒体对比特币日益减少的兴趣。”

In response to Tom-Lee’s accusation, CBOE’s Global Market President Chris Concannon said, “Some people say that bitcoin futures seriously affect bitcoin prices. This exaggerates the impact of bitcoin futures and ignores other important impact factors. We find that bitcoin price declines are justified by other factors, such as the review of global regulatory bodies, measures taken by tax agencies, the rise of other encrypted currencies and the decreasing interest of the media in contrast to bitcoins.”

加密货币分析师Darren Kleine认为,CBOE和CME的比特币期货最大的问题依然在于,它们是以现金结算的。

According to the encrypted currency analyst Darren Klein, the biggest problem with CBOE and CME's bitcoin futures remains that they are cash-based.

原因是,交易者可能持有大量比特币,同时在现金结算期货上投注BTC,在适当的时候,交易者可以清算他们的比特币,导致价格暴跌。

The reason is that traders may hold large amounts of bitcoins while at the same time paying BTC on cash settlement futures, where, in due course, traders may settle their bitcoins, resulting in a sharp fall in prices.

因此,以现金结算的期货并不是鼓励资产增长的好方法,然而,它们在抑制资产价格方面表现出色。

Cash-based futures are therefore not a good way to encourage asset growth, but they have done well in curbing asset prices.

相比之下,纽约证券交易所母公司美国洲际交易所(ICE)推出的交易所Bakkt则不存在这样的问题,它交易的是比特币实物交割期货。合约到期时,多空双方需要准备现货进行实物交割,这有助于遏制市场的过度投机行为,能让比特币的金融生态变得更加完善、稳定。

By contrast, Bakkt, an exchange launched by the New York Stock Exchange’s parent company, the Intercontinental Exchange of America (ICE), does not have such a problem. It deals with Bitcoin’s physical delivery of futures.

然而在专业投资社区TradingView的意见领袖余博伦看来,期货市场不应该为熊市背锅,牛熊更替的根本原因在于投资标的供需关系的变化,其他原因都只是附加。

However, according to the opinion leader of the professional investment community TradingView Boron, the futures market should not be a failure for the bear market, and the root cause of the change in the price-demand relationship between the investment target and the other reasons are just additional.

神奇的交割日效应

The magical hand-off effect

CME和CBOE在2017年年底推出比特币期货,除了被认为是熊市诱因,也让关于“交割日效应”的讨论逐渐增加。

The introduction of Bitcoin futures by CME and CBOE at the end of 2017 has led to a gradual increase in the discussion of the “sealing day effect” in addition to being considered as an incentive for the bear market.

比特币期货通常会有交割日,在快要临近合约交割日期的时候,参与期货交易的多空双方为了争取到一个对自己有利的合约交割价,运用各种手段对期货乃至现货价格施加影响,这被成为:交割日效应。

Bitcoin futures usually have delivery days and, as they approach the contract delivery date, the multi-empty parties involved in futures transactions have used various means to influence futures and even spot prices in order to obtain a contract price in their favour, which has become the day of delivery effect.

临近交割,比特币价格往往出现更剧烈的波动。

approaches, and bitcoin prices tend to fluctuate more sharply.

原因在于,市场上做多做空最后的决战时间,之前的亏损还可以采取等待或者补充保证金的方式继续持有仓位,一到交割日,亏损必须兑现。

This is due to the fact that the market has had to spend more time in the final battle and that earlier losses can continue to hold positions in the form of a waiting or replenishment bond, which must be honoured upon delivery date.

所以强大的一方会在最后时刻通过各种手段,包括释放对自己有利的消息、强大的资金实力迫使对手盘巨亏,让自己盈利。

So at the end of the day, the powerful side will be forced to make a profit by a variety of means, including releasing information that is in its favour, and by strong financial power.

余博伦告诉深链财经,临近交割,波动加大,已经是交易员的共识,对于大部分追求稳健的期货交易员来说,会尽量避免在交割日附近开单,但不乏有人专门在交割前开单,火中取栗。

Yu Boron told the deep chain of finances, close delivery, increased volatility and consensus among traders that, for the majority of futures traders who sought to be robust, they would try to avoid making bills in the vicinity of the cut-off day, but not to mention the fact that they were issued before the cut-off.

本文为深链Deepchain(ID:deepchainvip)原创。未经授权,禁止擅自转载。

was created in a deep chain of Deepchain (ID: Deepchainvip).

美化布局示例

币安(Binance)最新版本

币安交易所app【遇到注册下载问题请加文章最下面的客服微信】永久享受返佣20%手续费!

APP下载

官网地址

火币HTX最新版本

火币老牌交易所【遇到注册下载问题请加文章最下面的客服微信】永久享受返佣20%手续费!

APP下载

官网地址

发表评论