今日凌晨1时左右,也就是美国东部时间周三下午1点,USDT的发行公司Tether 在推特上宣布,已销毁5亿枚USDT。

At about 1 a.m. this morning, at 1 p.m. on Wednesday, Eastern Time of the United States, Tether, the distributor of USDT, announced on Twitter that 500 million USDTs had been destroyed.

尽管姊妹公司Bitfinex交易所的人表示此举“与捍卫USDT平价美元无关”,但事实上已经造成了USDT的供应量减少。

Although the sister company Bitfinex Exchange stated that it “does not have anything to do with defending the USDT dollar parity”, it has in fact led to a reduction in the supply of USDT.

这距离10月15日USDT大幅脱钩美元价格已经过去10天,当时,USDT在1个半小时里跌了 7%,让人们见识了稳定币也有不稳的一天。此后的日子里,USDT的价格再也没能1:1的钉在美元上。

Ten days have passed since the USDT significantly decoupled its dollar price on October 15, when it fell by 7% in an hour and a half, giving people an idea of a stable currency with an unstable day. In the days that followed, the USDT price was no more than 1:1 nailed to the dollar.

即使今日Tether销毁了占流通总量52.8%的USDT,这个稳定币“老大”仍然在 0.98美元附近徘徊,而GUSD这些竞争对手的币价对美元仍有溢价。

Even today Tether destroyed 52.8 per cent of the USDT in circulation, the stable currency, the “boss”, still hovers around $0.98, while the GUSD competitors still have a premium on the United States dollar.

加密货币的销毁机制似乎救不了Tether眉毛上火苗,出路之一或许是自证它的背后有相应数量的美元储备。

The destruction mechanism of the encrypted currency does not appear to have saved Tether's eyebrows from the fire, and perhaps one way to do so is to prove that it has a corresponding amount of United States dollar reserves behind it.

而加密货币市场研究公司Diar的最新的研究报告显示,Tether近期带来的市场恐慌已经让资本从USDT流向比特币或其他稳定币。

In contrast, recent studies by the crypto-currency market research company Diar show that the recent market panic caused by Tether has allowed capital to flow from USDT to Bitcoin or other stabilizers.

文|文刀

Wen Wei Wen Knife

编辑|问道

The editor asked.

USDT总供应量缩减52.8%

USDT total supply reduced by 52.8%

从OMNI浏览器上看,Tether宣布销毁5亿个USDT后,钱包里储备为466,678,763.48。OMNI是Tether公司当初发行USDT的底层协议。这一数据与Tether今日的对外声明一致。

According to the OMINI browser, after Tether announced the destruction of 500 million USDTs, it had a wallet reserve of 466,678,763.48. Omni was the bottom-of-the-line protocol from Tether. This data is consistent with Tether's external statement today.

该公司今日表示,除了销毁,他们还从USDT的流通供应中“赎回了大量”代币。

Today, the company stated that, in addition to destruction, they “retarded” large amounts of money from the circulation supply of USDT.

Tether还表示,留下的4.46亿的资金用于准备未来USDT的发行。这意味着赎回和销毁的USDT数量占总供应量的52.8%。

Tether also indicated that $446 million was left for the preparation of future USDT releases, which means that 52.8 per cent of the total supply was redeemed and destroyed.

今日,USDT的价格维持在0.98美元附近,尽管这和10月15日该稳定币跳水前的价格接近,但当天带来的市场恐慌似乎在之后的10天里也没能平复。

Today, USDT prices remain close to $0.98 and, although this was close to the price before the steady currency jumped on 15 October, the market panic of that day did not seem to have levelled off in the next 10 days.

这个以1:1锚定美元的稳定币,一直以来被投资者当做美元使用,而15日那天,USDT在1个半小时内,从0.986美元跌至了0.916美元,跌幅达7%。

This steady currency, which is a 1:1-fenced dollar, has been used by investors as a dollar, while on 15 days, USDT fell from $0.986 to $0.916 in an hour and a half, a decline of 7 per cent.

加上Tether一直都没有拿出证明其美元储备的有力证据,质疑缠身不断的背景下,USDT的短时下跌,让它的信任危机雪上加霜。

Together with the fact that Tether has never produced strong evidence to support its dollar reserves, it questions the entanglement of the short-term decline of the USDT, adding to its crisis of trust.

今日大规模的赎回和销毁,再次引发了人们对Tether激烈猜测。USDT持续地与美元脱钩,导致一些人指责该公司通过赎回来操纵市场,想要在市场反弹后,以低成本获利。

Today’s large-scale foreclosure and destruction has given rise to yet another vehement speculation about Teth. The USDT continues to delink from the dollar, leading some to accuse the company of being able to manipulate the market by redeeming itself and trying to profit at a low cost after the market rebounds.

除了抄底USDT的质疑外,Tether此举也被市场视作通过缩减供应量,重新将USDT拉升至1美元。

In addition to the challenge of copying the USDT, Tether's move was seen in the market as a reloading of the USDT to US$ 1 through a reduction in supply.

加密货币评论员WhalePanda就打趣说,“USDT稀缺来袭!很快就要1.01美元。”

The encrypt currency commentator WhalePanda used to say, "USDT is scarce. It's gonna be $1.01 soon."

Tether“赎回和销毁”之前的10天里,6.8亿个USDT被转移到该公司控制的钱包中,所有转账都来自Bitfinex控制的地址。而这家交易所在所有权和管理方面都与Tether有高度重合。

In the 10 days preceding Tether's “foreclosure and destruction” 680 million USDTs were transferred to the company-controlled wallets, all of which came from the address controlled by Bitfinex. The exchange had a high overlap in ownership and management with Tether.

频繁的转账让流通中的USDT在不到10天的时间里减少了25%,价值约在20亿美元。

Frequent transfers reduced the flow of USDT by 25 per cent in less than 10 days, with a value of about $2 billion.

Bitfinex的通信主管Kasper Rasmussen在接受媒体采访时表示,此举“与捍卫USDT平价美元无关”,他的理由是交易所和Tether都保证1对1的赎回,以此否认Tether故意缩减供应量。

In an interview with the media, Kasper Rasmussen, the communications manager of Bitfinex, stated that the move was “not related to the defence of USDT dollar parity” on the grounds that both the exchange and Tether guaranteed a one-to-one foreclosure, thereby denying that Tether had deliberately reduced its supply.

但长期以“Bitfinex'ed”的名字反对Bitfinex匿名人士,对Tether把资金转移描述为“赎回”表示怀疑,他在推特上写道,“没有人能站出来说他们把USDT换成了美元,并从Tether那里得到了汇款。”

However, long-standing opposition to the anonymity of Bitfinex #39; ed, expressed doubts that Teth had described the transfer as “foreclosure”, and he wrote on Twitter that “no one could stand up and say that they exchanged USDT for dollars and received remittances from Tether”.

“美元”成Tether和Bitfinex的敏感词

"United States dollars" in the sensitive words of Tether and Bitfinex

一直以“锚定美元”为骄傲的Tether,如今被“美元”所累,这个现实世界的硬通货像是个敏感词一样,让它和姊妹公司Bitfinex避之不及。

Tether, who has always been proud of the United States dollar, is now burdened by the United States dollar, and the hard currency of the real world, like a sensitive word, keeps it from sisterly company Bitfinex.

最近的一个趣事是发生在“USDT/美元”这个交易对上的“罗生门”,陷入其中的两方是CoinMarketCap和Bitfinex,前者是加密货币市场数据的服务商。

One of the most recent interesting things is that the transaction “USDT/United States dollar”, the two parties involved are CoinMarketCap, a service provider of encrypted money market data, and Bitfinex.

有媒体发现,CoinMarketCap收集的Bitfinex实时交易量统计表上,显示了一个USDT/USD 的交易对,这似乎是对USDT和美元之间的兑换表达,因为它以1美元显示了USDT的价格,比其他交易所上USDT的价格都高,且这个交易对的交易总量在本周二时达到了4800万美元,排在比特币之后。

The media have found that the real-time volume list of Bitfinex transactions collected by CoinMarketCap shows a USDT/USD transaction pair, which appears to be an expression of exchange between USDT and the United States dollar, because it shows USDT prices at US$ 1, higher than the USDT prices on other exchanges, and that the total volume of transactions for this transaction amounted to US$ 48 million at Tuesday this week, after Bitcoin.

CoinMarketCap后来反馈给媒体称,这个数据是从Bitfinex的API接口上抓的。

CoinMarketCap later reported to the media that the data had been captured from the API interface at Bitfinex.

要知道,市场上很少有交易所提供美元和USDT的直接交易。Bitfinex向媒体澄清说,他们没有这样一个交易对,更没有提供USDT和美元之间的直接兑换,CoinMarketCap上显示的数量,应该是代表了Bitfinex上USDT的提款和存款总和。

You know, few exchanges in the market offer direct transactions in US dollars and USDT. Bitfinex clarifies to the media that they do not have such a deal, let alone a direct exchange between USDT and US dollar, and that the quantities shown on CoinMarketCap are supposed to represent the sum of advances and deposits on USDT on Bitfinex.

如果Bitfinex没有这个交易对,为什么会出现在CoinMarketCap上?最终,这个疑问随着CoinMarketCap删除了这个交易对不了了之。

If Bitfinex did not have the right deal, why did it appear on CoinMarketCap? Ultimately, the question was not right with CoinMarketCap deleting the transaction.

Bitfinex对“美元”敏感,Tether也毫不例外。两家公司对于外界追问的“是否存在对应数量美元的银行账户”这个问题上一直讳莫如深,这也成了USDT 信任危机的根源。

Bitfinex is sensitive to the United States dollar, and Tether is no exception. Both companies remain silent on the question of whether there is a bank account equivalent to the United States dollar, which is the root cause of the USDT trust crisis.

资金从USDT流入比特币

Funds flowing from USDT to Bitcoin

USDT下跌带来的明显影响是比特币价格和交易量的上涨,这在10月15日表现的最为突出,当天,比特币快速突破了7000美元。

The obvious impact of the USDT decline was an increase in Bitcoin prices and volume of transactions, most notably on 15 October, when Bitcoin made a rapid breakthrough of $7,000.

10月22日,加密货币市场研究公司Diar用一份最新的研究报告说明了这一趋势。数据显示,资金在恐慌下从USDT流向了BTC和其他竞争性的稳定币中。

On 22 October, Diar, an crypto-currency market research company, described this trend with an updated study, which showed that funds moved from USDT to BTC and other competitive stable currencies in a panic.

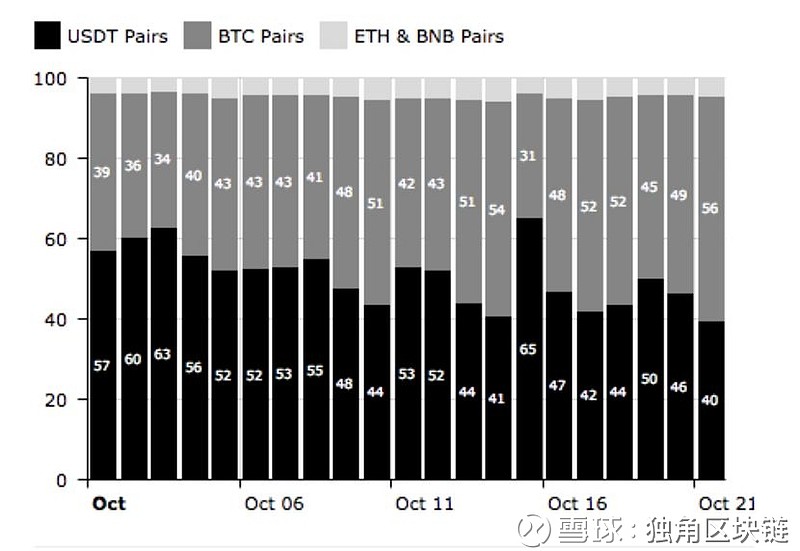

Diar的数据显示,在交易所币安上,从10月15日的“峰值危机”开始,USDT交易对的交易量下降了25%,比本月初下降了17%(见下图)。

Diar's data show that, on exchange currency security, the volume of USDT transactions fell by 25 per cent, from the beginning of the “peak crisis” on 15 October, to 17 per cent earlier this month (see figure below).

币安:USDT成交量创新低,比本月初下降了17%

Coin: USDT turnover innovation is low, down 17% from early this month

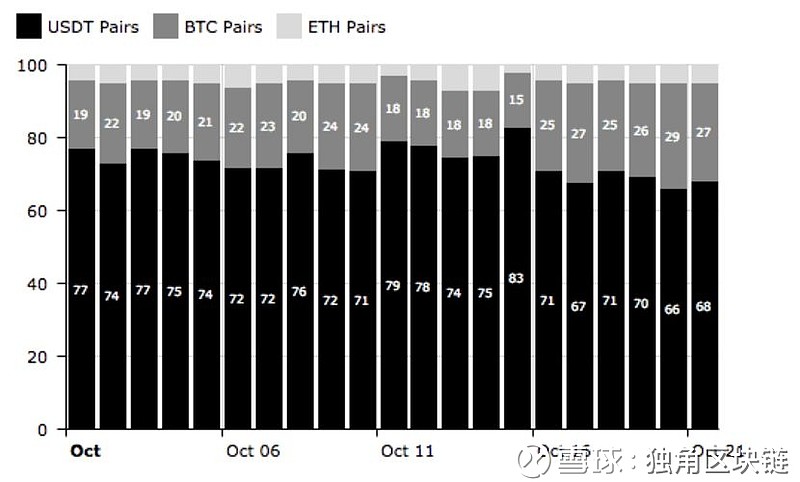

OKEx是USDT交易对最多的交易所,这一交易对的交易量也在下降,相对而言,BTC交易对的交易量增加了8-10%。

OKEx is the largest exchange for USDT transactions, and the volume of transactions for this transaction has also declined, with a relative increase of 8-10 per cent in the volume of transactions for BTC transactions.

OKEx:BTC交易对的交易量增加了8-10%

OKEx: BTC transaction-to-transaction volume increased by 8-10%

USDT失利后,其他诸如GUSD、TUSD等稳定币开始在竞争上加速,包括OKEx、火币、币安等主流交易所都上线了多种稳定币。

Following the loss of the USDT, other stable currencies, such as GUSD, TUSD and others, have begun to accelerate competition, including the entry of mainstream exchanges such as OKEx, tender, currency security, etc.

尽管USDT受到冲击,但由于支持其他稳定币的交易对比较少,USDT仍占主导地位。Diar以币安上的数据为例称,USDT交易量仍然占交易总量的98%。

Despite the impact of the USDT, the USDT dominates due to the relatively small comparison of transactions in support of other stable currencies. Diar, for example, says that USDT transactions still account for 98 per cent of total transactions.

Binance:USDT仍占据其他稳定币98%的成交量

Binance: USDT still accounts for 98% of the rest of the steady currency.

同时,Diar也指出,虽然比特币存在对USDT的溢价,但其美元价值仍保持不变,“因为市场对比特币/USDT/美元的估值相等。”

At the same time, Diar noted that while Bitcoin had a premium on USDT, its United States dollar value remained unchanged “because the market value of Bitcoin/USDT/United States dollar was equal”.

? ? ?市场对比特币/USDT/美元的估值相等

♪ The market is valued equally in bitcoin/USDT/dollar

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论