编译 | 刘教链

教链按:还有不到20天,BTC(比特币)就要迎来其历史上的第4次产量减半了。(参阅教链3.28文章《比特币减半,山寨始探春》)

加密行业的资深OG(老炮,老玩家)们普遍认为,每次减半都将推动下一轮牛市。

Senior OG& #xff08 of the encryption industry; old gun #xff0c; old player #xff09; widely believed xff0c; each time half will drive the next round of cattle.

对此,教链也曾多次撰文,辨析究竟是减半推动了牛市,抑或牛市是对下一次减半的“抢跑”。典型文章比如2020.5.14文章《【对话中本聪】系列之比特币减半》、2021.11.22文章《比特币产量减半和价格自我实现》、2023.11.19文章《比特币的周期》等。

In this regard, xff0c; the religious chain has written on several occasions xff0c; it has been clarified whether halving has contributed to xff0c; or whether the cow market is the “run-off” for the next half. Typical articles such as 2020.5.14, , 2023.11.19, .

以贵金属行业的S2F硬度模型(教链2023.2.19文章《小科普:什么是S2F(Stock-to-Flow)》)来度量BTC,便得出了BTC每4年会发生一次硬度“相变”的推论。把硬度相变作为价格“相变”的依据,便得出了S2F价格模型(为匿名分析师PlanB所主推)。有关于硬度相变,教链亦曾撰文多篇介绍,最近的如2023.12.5文章《2024减半之辩:涨幅消退或者超级周期?》、2023.8.28文章《比特币的币时模型》、2023.7.19内参《PlanB:S2F模型显示BTC下轮减半周期或达45.6万刀》、2023.2.17文章《2024奇点将至:人类尚未准备好迎接S2F大于100的巨硬资产》、2023.1.6文章《S2F:比特币即将超过黄金》等等。

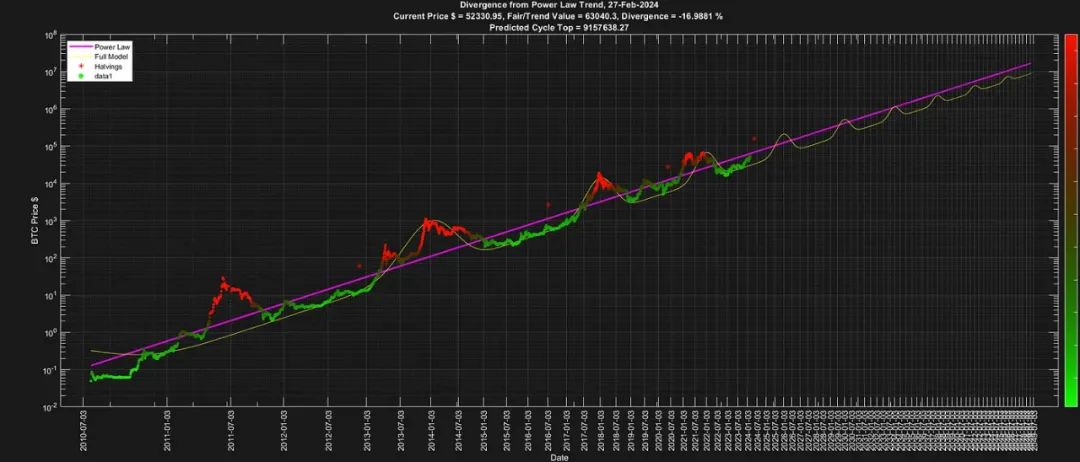

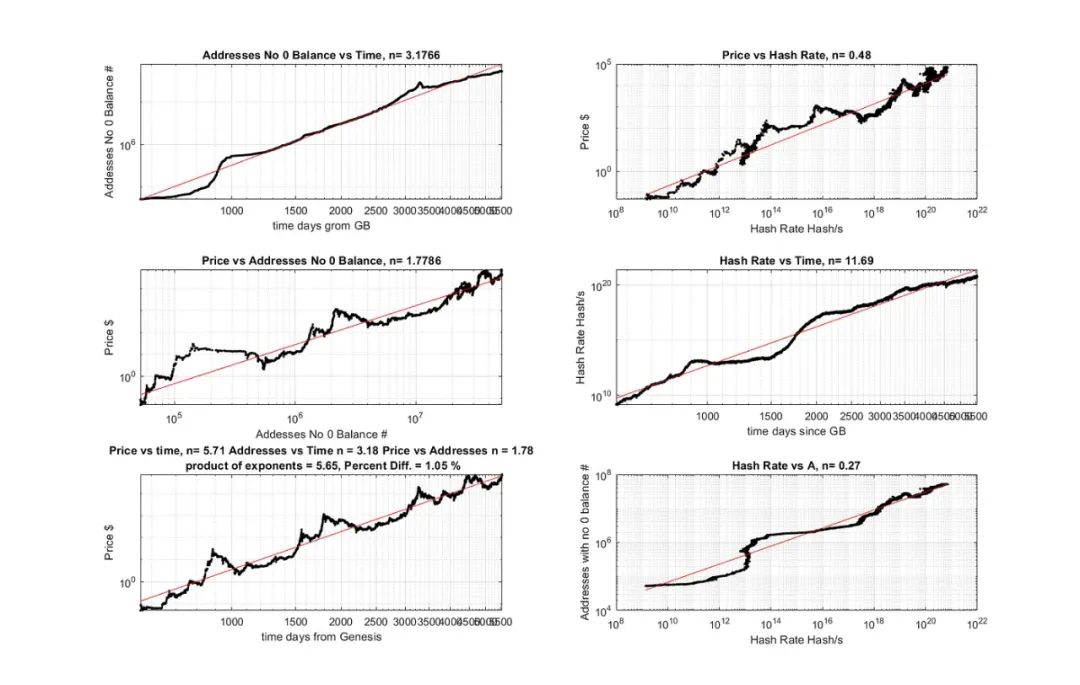

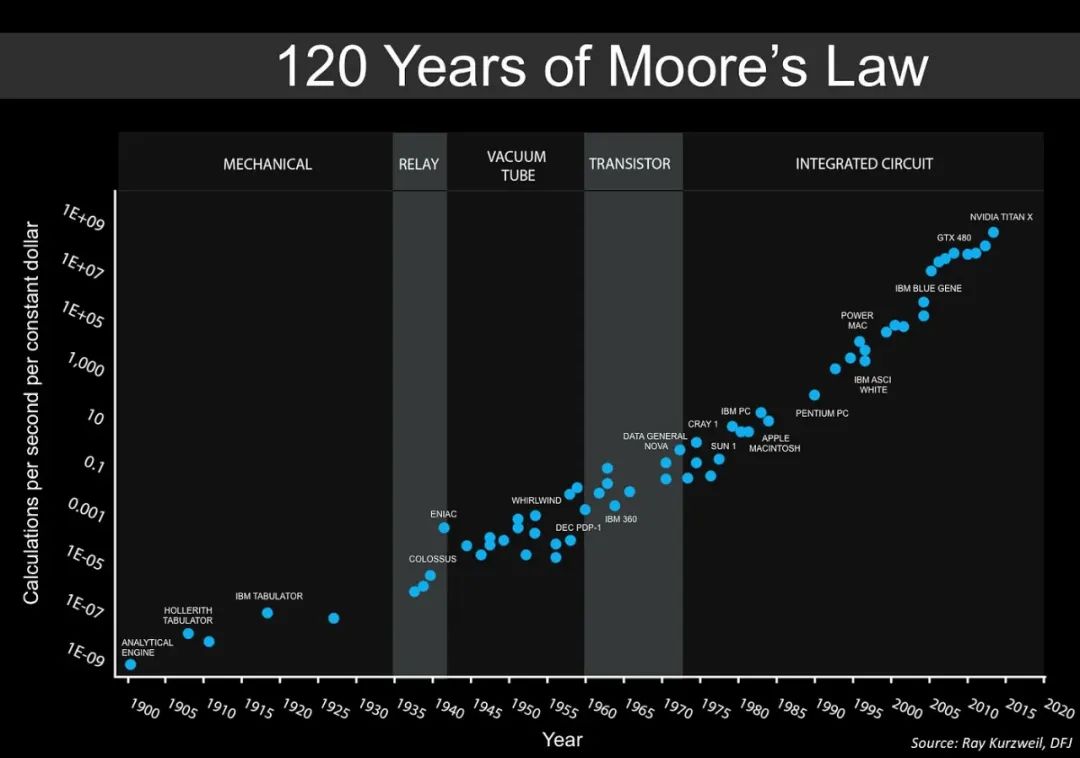

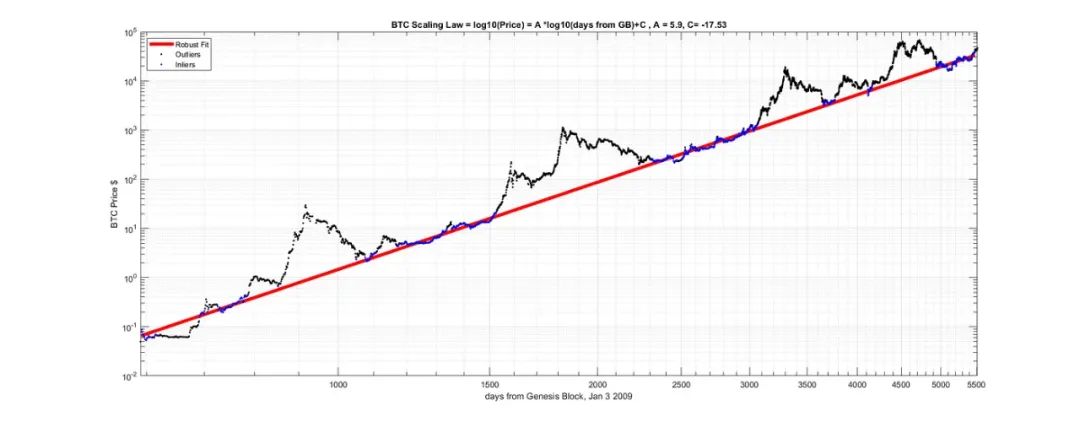

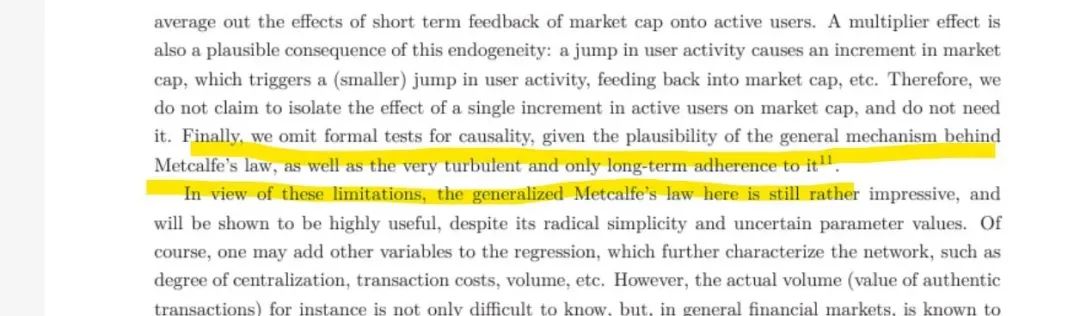

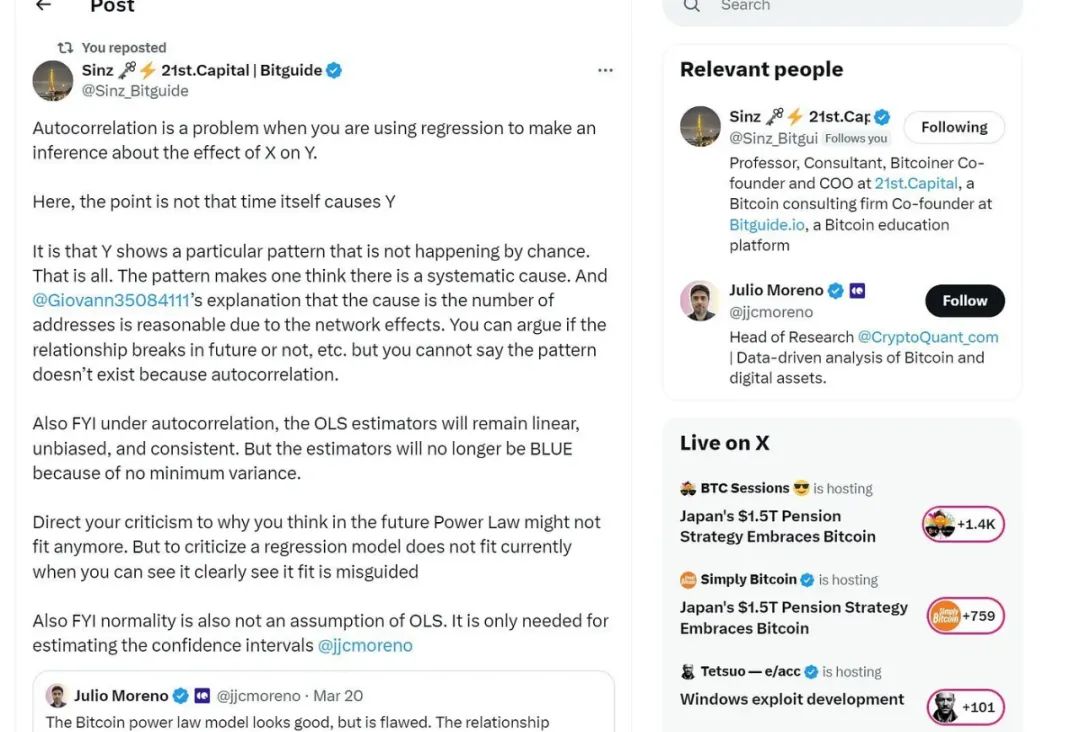

S2F hardness model & #xff08 in the precious metals industry; xff09; {refrefrefrefres 3月25日,教链分享了文章《比特币的时间幂律模型及其协整性再探讨》。其中介绍的时间幂律模型,教链最早在2021.7.24文章《比特币的价格走廊》中就有所介绍。后来更是在多篇文章中反复回顾,并作为价格前瞻的工具。一些文章在3月25日文章“教链按”中有所提及,此处不再一一枚举。 25 March xff0c; the church chain shared the article bitcoin's time law model and its overall rediscovery . The time rule model xff0c was introduced; the church chain was first described in the article . 此处有一个矛盾点,不知道有没有读者发现。本质上,幂律模型否定了S2F。因为在幂律空间中,只有时间(time)维度而并没有供应量(supply)维度。借用科幻小说《三体》里,造成众多物理学家死亡的那个问题,套用过来可以这么说: There's a paradox here xff0c; it's not clear if the reader finds it. In essence xff0c; the xff0c; in the xff08;time;time;time; xff09; dimension without supply xff08; Suply) dimension. Use of science fiction novels xff0c; the problem that caused the death of a large number of physicists xff0c; this can be said xff1a; 减半不存在了。 There is no more half of it. 曾经有老韭菜绝望地发问:如果说产量减半对BTC有决定性地推动作用,那么为什么它对LTC(莱特币)就没有作用呢? #xff1a has been asked in despair by old cucumbers; if the reduction of production by half is decisive for BTC #xff0c; then why it is not working for LTC #xff08; Lettcoin #xff09; #xff1f; 减半和牛市,不过是一种虚妄的联想。也许减半牛从来就没有存在过,将来也不会存在。 Halve the bull market #xff0c; it's just an illusion. Maybe half the cow never existed #xff0c; it never will. 如果减半不存在了,那么我们也就完美的解决了文首辨析的问题。答案很简单:既不是减半推动了牛市,也不是牛市领先于减半,二者并没有什么关系。 If the half doesn't exist xff0c; then we also have the perfect answer to the headline question. The answer is simple xff1a; neither half promotes the bull market xff0c; nor is the cow market ahead of the half xff0c; it doesn't matter. 虽然听上去很难接受,但是对于信奉奥卡姆剃刀原理的教链来说,剃除减半的幂律理论,确实更优美。 Although it sounds difficult to accept #xff0c; #xff0c for the church chain that believes in the Ocam Razor doctrine; #xff0c for the ruler that shaves by half; #xff0c; indeed, it's even better. 今天,教链就先把幂律模型的提出者Giovanni Santostasi最近(2024.3.20)的一篇文章《比特币幂律理论》(The Bitcoin Power Law Theory)介绍给各位读者,作为后续继续深入探讨有关话题的基础。 Today xff0c; the church chain began with Giovanni Santostasi, the author of the model law, recently xff08; 2024.3.20) an article, Bitcoin Theory & #xff08; The Bitcoin Power Law Theory #xff09; introduction to readers #xff0c; as a basis for further discussion of the topic. * * * 图释:比特币类似于自然现象,并非普通资产。这幅美丽的艺术作品归功于 @BainterSAT 与金融资产相比,比特币更像一座城市和一个有机体。 is more like a city and an organism than a financial asset xff0c; Bitcoin is more like a city and an organism. 12 年前,我开始研究比特币。 12 years ago #xff0c; I started studying bitcoin. 我在 Reddit 上发表我的探索,而不是在期刊上发表,主要是因为我想接触更广泛的比特币社区,而不是发表一篇非专业科学家不会阅读的论文。 I published my exploration on Reddit & #xff0c; not in journals & #xff0c; mainly because I wanted to reach out to the wider Bitcoin community & #xff0c; instead of publishing a paper that unprofessional scientists would not read. 我的主要发现是,比特币受幂律支配。其规律性表明,比特币的行为更像一个物理系统,而不是资产。这一直觉是基于比特币价格与时间的关系中观察到的惊人的幂律。 My main finding is that xff0c; bitcoin is dominated by hysteria. Its regularity suggests that xff0c; bitcoin behaves more like a physical system xff0c; not as an asset. This has always been based on the amazing laws observed in the relationship between bitcoin prices and time. 比特币幂律理论。 Theorem of Bitcoin. 我的幂律模型现在已经发展成为一个完整的比特币行为理论,能够以科学连贯和可证伪的方式解释所有主要链上参数,并描述比特币采用率的增长:比特币幂律理论或 PLT。 My model of law has now evolved into a complete bitcoin behavioural theory & #xff0c; capable of interpreting all major chain parameters & #xff0c in a scientifically consistent and perjured manner; and describing the growth of bitcoin adoption & #xff1a; Bitcoin theory or PLT. 下图概括地解释了 PTL 理论,并显示了支持该理论的主要数据。价格、哈希率和地址(我们使用高于阈值的地址来消除灰尘地址)都是彼此和时间的幂律。 The figure below provides an overview of the PTL theory & #xff0c; and shows the main data in support of the theory. Prices, Hashi ratio and address & #xff08; we use addresses above the threshold to remove dust & #xff09; they're the laws of each other and time. 它们在一个连续的反馈循环中相互作用、相互影响。 They interact and interact in a continuous feedback cycle. 幂律是 y=A x^n 形式的数学表达式,在自然界中无处不在,在社会现象以及与城市或国家发展相关的许多参数中也是如此。 The law is y= mathematical expression xff0c in the form of A xn; everywhere in nature xff0c; and also in social phenomena and many parameters related to urban or national development. 它们之所以如此常见,是因为可以用数学和物理学的方法证明,只要有某种过程,输出就会在迭代过程中成为新的输入,它们就会出现。 They are so common xff0c; they can be demonstrated by mathematical and physical methods xff0c; as long as there is a process xff0c; the output becomes a new input xff0c in an iterative process; they appear. 这正是比特币的情况,例如,现在的哈希率会影响以后的哈希率,形成无限循环。因此,比特币的行为具有幂律,这不仅令人惊讶,而且也完全符合比特币的本质。 This is the case of Bitcoin xff0c; e.g. xff0c; the current Hashi rate affects the later Hashi rate xff0c; forming an infinite cycle. So xff0c; Bitcoin's behavior xff0c; it's not only surprising xff0c; it's also perfectly compatible with the nature of Bitcoin. 下图支持这种相互作用,这在社区中是众所周知的。这张图不是我发明的,但我用它来说明理论是如何运作的。 The following graph supports this interaction xff0c; this is well known in the community. This is not my xff0c; but I use it to explain how theory works. 该理论基本上是一种数学表达,基于逻辑、物理和数学的反馈回路。 The theory is essentially a mathematical expression & #xff0c; feedback loop based on logic, physics and mathematics. 1. 最初,比特币需要被中本聪圈子的第一批用户接受和采用。 Initially xff0c; Bitcoin needed to be accepted and adopted by the first users of the central circle. 2. 比特币的“价值”(现在是“价格”,可全天候在线查询)随着用户数量的平方而增加(经验测量值更像是 1.95,但为了简单起见,我们将以下所有幂数四舍五入为整数)。这证实了梅特卡夫定律的理论结果。 Bitcoin's “value” & #xff08; now “price” & #xff0c; full-time online search & #xff09; increased xff08 as the number of users squared; empirically measured values more like 1.95, but for simplicity xff0c; we rounded all of the following to integer xff09; this confirms the theoretical results of Metkaf Maift. 3. 价格上涨带来了更多的资源,尤其是采矿能力。 Higher prices have generated more resources xff0c; in particular, mining capacity. 4. 价格上涨减少了开采一个区块的时间,但由于“难度调整”,开采一个区块所需的哈希率会反复变化。由于挖矿几乎无利可图,因此补偿机制需要与价格的增长成正比,而价格的增长是通过 P=users2 和奖励本身来实现的,因此从逻辑和维度上讲,我们可以得出哈希率=价格2(这正是在幂律的经验值接近 2 或价格=哈希率^1/2 时观察到的结果)。 The price increase has reduced the time for mining a block xff0c; however, because of the “difficult adjustment” xff0c; the Hashi rate required for mining a block will change over and over again. Because mining is almost unprofitable xff0c; thus the compensation mechanism needs to be proportional to price growth xff0c; whereas price growth is achieved through P61; users2 and incentives per se xff0c; thus xff0c in terms of logic and dimensions; we can derive Hashi ratio 61; price 2xff08; this is the result observed at 2 or 61 at 1/2; ff09; 5. 哈希率的增加会给系统带来更多的安全性,从而吸引更多的用户。现在有些读者可能会说,大多数人购买比特币并不是因为“安全”,但他们间接地购买了比特币,因为如果它不是一个安全的系统,就不会有人在它身上投入巨大的价值。所以是的,系统的安全性直接或间接地带来了新用户。 The increase in the Hashi rate will bring more security to the system xff0c; thereby attracting more users. Some readers may now say xff0c; most people do not buy bitcoin because of “safe” xff0c; they buy bitcoin xff0c indirectly; because if it is not a secure system xff0c; no one will put a great deal of value into it. So xff0c; the security of the system brings new users directly or indirectly. 6. 随着时间的推移,用户数量会以 3 的幂次增长。这也是该理论的一个新结果。大多数比特币应用模型都采用 S 型曲线增长。S 曲线是电视、冰箱、汽车、手机等许多技术应用的典型曲线。比特币并不遵循 S 型曲线,它最初是指数型的。它在时间上遵循 3 的幂律。事实证明,许多现象在采用或传播时都有一个潜在的 S 曲线机制(以病毒为例),如果它们有一个抑制机制,它们就会变成幂律。就比特币而言,“难度调整”和任何类型的投资所涉及的风险都是抑制机制,这就是为什么我们通过经验观察到,比特币的采用率增长在时间上呈现 3 的幂律。有大量文献显示,在涉及风险的疾病传播中存在这种抑制现象,例如艾滋病(比特币不是艾滋病,但这些研究表明,如果疾病的传播涉及某种决策,例如与伴侣发生性关系,那么疾病的传播在时间上就会呈现 3 的幂次,而不是 S 曲线或其他类型的逻辑曲线)。 6. Over time xff0c; the number of users will grow exponentially by 3. This is also a new result of the theory. Most bitcoin application models use S curves to grow. S curves are typical of many technology applications, such as television, refrigerators, cars, mobile phones. Bitcoin does not follow S-type curves xff0c; it is initially exponential. It follows the rule of time. xff0c; many phenomena are introduced or transmitted with a potential S curve mechanism xff08; viral cases xff09; xff0c; if they have a containment mechanism xff0c; if they do, they become xxxxx; x#x#xxxxxx#xxxxxx#xxxx#xxxxxxxx#fffffx. #xx.0cx.0; if fffffffffffffft. ; this is used to control disease x. 7. 这种循环无限重复。泡沫是这一循环的重要和必要组成部分,下文的推论将对其进行单独讨论。 This cycle repeats indefinitely. Foams are an important and necessary component of the cycle xff0c; their reasoning will be discussed separately below. 8. 那么,采用率的这种幂律增长(连同之前解释过的幂律)就解释了为什么我们能及时观察到其他幂律:地址=t3,价格=地址2=(t3)2=t?,哈希率=价格2=(t?)2=t12。 So xff0c; this xff08 for application rate; xff09 with previously explained xff09; explains why we were able to observe other xff1a; address 61; t3xff0c; price 61; address 261; t361; xff0c; Hashi ratio 61; price 61; 261; 61; t12. 下面的图表显示了所有相互幂律及其拟议的因果解释。 The chart below shows all cross-colleges and their proposed causal explanations. 幂律理论的后果和预测。 这一理论解释了比特币的长期行为,并产生了许多后果。 This theory explains the long-term behaviour of Bitcoin xff0c; it has many consequences. 其中最令人震惊和最相关的,也是大多数普通比特币投资者经常误解的,就是标度不变性(Scale Invariance)。 The most shocking and relevant of these are xff0c; xff0c, which is often misunderstood by most ordinary bitcoin investors; strong xff08; Scale Invariance) . 标度不变性是物体或定律的一种特性,当长度、能量或其他变量的标度乘以一个公共因子时,它们保持不变。它是物理学、数学和统计学中的一个特征。 Punctuation is a characteristic of an object or law xff0c; it is a feature of physics, mathematics and statistics when the scales of length, energy or other variables are multiplied by a public factor xff0c; they remain unchanged. 标度不变性是受幂律支配的系统的典型特征。 Stereotyping is a typical feature of a system governed by discipline. 从本质上讲,它表示系统在以相同的方式增长时将继续扩大规模(scale),这就是为什么我们可以使用标度不变性来进行预测,鉴于系统的增长已经超过了 9 个数量级,几乎可以肯定的是,其他 1 或 2 个数量级的增长也将继续发生(达到 100 万 BTC 大约需要 10 年时间)。虽然这听起来不可思议,但从长远来看,系统、价格、哈希率和采用率等一切重要因素都是可以预测的。 In essence, xff0c; it means that the system will continue to grow in size as it grows in the same way as xff08; scale) xff0c; this is why we can predict xff0c by using not changing metrics; given that the system has grown by more than 9 orders of magnitude xff0c; almost certainly xff0c; other 1 or 2 levels of volume will also continue to grow xff08; reaching 1 million BTC will take about 10 years xff09; although this sounds incredible xff0c; in the long run, all important factors xff0c; systems, prices, Hashi rates and adoption rates are predictable. 标度不变性还能让我们理解大型机构 ETF 最近对比特币系统的投资流入等事件的作用和重要性。 It also allows us to understand the role and importance of events such as the recent investment inflows into the bitcoin system by large agencies. 标度不变性告诉我们,这些事件不会极大地影响比特币的价格轨迹,相反,它们是比特币系统继续保持标度不变增长所必需的关键事件。 xff0c. The scale is not variable; these events do not significantly affect the price trajectory of Bitcoin xff0c; on the contrary xff0c; they are key events necessary for the Bitcoin system to continue to grow at constant scales. 这也意味着,许多人很难理解,幂律趋势(加上泡沫)就是你所得到的一切。不多也不少。 It also means #xff0c; many people have difficulty understanding #xff0c; #xff08; plus foam #xff09; that's all you get. Not much, not much. 这是该理论最令人震惊的预测。 That is the most alarming prediction of the doctrine. 所有理论都是可证伪的,而这正是证伪该理论(至少是目前形式的理论)的方法之一。 All theories are perjured xff0c; this is one of the methods of perjury xff08; at least in its current form xff09; 未来的理论可以修改,增加斜率变化或相变,但目前的理论认为,比特币的价格路径已经确定,除非发生灾难性事件,否则不会发生改变,尤其是在 1 或 2 个数量级上,而这只是比特币整体历史增长的一小部分。如果比特币在 15 年中保持标度不变,那么在接下来的 10 年(下一个数量级)中,比特币也可能保持标度不变。 Future theories can modify xff0c; increase the change in the tilt rate or the variation xff0c; but the current theory considers xff0c; price paths for bitcoin have been determined xff0c; xff0c; unless catastrophic events occur xff0c; xff0c; especially on 1 or 2 orders of magnitude xff0c; and only a small fraction of the historical growth of bitcoins as a whole. If bitcoin remains constant xff0c over 15 years, then the next 10 years xff08; next level of magnitude xff09; medium xff0c; bitcoin may also remain constant. 顺便提一下,就规模而言,未来 10 年与之前的 15 年是不相容的,因为这只是另一个数量级。对于大多数不熟悉这些概念的人来说,需要花一些时间来理解对数比例的工作原理。 By the way, xff0c; xff0c in terms of size; xff0c in the next 10 years is incompatible with the previous 15 years; because this is just another order of magnitude. xff0c for most people who are not familiar with these concepts; it takes some time to understand the working principle of logarithm. 该理论还有更多的内容(例如,为什么我们会看到如此吻合的底部遵循幂律),但我们将在后续文章中详细阐述。 There is more to the theory xff08; xff0c, for example; why do we see that the bottom of the match follows the rule xff09; xff0c; but we will elaborate on it in a follow-up article. 理论的推论。 Theorem of the theory of 泡沫是如何产生的? how foams are producedxff1f; 与稀缺无关,与摩尔定律有关。 Not related to scarcity #xff0c; related to Moore's Law. 中本聪知道摩尔定律。这是一个启发式定律,宣称计算能力每两年翻一番。“难度调整”机制确保你需要花费大量的金钱和精力来获得一些额外的比特币。 It's an inspirational law & #xff0c; claims that computing capacity doubles every two years. The "difficult adjustment" mechanism ensures that you spend a lot of money and effort to get some extra bitcoins. 但摩尔定律给了你一个不公平的优势。4 年后,你将拥有 4 倍的哈希值计算能力,基本上与 4 年前的机器(大致相同)的能耗成本相同。由于磨损,你无论如何都需要更新,而机器的成本只是运营成本的一部分。事实证明(我在理论中解释了以何种方式),无论是从逻辑上还是从经验上,我们都可以得出价格(或通常所谓的奖励)=哈希率1/2。因此,基本上 4 倍的哈希率只能带来 2 倍的收益。但减半后,收益减半,增加的收益为零。这一切都是为了让矿工处于盈利的边缘,永远不允许有免费的午餐。这太完美了,不可能是偶然的,我认为中本聪正是这样计划的。 But Moor's law gives you an unfair advantage. Four years later xff0c; you will have four times the capacity to compute Hashi's values xff0c; basically the same energy consumption costs as four years ago xff08; xff09; roughly the same energy consumption costs. Because of wear xff0c; you will need to update xff0c; in any case, machine costs are only part of the operating costs. xff08; I explain in theory how xff09; xfff0c; xff0c; xffoc; we can get a price xff08; 61; #Hahp1/2. So xff0c; basically 4 times the Hashi rate can only yield two times the benefit of the operating cost. 4年,而不是2年或者连续减少奖励,是因为这在供应链方面也是一个好主意,因为芯片行业的更新和进步需要时间,也给了矿工时间去计划更新,让设备自然贬值。这纯属天才之举,与比特币有关的任何事情都极其务实,切中要害。泡沫是“安全吸引更多采用”这一循环的结果。这个循环并不是我发明的,而是其他人发明的,而且它一直被用来解释采用比特币的周期。 Four years xff0c; not two years or consecutive reduction of incentives xff0c; because this is also a good idea in the supply chain xff0c; because it takes time to update and progress in the chip industry xff0c; it also gives time to miners to plan to upgrade xff0c; let equipment depreciate naturally. It's a genius xff0c; everything about bitcoin is very practical xff0c; the point in the equation. The bubble is the result of a cycle that “safe attracts more use”. This cycle is not xff0c; it's xff0c; it's xff0c; and it's been used to explain the cycle of bitco. 这是有道理的,因为直接提高安全性会吸引更多的人,让你对比特币存储价值的能力更有信心。没有这一点,就没有价值。我有一个最好的比喻,当人们搬到一个发展中的城市(就像赛勒(教链注:微策略公司创始人)说的,比特币是数字世界中一个闪亮的城市)时,会出现一阵活动。你想搬进去,因为那里有桥梁、房屋、道路等等。你不一定会直接考虑这些事情,但你会被这些活动所吸引。所有的新事物和好事都在那里发生。这就产生了一种暂时的“FOMO”(教链注:害怕错过),这种“FOMO”是好的“FOMO”,因为它是基于基本面的,而不是一些愚蠢的猜测,也许“FOMO”不是一个最好的词,所以你可以帮我找一个更好的词。但你知道我的意思。 This is a valid xff0c; because a direct increase in security will attract more people xff0c; and make you more confident about the storage value of the currency. There is no such xff0c; there is no value. I have the best metaphor xff0c; when people move to a developing city xff08; like Syll xff08; #xff1a; the founder of micro-strategy xff09; xff0c; Bitcoin is a shiny city in a digital world xff09; xff0c; there is a wave of activity. You want to move in xff0c; because there are bridges, houses, roads, etc. 图释:kuntah ? 是这张神图的作者。 价格上涨很快,几乎呈指数增长。这是价格唯一一次出现这种情况,而不是按幂律增长。事实上,从下图中可以看出,它几乎是完全对称的,价格下跌的速度和上涨的速度一样快(有时更快)。泡沫破灭后,它又会回到平衡状态。这是一种点状进化,是比特币增长的必要条件。 The price rise is fast xff0c; it is almost exponentially increasing. This is the only time that the price goes up xff0c; it does not grow by xff0c. In fact, xff0c; as can be seen from the figure below; it is almost entirely symmetric xff0c; prices fall as fast as they rise xff08; sometimes faster xff09; xff0c; it returns to equilibrium when the bubble collapses. This is a dot-like evolution xff0c; it is a sine qua non for bitcoin growth. “所谓点状平衡,是指进化是以脉冲的形式发生的,而不是达尔文所说的那种缓慢而稳定的进化。在物种灭绝或新物种出现方面几乎没有活动的长期停滞期,被间歇性的突发活动所打断。” "The so-called point balance xff0c; evolution is xff0c, which takes the form of a pulse; not the slow and steady evolution that Darwin calls. There is little activity in species extinction or the emergence of new species for a long period of stagnation xff0c; interrupted by intermittent outbreaks." 因此,泡沫也是比特币故事的一部分。它们并不是整个幂律增长的主线,但它们也是其中重要的一部分和必要的一部分。 So xff0c; bubbles are also part of the Bitcoin story. They are not the main line of growth xff0c; they are also an important part and necessary part of it. 我认为,这就完美地解释了整个周期中泡沫外(约 2 年)和泡沫内(约 2 年)的增长。请告诉我你的想法以及这是否合理。 I think xff0c; this is a perfect explanation for the growth of the bubble outside xff08; about 2 years xff09; and within the bubble xff08; about 2 years xff09; ff09;. Please tell me what you think and whether it makes sense. 知名物理学家 D. Sornette 的这篇论文对泡沫的起源和性质持非常相似的立场。 This paper by D. Sornette, a leading physicist, takes a very similar position on the origin and nature of foams. 注释 稀缺性在这一理论中完全不起作用。稀缺性没有任何机制或解释力。 Scarcity does not work at all in this theory. There is no mechanism or interpretation for scarcity. 附录 appendix 一些模型证实了我的发现。比特币幂律理论(BPLT)比这些工作要早几年,但其他研究人员也发现了类似的结果,这一点令人欣慰: Some models confirm my findings. Bitcoin theory & #xff08; BPLT) years earlier & #xff0c; but other researchers have found similar results & #xff0c; this is reassuring & #xff1a; https://stephenperrenod.substack.com/p/bitcoins-lindy-model 斯蒂芬是另一位拥有哈佛大学博士学位的天体物理学家。 Stephen is another astrophysicist with a Ph.D. from Harvard University. Q&A 我不明白什么是幂律 ♪ I don't know what strong is ♪ ♪ strong ♪ ♪ strong ♪ ♪ I don't know what strong ♪ ♪ strong ♪ 幂律是一个简单的概念,它是一种 y=A x^n 的关系式。 Ration is a simple concept xff0c; it is a y61; A xn relationship style. 这种等式虽然简单,但它代表了自然界和人为现象中的许多现象。 This equation, although simple xff0c, represents many of the phenomena of nature and man-made phenomena. 但是,既然比特币是由人类互动产生的,那么幂律怎么可能出现在比特币中呢? but #xff0c; since bitcoin is created by human interaction xff0c; then how is it possible to show up in bitcoin? #xff1f; 首先,比特币并非仅由人类互动产生。毕竟,比特币是一个拥有精确算法的代码,通过精确的数学公式运行。“难度调整”是系统中存在的众多反馈回路之一,其作用类似于恒温器,因此可以将其作为一个物理系统来研究。矿工对能源的需求也是纯物理学。但是,更多基于社会互动的物理学,比如新比特币用户的采用,也可以用类似于物理学和生物学中的方程式来建模,比如病毒的传播。 First xff0c; bitcoin is not produced by human interaction alone. After all, xff0c; Bitcoin is a code with precise algorithms xff0c; it operates through precise mathematical formulas. “Risk adjustment” is one of the many feedback loops that exist in the system xff0c; it functions like a thermostat xff0c; it can therefore be studied as a physical system. Miners’ demand for energy is also pure physics. But xff0c; more physics based on social interaction xff0c; for example, the use of xff0c by new bitcoin users; it can also be modeled with equations similar to those in physics and biology xff0c; for example, the spread of viruses. 单个个体可能有自由意志并独立行动,但当你考虑到大量的代理人时,就会出现一些模式,这些模式可以用我们为理解自然现象而开发的工具来研究。我们称之为“普遍性”,这意味着我们可以在自然界中找到与所研究现象的特殊性质无关的相似模式。 Individual individuals may act freely and independently xff0c; but when you consider a large number of agents xff0c; there are models xff0c; these models can be studied using tools we have developed to understand natural phenomena. What we call “universal” xff0c; this means that we can find similar patterns in nature that are not related to the particular nature of the phenomena being studied. 科学家们已经将这些方法应用于社会网络的增长、城市如何发展、企业如何生存等许多方面。这些社会或经济现象往往遵循幂律。甚至恐怖袭击也遵循幂律。 Scientists have applied these methods to many aspects of the growth of social networks, how cities develop, and how businesses survive. These social or economic phenomena often follow the law. Even terrorist attacks follow the law. 稀缺性、需求和供应又是什么? what's scarce, demand and supply? #xff1f; 它在比特币幂律理论中的作用为零,我们将在今后的文章中详细阐述。 Its role in the Bitcoin doctrine is zero #xff0c; we will elaborate on it in future articles. 为什么不使用美元以外的其他货币? Why not use currencies other than United States dollarsxff1f; 与世界上大多数货币相比,美元仍然是稳定的。虽然通货膨胀,但这对比特币来说只是一个小小的修正。当我们研究物理时,我们首先会简化,排除可能出现的复杂情况,如摩擦或空气阻力。我们可以稍后再添加,但首先,我们要了解现象的本质,不要分心。 xff0c; the dollar is still stable compared to most of the world's currencies. Inflation xff0c; but this is only a small correction for bitcoin. When we study physics xff0c; we first simplify xff0c; exclude possible complications xff0c; e.g. friction or air resistance. We can add xff0c; first xff0c; we need to understand the nature of the phenomenon ff0c; don't be distracted. 幂律对通货膨胀货币有效吗? 我不知道,我为什么要尝试?我们能从中得到什么信息?我可以这么做,但我有 300 件关于比特币的事情想要探索,这似乎是在浪费时间,就像这些货币一样浪费。 I don't know xff0c; why I tried xff1f; what information we could get from xff1f; I could do this xff0c; but I have 300 things about bitcoin that I want to explore xff0c; this seems to be a waste of time xff0c; it's a waste of money like these. 不过,一般来说,BTC 的幂律与稳定的通货膨胀有关。如果你的通货膨胀率过高(比如通货膨胀率快速上升),那么问题就不在于幂律,而在于通货膨胀的货币。 But xff0c; generally xff0c; BTC’s laws are related to stable inflation. If your inflation rates are too high xff08; for example, inflation rises rapidly xff09; xff0c; then the problem is not xff0c; it is the currency of inflation. 这就好比我告诉你地心引力会让物体向下运动。然后你又问,那在飓风中呢?是的,猪在飓风中可以飞起来,你和你的房子也一样。这并不违反万有引力定律。 That's more than I told you the gravity of the Earth's heart would drive objects down. Then you asked xff0c; that was in the hurricane xff1f; that was xff0c; that pigs could fly in the hurricane xff0c; that you and your house would do the same. That is not against the law of gravity. 你看到这里的逻辑谬误了吗? Did you see the logic error here? #xff1f; 2060 年的价格是多少? What's the price in 2060? 102?123?,您现在满意吗?幂律理论不能被用于预测2040年以后的情况。雷·库兹韦尔(Ray Kurzweil)的“技术奇点”(technological singularity)接下来就会到来,而所有的预测都是错误的。历史上有一个字面意义上的奇点,所以没人知道会发生什么。 102?123? #xff0c; are you satisfied now xff1f; the theory of porcelain cannot be used to predict what will happen after 2040. Ray Kuzwell & #xff08; Ray Kurzweil #xff09; “Technology singularity” & #xff08; technical singularity #xff09; then xff0c; all the predictions are wrong. There is a literal anomaly in history xff0c; so no one knows what will happen. 它不可能永远上涨 It can't go up forever. 1. 我们不知道,因为我们不知道未来有多少价值会转移到比特币中。我们可能会开始开采小行星或发明纳米技术,从而开创一个富足和财富的新时代,这样比特币就会永远上涨(见上文问题)。 We don't know xff0c; we don't know how much value will be transferred to Bitcoin in the future. We may begin to exploit asteroids or to invent nanotechnologies xff0c; thus create a new era of abundance and wealth xff0c; thus Bitcoin will rise forever xff08; see question #xff09 above. 2. 这个模型可以很容易地进行调整,加入一个缩减的部分。幂律基本上是该模型的近似值。顺便说一下,这些模型不会导致指数行为,但事实上,它们比幂律本身更温和。就目前而言,没有必要添加这个会使模型变得更加复杂,却对我们的理解没有实际益处的成分。 This model can easily adjust xff0c; add a reduced part. The rule is basically the approximation of the model. By the way, xff0c; these models do not lead to index behaviour xff0c; but in fact xff0c; they are milder than the law itself. xff0c for the moment; there is no need to add this element that would complicate the model xff0c; but there is no real benefit to our understanding. 你说价格=哈希率^(1/2),但等式的维度不对。 you say price #61; Hashi rate ~ (1/2) xff0c; but the equation's dimensions are not right. 为了简单起见,我们的意思是这种关系在本质上是成正比的,正确的等式当然是价格=A 哈希率^(1/2),其中 A 是一个常数,单位正确,使等式在维度上有效。 For the sake of simplicity xff0c; we mean that the relationship is in essence positive xff0c; the correct equation is, of course, price 61; A Hashi rate 1/2 xff0c; of which A is a constant xff0c; the correct unit xff0c; making the equation effective in dimensions. 价格是自相关的,因此幂律是虚假的 这是统计学家和经济学“专家”最喜欢的论点之一。价格当然是自相关的,但我们声称它是确定性的。所以你是在支持我们的假设?总之,关于这个荒谬的论点还有很多可说的,你可以在下面的链接文章中读到,我们在文章中揭穿了揭穿者的谎言。 This is one of the most popular arguments of statisticians and economics “experts”. Prices are of course related to xff0c; but we claim they are certain. So you are supporting our hypothesis xff1f; xff0c in sum; there is much more to say about this absurd argument xff0c; you can read xff0c in the link article below; we expose the lies of the exposed. 另外,请注意下面一篇关于比特币的同行评议文章,它以一种更礼貌、更专业的方式提出了类似的论点,即如果你一开始就说你声称因果关系是由于一种似是而非的机制,那么你就可以忽略这些更正式的因果关系测试,因为如果存在因果关系并且数据是部分确定性的,那么数据显然是相关的。 Also xff0c; note the following peer review article on Bitcoin xff0c; it makes a similar argument in a more polite and professional manner xff0c; i.e. if you start by saying that causation is due to a seemingly opposite mechanism xff0c; then you can ignore these more formal causality tests xff0c; because if causality exists and the data are partially determinative xff0c; then the data are clearly relevant. 我们观察到的所有幂律都声称是由因果过程产生的,如梅特卡夫定律、“难度调整”、幂律,如社会信息的传播和比特币网络用户之间的互动。 All the laws we observe claim to be the result of a causal process & #xff0c; e.g. the laws of Metcalf, “difficult adjustments”, & #xff0c; e.g. the dissemination of social information and the interaction between the users of the Bitcoin network. 因此,在将比特币作为一个自然过程(基于类似于生物学、网络理论和物理学中的原理和机制)来研究的背景下,我们将在下文中运用同样的论点来论证这些测试的遗漏及其不恰当性。 So xff0c; in treating Bitcoin as a natural process xff08; based on principles and mechanisms similar to those in biology, network theory and physics xff09; in the context of the study xff0c; and we will use the same arguments below to justify the omissions of these tests and their inappropriateness. 而且,Sinz 给出了一些解释: And xff0c; Sinz gave some explanations xff1a; 那么 S2F 或其他价格模型呢? What about S2F or other price models? S2F 充满了数学和概念上的错误,请参阅我们之前关于此主题的讨论。基本上,它就是一派胡言。没有自相关性或协整性也杀不死这只吸血鬼。基本概念和模型构建中使用的数学才是关键。 S2F is full of mathematical and conceptual errors xff0c; see our previous discussion on this subject. Basically xff0c; it's a lie. The vampire can't be killed without self-relevance or symmetry. The math used in basic concepts and model construction is the key. 如果美元出现恶性通货膨胀会怎样?模型是否会崩溃? What would happen if there were hyperinflation in the United States dollar xff1f; whether the model would collapse xff1f; 这是最常见也是最烦人的问题之一。提问者想暗示什么?他很快就会成为百万富翁? This is one of the most common and annoying questions. Askers want to hint at #xff1f; he will soon become a millionaire #xff1f; 1. 上行到什么程度?甚至更多不值钱的美元?你梦想过这样的场景吗?你将成为不值钱货币的百万富翁。开心吗? To what extent #xff1f; even more worthless dollars #xff1f; have you dreamed of such a scenario #xff1f; you will become a millionaire in worthless currency. Happy? #xff1f; 2. 你知道这会导致内战,甚至核战争吗?那你的比特币怎么办? Do you know that this could lead to civil war #xff0c; even nuclear war #xff1f; what about your bitcoin #xff1f; 3. 如果那样的话,比特币(价格)图表将是你最末位的问题了。 In that case xff0c; Bitcoinxff08; Price xff09; the chart will be your final problem. 所有的“模型都将被摧毁” (微策略创始人)赛勒(Saylor)指的根本不是比特币模型,而是一些通用的经济模型。我不得不回去听听那个采访。完全不相关。让我们停止思考,让人们自己去思考,包括我在内。你可以的。我爱赛勒,爱得要死,但我相信他从来没有自己绘制过比特币图表,即使有,他也没有花几年时间去研究。当他对比特币说三道四的时候,我在试着理解它。好吧,让我们妥协,所有的模型都将被摧毁,幂律理论是一个理论,而不是一个模型。好吗? & #xff08; founder of micro-strategy & #xff09; Syler & #xff08; Saylor & Xff09; it's not a bitcoin model & #xff0c; it's a general economic model. I have to go back to that interview. It's totally irrelevant. Let's stop thinking about , let's think about #xff0c; including me. You can. I love #xff0c; #xff0c; but I'm sure he's never made a bitcoin chart xff0c; xff0c; even if there's xff0c; he hasn't spent several years studying it. #xf; I'm trying to understand it. Okay #xff0c; let's compromise #xff0c; all models will be destroyed xff0c; the theory is a theory xff0c; and not a model. 难道我们正处于 S 型曲线的起点? are we at the starting point of the S curve #xff1f; 不是,原因有几个(我们很快会讨论)。 Not xff0c; for several reasons xff08; we'll discuss xff09 soon. 如果知识真的变得普及,价值就会暴涨,因为人们会以未来的价格来定价? If knowledge really becomes popular xff0c; values rise xff0c; because people are priced at future prices xff1f; 不,这违背了幂律理论的主要预测和基本原则之一。任何形式的操纵都可能使价格瞬间上涨或下跌。但这种情况不会持续,一般来说,趋势会得到尊重。 No. #xff0c; this is contrary to one of the main predictions and fundamental principles of the doctrine. Any form of manipulation can cause prices to rise or fall. But this will not last xff0c; xff0c in general; trends will be respected. 这是一个很难理解的概念。你可以意识到专利与城市规模之间的关系,这是一个幂律,但你不能改变它或者改变太多,这是系统的基本属性。它的存在并非偶然。它就是系统的本质。 It's a hard concept. You can realize the relationship between patents and city size xff0c; it's a rule xff0c; but you can't change it too much xff0c; it's the basic attribute of the system. It's not a coincidence. It's the essence of the system. 我们在比特币中观察到的幂律就是比特币的本质。 What we see in bitcoin is the essence of bitcoin. 除非从根本上改变比特币,否则我们无法改变它们。 We can't change them unless we fundamentally change Bitcoin #xff0c; we can't change them. 这是理论中最强大、最有影响的部分,随着时间的推移,它可以被证伪,或者更多的观察结果会支持它。 This is the strongest and most influential part of the theory xff0c; xff0c over time; it can be proved false xff0c; or more observations will support it. 号外:教链内参3.29《内参:对冲基金称BTC有望再涨150%》 * * * 延伸阅读更多刘教链精彩文章: 如果你在2010年拥有5000个比特币?2024.3.24 【硬核】一文读懂比特币?2020.6.9 挖矿漫谈?2023.2.21 比特币白皮书中文版(刘教链译本)?2022.11.1 比特币黄皮书(论比特币的经济学)?2023.1.3 比特币已胜?2022.7.1 比特币终局:或将等于人类全部剩余的价值总和!?2024.3.4 微策略创始人迈克·赛勒通往世界首富之路?2024.3.14 比特币不只是人类自由的定价,而是对人类宇宙文明等级的精确测量?2024.3.7 入行不读比特币,炒遍热点也枉然!《比特币史话》已位居“投资>加密货币”分类畅销榜榜首?2023.3.17 上帝掷骰子,比特币向前进?2023.2.28 (公众号:刘教链。知识星球:公众号回复“星球”) (Public & #xff1a; Liu Congregation. Knowledge planet & #xff1a; Public #responsible Planet) (免责声明:本文内容均不构成任何投资建议。加密货币为极高风险品种,有随时归零的风险,请谨慎参与,自我负责。) (Exemption statement xff1a; nothing in this paper constitutes an investment recommendation. Encrypted currency is a very high risk variety xff0c; there is a risk of zero at any time xff0c; be careful to participate xff0c; be self-responsible. 喜欢本文就请点亮在看、点赞、转发支持哦 👇👇👇

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论