文|科技金融在线

Brunei Science and Technology Finance Online

8月19日,币圈自媒体壹块硬币发布了一篇文章,称币圈资深玩家王先生(化名)在数字货币交易所OKEx上的账户成为空号,价值1亿美元的数字货币也不知所踪。

On 19 August, a currency circle from a coin in the media published an article stating that the account of Mr. Wang, a senior player in the currency circle, on the digital currency exchange OKEx was empty and that the $100 million worth of digital currency was missing.

两个月后,王先生的真实姓名被媒体曝出,其真实身份竟然是十年前在股市名噪一时的短线交易奇才杨永兴。2011年杨永兴卷入被证监会调查传闻后,就一直销声匿迹,没想到最后以此种身份再次出现在公众面前。

Two months later, Mr. Wang’s real name was exposed by the media, and his true identity was the short-term deal in the stock market 10 years ago, Quixin Yang. After Yang Yonghing’s involvement in the CSRC investigation in 2011, he disappeared, and finally appeared before the public in that capacity.

除了炒币,杨永兴也多次布局币圈,投资了币圈自媒体壹块硬币和矿机巨头亿邦国际。此前,亿邦国际因为牵涉P2P平台银豆网集资诈骗案在香港上市失败。与宁夏首富孙珩超搭伙搞私募基金,最终也因为孙珩超涉嫌诈骗而无疾而终。

In addition to coin-fixing, Yang Young-heung has repeatedly set up currency circles, investing in them from the media, a coin and mining machine giants, International. Prior to that, Billion States had failed in Hong Kong because of a fraud involving the P2P platform's Silver Bean Network.

通常,股市大佬都是“收割”其他韭菜的,为何这次在币圈被“收割”了?还是此事另有隐情?

Usually, stock marketers are all "breeding" other pickles. Why is this "breeding" in the currency ring? Or is there something else about this?

“股市大佬”变“币圈大佬”

"Strange" to "Strange"

杨永兴在接受壹块硬币的采访中称,2017年比特币暴涨促使其开始关注币圈,并选择OKEx和火币两个交易所进行交易,初期其本人和一些朋友投入资金约6-7亿人民币。

In an interview with a coin, Yang Young-sung stated that the surge in bitcoin in 2017 prompted him to focus on the currency ring and to choose the two exchanges of OKEx and coin to trade, with initial investment of about 600-70 million yuan from himself and some of his friends.

天眼查显示,壹块硬币的运营公司深圳三点钟信息科技有限公司的股东名单中,出现了深圳市永圣慧远投资有限公司,其持股16.97%,为第二大股东,永圣慧远正是杨永兴当年发行阳光私募的平台。

In the list of shareholders in Shenzhen 3 o'clock Information Technology Ltd., a coin-operated company, Skywatch shows that Shenzhen City's Shenzhen City and Young-Hyun Investment Company Ltd., with 16.97 per cent shares, is the second largest shareholder, and Young-hye-Hyun was the platform for the release of Sunshine's private fund-raising for Young-Hing in the year.

除了投资币圈媒体,杨永兴在接受采访时透露也曾涉足矿机领域,是矿机制造商亿邦国际的股东之一。亿邦国际去年6月曾经向港交所提交招股书,但是提交招股书后上市没有进展,状态显示为失效。而亿邦国际还被曝出卷入银豆网非吸案。

In addition to investing in currency media, Yang Young-sung revealed that he was also involved in mining machines, and was one of the shareholders of the company’s billion-state manufacturer. Billion-state internationals had submitted shares to the Hong Kong border office in June last year, but there was no progress on listing since the offer was submitted.

《中国经营报》曾报道称,银豆网投资者发现亿邦国际与银豆网存在大额资金往来,并指出亿邦国际疑似利用来自银豆网的5.2亿元资金虚增销售收入。

The China Business newspaper has reported that Silver Bean Network investors have found that billion States have significant financial transactions with Silver Bean Network and that it is suspected that billion yuan from Silver Bean Network have been used internationally to surreptitiously increase sales revenue.

2018年7月18日,银豆网公告称实控人李永刚失联,资金暂无法兑付,涉及金额高达44亿元人民币,受害人约2万人。同日,北京市海淀公安分局对该公司立案侦查。2019年1月,李永刚等人涉嫌集资诈骗罪,报送北京市人民检察院第一分院审查起诉。

On 18 July 2018, the Silver Bean Network announced that Li Yonggang, the real controlr, had lost contact with him and that the funds were temporarily unpayable, amounting to RMB 4.4 billion, with some 20,000 victims. On the same day, the Heining Public Security Division in Beijing opened an investigation into the company. In January 2019, Lee Younggang et al. were accused of collecting funds for fraud and sent to the first branch of the People's Procuratorate in Beijing to examine the charges.

在2007年私募数据网站朝阳永续举办的股票实盘大赛中,年仅25岁的杨永兴以高达1497%的收益率夺冠,成绩远远超过同期参赛的其他阳光私募和券商集合理财。

During the 2007 stock-plate competition, which was organized by the private sector data website, Yang Yongjing, a 25-year-old, won a return of up to 1497 per cent, far exceeding the other Sunny private collectors and coupons who participated in the competition during the same period.

凭借在炒股大赛中取得的业绩,2009年3月,杨永兴发行了第一只信托产品“策略大师”,这只阳光化运作的产品在一年内净值增幅近200%,把杨永兴塑造成阳光私募市场上的神话。2009年12月,杨永兴又发行了阳光私募“永圣慧远稳健增值”。

As a result of its performance in the stock contest, in March 2009, Yang Young-sung launched his first trust product, the “Tact Master”, a Sunny operation whose net value increased by nearly 200% in one year, shaping Yang to become the myth of the Sun’s private marketplace. In December 2009, Yang Young-sing launched the Sun’s Private Call-up, “Young Saint-Hyun added further value.”

但是2011年,有媒体报道杨永兴因为涉嫌违规操作而被带走协助调查,其一手创办的深圳证通天下科技有限公司亦被解散。一位前证通天下员工向媒体透露,杨永兴确实被查,但是目前已经被放出来,听说是罚款了事,但是公司已被解散。

In 2011, however, media reports reported that Yang Yongjing was taken away to assist the investigation because of alleged irregularities, and that his first-hand Shenzhen General Security Technology Company Ltd. was dissolved. A former public employee revealed to the media that Yang Younghing was indeed being investigated, but has now been released, reportedly with a fine, but the company has been dissolved.

虽然后来杨永兴本人出面澄清,称自己从未接受任何部门调查。但是自此之后,江湖中只留下了杨永兴的传说,媒体中再鲜有人提及。此后的杨永兴基本远离了股票二级市场,开始了职业投资人的生涯,主要布局一级市场。

Since then, only the legend of Yang Young-hing has been left behind. After that, Yang Young-hing has largely moved away from the second-tier stock market, starting his career as a professional investor, mainly at the first-tier level.

相较于杨永兴在二级市场上的投资传奇,在股权投资领域,杨永兴业绩平平。除了在币圈的布局,从其投资公司看,多聚焦于热门的VR领域,包括中科金睛视觉科技(北京)有限公司和中科唯实科技(北京)有限公司,中科唯实公司股东出现了中科院院士谭铁牛身影。

Compared to Yang Young-hing’s investment legend in the second-tier market, Yang Yong-hsing’s performance is flat in the area of equity investment. In addition to the currency circle’s layout, there is much focus on the popular VR fields from its investment companies, including China’s Golden Eyes Visual Technology (Beijing) Ltd. and China’s Physical Science and Technology (Beijing) Ltd., where the shareholders of China’s real-estate companies appear in the presence of the Chinese Academy’s champion Tan Iron Bull.

谭铁牛是图像处理、计算机视觉和模式识别等相关领域的专家,曾担任中国科学院副院长一职。

Tan Tianx is an expert in areas related to image processing, computer visualization and mode recognition and has served as Vice-President of the Chinese Academy of Sciences.

与宁夏首富孙珩超搭伙搞私募

{\bord0\shad0\alphaH3D}Strange with Ningxia's rich grandkids.

除了在币圈布局投资,杨永兴还与宁夏首富、宝塔石化董事长孙珩超发起成立了深圳宝塔公交一号投资合伙企业(有限合伙),天眼查显示,杨永兴持股89.97%,而执行事务合伙人为宝塔资本管理有限公司。

In addition to investing in the currency circle, Yang Wing-Hing has set up the Shenzhen Pita Bus I Investment Partnership (limited partnership) with Hing-heung-Hing, Hing-Hyeong-Hing, Hing-Hing, Hing-Hing's shareholding, and the executive partner is Pita Capital Management Limited.

宝塔资本管理有限公司、宝塔金融控股集团有限公司和宝塔石化集团财务有限公司是孙珩超金融业务版图的重要组成部分。

Bota Capital Management Ltd., Bota Financial Holdings Ltd. and Bota PIC Finance Ltd. are important components of Sun Yu's super-financial business map.

宝塔石化集团是宁夏第二大民营企业,位居2017中国企业500强第318位,民营企业500强第98位,中国化工企业500强24位。虽然看起来实力强大,但宝塔石化也面临几乎所有民营企业都面临的问题:债务。通过布局金融业务筹集资金成为孙珩超重要工作,但也导致宝塔石化债务问题越来越严重,最后有170亿资金无法兑付。

The Pocahontas petrochemical group, the second largest private enterprise in Ningxia, stands at 318th in the top 500 Chinese enterprises, 98th in the top 500 private companies, and 24th in the top 500 Chinese chemical companies. Although it seems powerful, Pocahontas also faces problems for almost all private enterprises: debt.

去年12月,银川市公安局对宝塔石化涉嫌票据诈骗一案立案侦查,银川人民检察院于2018年12月18日决定对孙珩超等八人涉案犯罪嫌疑人批准逮捕,其中宝塔石化董事长孙珩超涉嫌票据诈骗罪,其余高管涉及违规出具金融票证罪。

In December of last year, the Shinchuan City Public Security Bureau opened an investigation into a case of alleged document fraud involving the peta petrochemicals. On 18 December 2018, the People's Procuratorate decided to authorize the arrest of the eight suspects involved in the case of Sun Su-hyun, who were suspected of being involved in document fraud, while the remaining officers were involved in irregularities in the production of financial certificates.

疑似控盘OKB 巨额数字货币资产成谜

suspected control program OKB huge digital currency asset enigma

杨永兴称2018年初在OKEx完成开户后,以约1美元的价格买入了1亿枚OKB。在此期间,杨永兴获利一倍,其所持有的数字货币资产从最初的8亿元人民币变成16亿元,他把其中价值8亿元人民币的数字货币资产出售,将资金从OKEx账户中转出。

Yang Young-sung claimed that 100 million copies of OKB were bought at a price of about US$ 1 at the beginning of 2018 after the opening of the account by OKEx. During this period, Yang Yong-sing doubled the profits and changed his holdings of digital monetary assets from the original RMB 800 million to RMB 1.6 billion, of which he sold digital monetary assets worth RMB 800 million and transferred the funds out of the OKEx account.

但是今年3月22日,在登录OKEx平台时发现账号显示“被冻结”,而里面尚剩余其投资数字货币的盈利部分,约3100万USDT以及2800万个OKB,价值约8亿元人民币。

However, on 22 March of this year, when entering the OKEx platform, the account number was found to be “frozen”, with the remainder of the profit portion of its investment digital currency, approximately 31 million USDT and 28 million OKBs, valued at about 800 million yuan.

OKB是OKEx 2018年3月发行的平台币,总发行约10亿个,10%出售给机构;50%逐年免费派发给用户;10%用作基金会运营;10%早期股东购买;20%团队持有。据目前OKEx平台公布的信息显示,目前OKB的流通量为3亿个。

OKB is a platform currency issued by OKEx in March 2018, with a total circulation of about 1 billion and 10 per cent sold to institutions; 50 per cent distributed to users free of charge on a year-to-year basis; 10 per cent used for foundation operations; 10 per cent purchased by early shareholders; and 20 per cent held by teams. According to information currently published by OKEx platform, the current circulation of OKB is 300 million.

如果按照杨永兴所述,其在OKB发行初期通过多个账户购入了1亿个OKB,这占据了OKB总流通量的1/3,几乎等同于控制了OKB的流通盘。杨永兴靠短时间的买买买,硬是买成了OKB的“大股东”。

If, according to Yang Young-sung, 100 million OKBs were purchased through multiple accounts in the early days of the release of OKBs, which accounts for about one third of the total amount of OKB flows, it is almost equivalent to controlling the OKB's circulation plate. Yang Yong-sing buys it for a short period of time and becomes a “big shareholder” of the OKB.

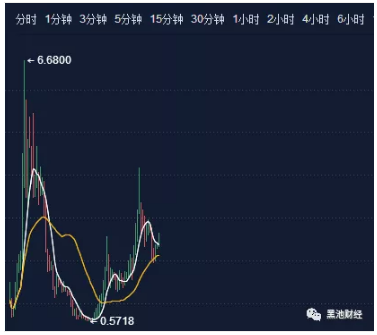

从OKB的K线图走势看,OKB在上市之后经过短暂下跌,之后一路上涨,在2018年5月19日一度达到6.68美元左右,短短2个月时间涨幅超过6倍。

In the light of the K-line movement of OKB, after a brief decline after its listing, it rose to about $6.68 on 19 May 2018, with an increase of more than six times in a short period of two months.

对于杨永兴所言的种种细节,OKCoin创始人徐明星在微博上回复称,这是一个现代版的农夫与蛇的故事,而且杨永兴本人也是OKCoin小股东,“杨永兴不满足1倍的投资收益,多次勒索不合理的数倍的超额收益,被公司董事会明确拒绝以后,其开始捏着事实,攻击本人和OKCoin公司。”

With regard to the details of Yang Yongcheng's statement, the founder of OkCoin, Star Seo, replied on Twitter that it was a modern version of the story of farmers and snakes, and that Yang Yonghing himself was also a small shareholder of OKCoin. “Yang Yonghing did not satisfy one-fold of the return on investment, extorted several times the unreasonable excess gains, and, after being explicitly rejected by the company's board of directors, he began to squeeze the facts and attacked himself and the company OkCoin.”

OKEx首席战略官徐坤日前在接受媒体采访时称,从OKEx后台并未查到杨永兴主张的拥有8亿资产的账户,事件的本质是股权纠纷。

In a recent interview with the media, the Chief Strategic Officer of OKEx, Xu Kwan, stated that the 800 million-dollar account advocated by Yang Yongcheng had not been traced from the background of OKEx and that the essence of the incident was an equity dispute.

最新消息显示,杭州互联网法院日前已经受理了杨永兴等人起诉OKEx及徐明星的案件,杨永兴与卫伟平共同持有OK集团1%的股权。

According to the latest information, the Hangzhou Internet Court has been seized of the case of Yang Yongcheng and others against OkEx and Xu Star, who share 1 per cent of the OK Group's shares with Wei Weiping.

神仙打架,孰是孰非,也许只能等待法院的裁决。

If a fairy fights, it's either right or wrong, perhaps it's just a matter of waiting for a court decision.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论