在比特币最风光的那些日子里,每枚比特币的报价最高可达6.7万美元,加密货币市场的总市值也突破2.7万亿美元。而随着比特币在六月份的暴跌,加密货币总市值也蒸发了一点多万亿美元,来到了1万亿美元左右。而就在本周,比特币的价格再度下跌,加密货币总市值也跌破1万亿美元。

In the best days of Bitcoins, the price of every bitcoin was up to $67,000, and the total market value of the crypto-currency market was over $2.7 trillion. As Bitcoin plunged in June, the total market value of the crypto-currency evaporated by over $1 trillion, reaching about $1 trillion.

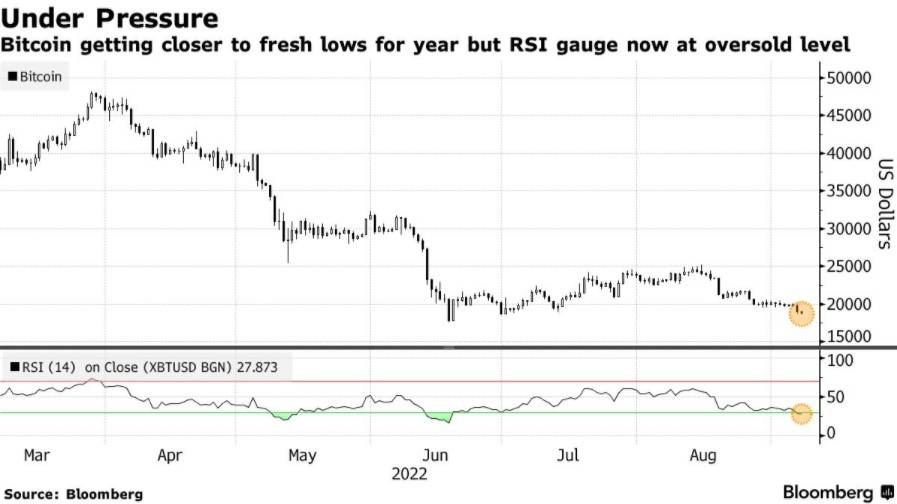

根据CoinGecko的信息,本周迄今为止,比特币价格下跌,日内跌幅逾5%,报18787.3美元/枚。

According to CoinGecko, so far this week, Bitcoin prices have fallen by more than 5 per cent per day, at US$ 18787.3 per metre.

不到10个月的时间,比特币价格即从最高位的69185.5美元跌至18787.3美元,跌幅累计高达72.85%。以太币在这段时间同样大幅下跌,跌幅达到68.67%。

In less than 10 months, the price of Bitcoin fell from the highest of $69185.5 to $187.7.3, with a cumulative decline of 72.85 per cent. In the same period, the Ether also fell sharply, with a decline of 68.67 per cent.

在过去的24小时内,加密货币的总市值跌破1万亿美元大关,最新仅为9468亿美元。

In the past 24 hours, the total market value of encrypted currencies has fallen by $1 trillion, the latest amount being only $94.6 billion.

而根据coinglass的数据显示,此次下跌导致全网24小时内有超10万人爆仓,近10亿人民币的资金蒸发。

According to coinglass, the fall led to more than 100,000 explosions and the evaporation of nearly RMB 1 billion in 24 hours.

加密货币不同于传统意义上的真实货币,也没有黄金、石油的价值,上涨与暴跌,完全取决于人们对其的信心。

Unlike the traditional real currency, there is no value for gold or oil, and rising and falling depend entirely on confidence in it.

今年,美国联邦储备委员会连续四次加息,其中6月和7月分别加息75个基点,为上世纪80年代初以来最大幅度的集中加息。不断飙升的实际利率(被视为借贷的真实成本)正在给一系列风险资产带来压力,加密货币就是首当其冲的代表。

This year, the US Federal Reserve increased interest rates four times in a row, with 75 basis points in June and July, respectively, raising interest rates for the largest concentration since the early 1980’s. Rising real interest rates – seen as the real cost of borrowing – are putting pressure on a range of risky assets, with encrypted currencies being the first to hit.

投资者在宏观经济不好的情况下,自然会减少风险投资,加密货币就是目前风险最高的投资项目之一。大量的抛售就会导致供大于求,加密货币的价值就会越来越低。今年币圈震动引发了大大小小的交易所关停、跑路,虚拟货币业务存在的高风险在这次熊市中表露无遗。

A large number of sells will lead to greater supply than demand, and the value of encrypted money will become increasingly low. This year’s currency boom has triggered large and small exchange closures and run-offs, and the high risk of virtual currency operations is evident in this bear city.

我国严令禁止虚拟货币业务的运营,监管部门曾多次声明,提醒虚拟货币交易存在的高风险。

在央行、最高法院等多部门联合发布《关于进一步防范和处置虚拟货币交易炒作风险的通知》,明确表示:虚拟货币不具有与法定货币等同的法律地位;虚拟货币相关业务活动属于非法金融活动;境外虚拟货币交易所通过互联网向我国境内居民提供服务同样属于非法金融活动。

The Circular on the Further Prevention and Handling of the Risks of Virtual Currency Transactions, issued jointly by the Central Bank and the Supreme Court of Justice, makes it clear that virtual currency does not have the same legal status as legal currency; virtual currency-related operations are illegal financial activities; and offshore virtual currency exchanges provide services to residents in the country via the Internet are also illegal financial activities.

参与虚拟货币投资交易活动存在法律风险,任何法人、非法人组织和自然人投资虚拟货币及相关衍生品,其民事法律行为无效,由此引发的损失由其自行承担。涉嫌破坏金融秩序、危害金融安全的,将由相关部门依法查处。

Any legal person, organization of an illegal person, or a natural person who invests in virtual money and related derivatives is liable for the damage incurred.

免责声明:素材源于网络,如有侵权,请联系删稿。

Exempt declaration: material originating from the Internet, please contact deleted if violation occurs.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论