作者:EarnBIT

Author: EarnBIT

翻譯:白話區塊鏈

Translation: White section chain

2024 年4 月,比特幣將進行另一次減半,即每四年一次的活動,削減礦工的獎勵。市場結構的演變支持了人們廣泛預期的上漲。這次減半週期基本上與以往不同,我們的指南總結了常見的價格預測和獨特的推動因素。

In April 2024, the Bitcoins will be reduced by another half, that is, every four years, by cutting the incentives for miners. The evolution of the market structure supports a broad-based upturn. This half-week period is largely different, and our guidelines sum up the usual price predictions and unique push factors.

減半獎勵會相應地減少新挖出的比特幣數量。這發生在每產生210000 個區塊後,形成了一個四年的價格週期。之前的減半分別發生在2012 年、2016 年和2020 年。

A reduction of half of the reward would reduce the number of newly dug bits. This occurred after each of the 210,000 blocks was generated, creating a four-year price period. The previous half split occurred in 2012, 2016 and 2020.

「總發行量將為21,000,000 個硬幣。它們將在網路節點產生區塊時分發,每四年減半一次。前四年:105,0000 個硬幣。接下來四年:5,250,000 個硬幣。再接下來四年:2625000 個硬幣。再接下來四年:1312500 個硬幣。等等…” — Satoshi Nakamoto,《密碼學郵件列表》,2009 年1 月8 日

For the next four years: 262,500 coins. For the next four years: 1312,500 coins.... — Satoshi Nakamoto, List of Passwords, 8 January 2009

此事件將降低礦工的獲利能力,礦工使用客製化的硬體(特定應用積體電路,ASIC)來處理交易。根據CoinDesk 的數據,在2023 年,挖掘一個區塊的利潤需要至少10000 美元至15000 美元。在減半之後,成本可能會飆升至每個幣40000 美元。

According to CoinDesk, in 2023, it would cost between $10,000 and $15,000 to dig a block. After a reduction of half, the cost could rise to $40,000 per coin.

獎勵將從每個區塊的50 個比特幣減少到6.25 個比特幣,並將在2024 年4 月19 日進一步縮減至3.125 個比特幣。您可以在此處使用比特幣減半倒數計時表觀看倒數計時。

The reward will be reduced from 50 bits per block to 6.25 bits, and will be further reduced to 3.125 bits on April 19, 2024. Here you can use bitcoins to reduce the countdown by half.

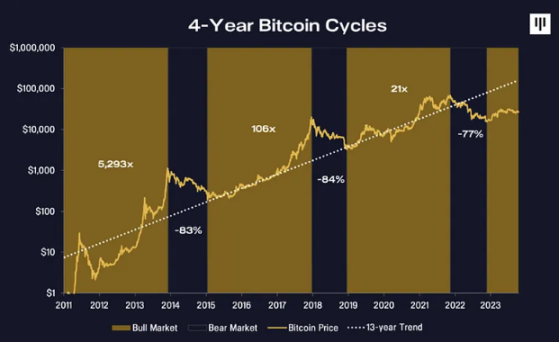

比特幣的四年價格週期。來源:Pantera

儘管稀缺性的敘事很重要,但除了供應的收縮之外,還有其他因素在起作用。從理論上講,通膨率下降應該提振需求,但實際的價格影響可能有限。

Despite the importance of scarce narratives, there are other factors that work in addition to supply contraction. The fall in inflation is theoretically supposed to boost demand, but the real price impact may be limited.

較慢的產幣速度降低了通貨膨脹率,同時確保比特幣的供應保持有限(2,100 萬枚)。這種非通膨性吸引了加密貨幣愛好者:與法定貨幣和黃金不同,比特幣不受中央機構和自然儲備的影響。

Slower yields reduce inflation rates and ensure that the supply of Bitcoins remains limited (21 million). This non-inflationality attracts encoded currency preferences: unlike statutory currencies and gold, bitcoins are not affected by central structures and natural reserves.

較低的獎勵促進了網路的健康和永續發展。據Dig1C0nomist 稱,年化能耗為141.46 TWh,相當於整個烏克蘭的能耗,碳足跡類似於阿曼(78.90 Mt 二氧化碳)。

According to Dig1C0nomist, the annual energy consumption is 141.46 TWh, equivalent to the overall energy consumption in Ukraine, and the carbon footprint is similar to that in Oman (78.90 Mt CO2).

比特幣也受到供應擴張速度以外的因素的影響。這些因素包括區塊鏈產業內外的推動因素:監管、聯準會的貨幣政策、地緣政治等等。

Bitcoins are also affected by factors other than the speed of supply expansion. These factors include push factors within and outside the chain industry: supervision, the association’s currency policy, geopolitics, etc.

根據有效市場假說(EMH),如果所有交易者都知道減半的情況,那麼效應必須已經在價格中反映出來。然而,正如華倫·巴菲特三十多年前所說:「投資於一個人們相信有效率的市場,就像與一個被告知看牌沒有任何好處的人打橋牌一樣。」

According to the valid market hypothesis (EMH), if all traders know about the reduction, then the effect must already be reflected in the price. But, as Warren Buffett said more than 30 years ago, "Investing in a market that people believe to be efficient is like playing a bridge with a man who is told to watch cards for nothing."

正如Grayscale 所指出的,供應結構的變化是唯一確定的。減半使比特幣接近其最大供應量,給所有礦工帶來了挑戰。

As Grayscale has pointed out, the changes in the supply structure are only certain. The half reduction brings bitcoins closer to their maximum supply and poses a challenge to all miners.

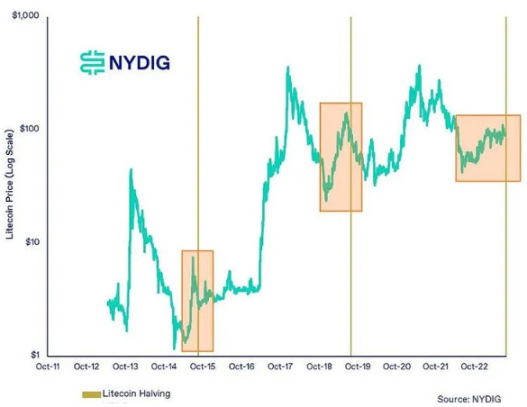

也就是說,比特幣的稀缺性也是可編程的,因此事先是已知的。將其直接與價格上漲聯繫在一起的模型可能存在缺陷。否則,萊特幣(另一種進行減半的加密貨幣)在每次減半後將會持續上漲,但事實並非如此。

In other words, the scarcity of bitcoins is also programmable, so it is known in advance. Models that link them directly to price increases may be flawed. Otherwise, the Lightcoins (the other encrypt currency, which is reduced by half) will continue to rise after each reduction, but that is not the case.

萊特幣的減半週期。來源:NYDIG

先前的減半事件伴隨著強調比特幣作為替代價值儲存工具的基本面,或幫助其間接受益的因素。

The previous half-lives were accompanied by an emphasis on the basics of Bitcoin as an alternative value saving tool, or the factors that helped them to accept the benefits.

2012 年,歐盟正遭受深刻的債務危機。到2013 年11 月,比特幣從12 美元飆升至1,100 美元。

In 2012, the European Union was experiencing a profound debt crisis. By November 2013, the Bitcoins had risen from $12 to $1,100.

2016 年是初級幣發行熱潮,超過56 億美元流入其他加密貨幣。到2017 年12 月,比特幣從650 美元升至20,000 美元。

In 2016, there was a boom in the first currency, with more than $5.6 billion flowing into other encrypted currencies. By December 2017, Bitcoins had risen from $650 to $20,000.

2020 年,在冠狀病毒大流行期間,通膨擔憂高漲。到2021 年11 月,比特幣從8,600 美元飆升至68,000 美元,並在11 月10 日創下歷史新高69,044.77 美元。其被認為是避險資產的認知發揮了重要作用。

In 2020, during the coronary virus pandemic, inflation rose. By November 2021, the Bitcoins had risen from $8,600 to $68,000, and by November 10, they had been founded with a record high of $69,044.77.

比特幣2024 年減半:從過去的表現中尋找線索

過去的表現並不能保證未來的結果,而且正如我們所示,影響因素不僅限於加密貨幣。然而,以往的減半事件提供了一些可能情境的線索。

Past performance does not guarantee future results, and, as we have shown, the influence is not limited to encrypted currency. However, past half-lives provide some possible clues.

高點和低點的時間

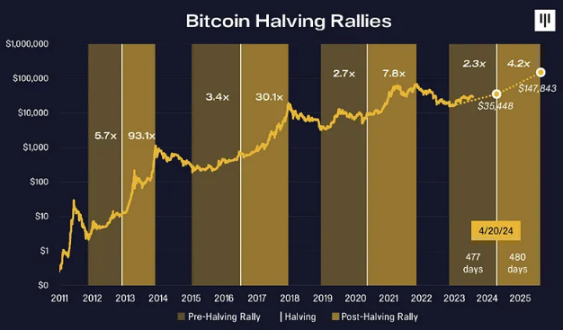

理論上,比特幣在減半之前很長時間就從低點反彈,通常是在減半事件前的12-16 個月,根據CoinDesk 的數據。 Pantera 的分析師估計,觸底通常發生在離減半事件還有477 天的時候。

Theoretically, Bitcoins rebounded from a low point long before the reduction of half, usually 12-16 months before the reduction, based on CoinDesk’s data. Pantera analysts estimate that bottom contact usually takes place 477 days before the reduction.

上漲趨勢在減半之前和之後都會持續。減半後的上漲行情平均持續480 天(在隨後的多頭高點結束)。

The upswing will continue before and after the drop of half. The upswings after the reduction averaged 480 days (at the end of the later peaks).

這次,最低點出現在預期日期之前(2022 年12 月30 日)。它發生在11 月10 日(15,742.44 美元)。

This time, the lowest appears before the expected date (30 December 2022). It happened on 10 November ($15,742.44).

比特幣減半行情的反彈。來源:Pantera

如果歷史重演,根據Pantera 的通訊,行情將在2025 年底停止。

If history repeats itself, according to Pantera's communication, it will stop at the end of 2025.

比特幣減半2024 年的預測:很快又回到69,000 美元?

在過去的三個減半週期中,比特幣在前八週的漲幅超過30%。正如10x Research 的創始人馬庫斯·蒂倫所說的那樣,在那段時間裡,比特幣的漲幅平均為32%。

In the last three half-weeks of decline, Bitcoins rose by more than 30 per cent in the first eight weeks. As Marcus Tyron, the founder of 10xResearch, said, during that period, Bitcoins rose by an average of 32 per cent.

鑑於目前的價格為52,456.77 美元,如果同樣的趨勢重複出現,價格將會回到歷史最高點69,000 美元。蒂倫補充說,這種可能性在「我們越接近比特幣減半的時候」越大。

At the current price of $52,456.77, if the same trend reappears, the price will return to its highest point in history of $69,000. Tyrann adds that this possibility is greater “when we get closer to half the bitcoins”.

每日RSI

10xResearch 在2 月19 日報道稱,每日RSI(相對強弱指數)已經突破了80。這個動量指標衡量價格變動的速度和變化,當指數達到70 時,意味著強勁的上漲動力。

10xResearch reported on February 19 that the daily RSI (comprehensively strong and weak index) has passed 80. This moving indicator measures the speed and variability of prices, which means strong upwards when the index reaches 70.

從歷史上看,當RSI 超過80 時,預示著未來60 天內的漲幅將超過50%。比特幣的14 天RSI 最後一次達到如此高點是在2023 年12 月。截至2 月22 日,它為70.88%。

History suggests that when RSI is over 80, it will rise by more than 50% in the next 60 days. The last time RSI reached such a high point in the 14 days of Bitcoins was in December 2023. As of 22 February, it was 70.88%.

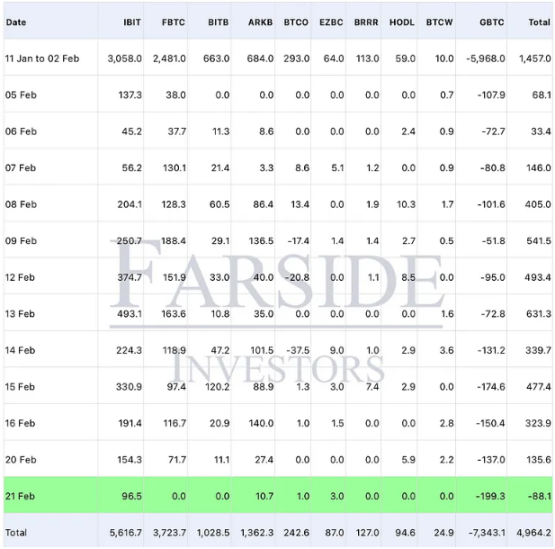

今年,比特幣的上漲得到了現貨比特幣ETF 的採用的支持。截至目前,這些交易平台交易基金使投資者能夠獲得比特幣的投資收益,而無需直接持有比特幣,其總計吸引了超過50 億美元的資金淨流入。

This year, the Bitcoins rise was supported by the current bitcoin ETF. So far, these trading-platform funds have enabled investors to earn the bitcoins’ investment gains without having to hold the bitcoins directly, attracting a net inflow of more than $5 billion.

這種資金流入不僅支撐了投資者的高昂情緒,也減輕了區塊獎勵(即所有新挖掘的比特幣可能被全部出售)所帶來的賣壓。

This inflow not only sustains the high sentiment of investors, but also reduces the pressure of a block of incentives (i.e., all newly excavated bitcoins may be sold altogether).

根據Grayscale 的計算,以目前每個區塊6.25 個比特幣的產量計算,年度賣壓金額達到140 億美元(基於43,000 美元的價格)。在2024 年的減半之後,總量將減少到70 億美元,因此需要更少的買盤壓力來抵銷賣盤壓力。

According to Grayscale's calculations, the current product of 6.25 bits per block amounts to $14 billion per year (at a price of $43,000). After half of the 2024 decline, the total volume will be reduced to $7 billion, so less pressure is needed to counter sales pressure.

現貨比特幣ETF 已經吸收了「幾乎相當於減半後潛在賣盤壓力的三月份」。這僅用了15 個交易日。

The current Bitcoin ETF has absorbed the "triple month of selling pressure almost half down". This is only 15 trading days.

比特幣ETF 的累計資金流入。來源:Farside Investors

由於對行情的預期,市場通常在比特幣減半之前的期間上漲。截至2024 年2 月22 日,專家和研究機構普遍持樂觀態度,預測比特幣在2025 年中期的平均價格範圍為15 萬美元至20 萬美元。

Because of expectations, the market usually rises in the period before the Bitcoin is reduced by half. As of February 22, 2024, experts and research institutes were generally optimistic, predicting an average price range of 150,000 to 200,000 dollars in mid-2025.

比特幣的訂單簿流動性自2023 年10 月以來達到最高水平,儘管低於FTX 崩盤之前的水平。除非需求下降(與目前情況相反),減少新比特幣供應必定會提振其價格。一些分析師表示,新的歷史最高點已經開始了。

Bitcoin’s book flow has been at its highest level since October 2023, although at a level lower than before the FTX collapse. Unless demand falls (in contrast to the current situation), reducing the supply of new bitcoins will certainly boost its price. Some analysts say that the new historical peak has already begun.

伯恩斯坦(Bernstein)表示,減半前的行為反映了即將到來的供應緊縮和對現貨ETF 的成長需求。該公司預計價格「將在2024 年觸及歷史新高」,並在2025 年中期達到15 萬美元的峰值。

Bernstein states that the half-time reduction reflects the impending supply contraction and growing demand for the current ETF. The company’s forecast price is “to reach a new high in 2024” and peaks at $150,000 in mid-2025.

Skybridge Capital 的創始人安東尼·斯卡拉穆奇(Anthony Scaramucci)預計比特幣在2025 年7 月將達到17 萬美元或更高的高點。他在1 月接受路透社採訪時表示:

The founder of Skybridge Capital, Anthony Scaramucci, predicted that Bitcoins would reach $170,000 or higher in July 2025. In a January interview with Reuters, he said:

「無論4 月減半日的價格如何,將其乘以4,它將在接下來的18 個月內達到那個價格。」

"Whatever the price of a half-day reduction in April, multiply it by four, it will reach that price within the next 18 months."

斯卡拉穆奇在計算17 萬美元時使用了保守的起點35,000 美元(減半時的價格)。根據目前的價格52,000 美元,這種情況將使比特幣超過200,000 美元。

Scalamucci used a conservative starting point of $35,000 (a half-time reduction) when calculating $170,000. According to the current price of $52,000, this would make bitcoins more than $200,000.

同時,根據他的長期估計,這種開創性加密貨幣的市值應該會達到黃金市值的一半。這將需要市值從目前的約1 兆美元成長到約6.5 兆美元,相當於成長超過6 倍。

At the same time, according to his long-term estimates, the market value of this innovative encrypt currency should reach half of the value of gold. This would require a market value of about $1 trillion to about $6.5 trillion, or more than six times that.

懷疑者:需要更多驅動力才能達到歷史最高點

SynFutures 的聯合創始人兼首席執行官Rachel Lin 表示,減半「不太可能引發全面的牛市」,除非加密貨幣的採用顯著增長,「僅憑這一點是不足以使比特幣回到近69,000 美元的峰值,更不用說超過它。」

Rachel Lin, the co-founder and CEO of SynFutures, said that a reduction of half was "not likely to lead to a full-scale cattle market" unless the use of the encrypted currency increased significantly, "not enough to get the bitcoin back to its peak of nearly $69,000, let alone exceed it".

然而,由於美國選舉的原因,當地監管機構可能會在這個關鍵時刻減少「追求頭條」的行為。因此,加密貨幣在未來可能不會有太多負面消息來削弱投資者的熱情。這可能為下一個多頭趨勢鋪路。

However, for reasons related to the United States elections, local regulators may reduce their “headline-seeking” behavior at this critical juncture. As a result, encrypted currency may not have much negative news in the future to weaken investors’ enthusiasm. This could pave the way for the next multi-heading.

短期和中期需要關注的因素

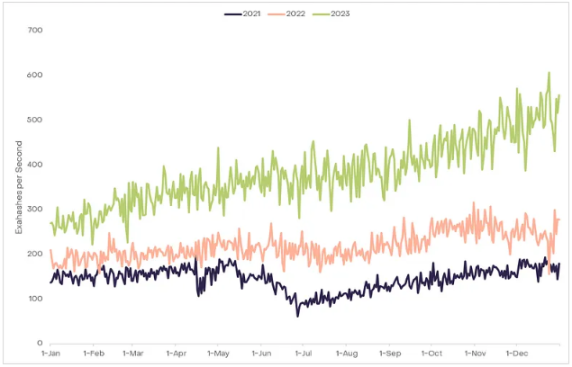

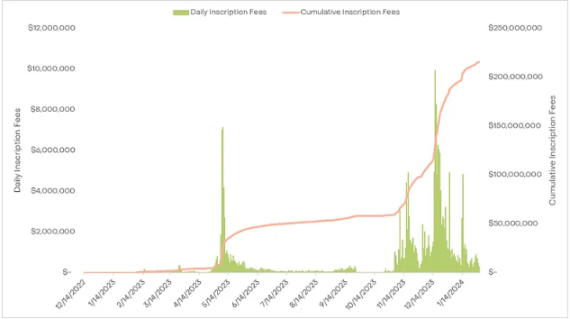

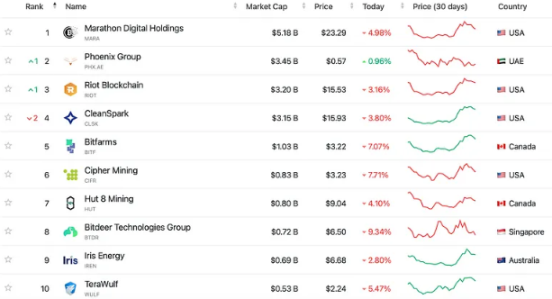

減半是一個中期的正面因素。 CCN 的彼得·亨恩(Peter Henn)總結了未來幾週和幾個月比特幣可能面臨的積極和消極因素。 The reduction of half is a positive factor in the medium term. CCN’s Peter Henn sums up the positive and negative factors that may be faced by bitcoins in the coming weeks and months. 機構採用的成長是其中主要的正面因素,同時還有價格反彈和正面的技術指標。然而,監管政策和宏觀經濟背景的不利變化,如通膨上升,可能會影響市場情緒。 The growth of institutions is one of the main positive factors, along with price rebounds and positive technical indications. However, adverse changes in the regulatory policy and economic landscape, such as rising inflation, may affect market sentiment. 中期的預警因素包括監管政策和其他競爭加密貨幣,包括央行數位貨幣(CBDC)。駭客攻擊和其他安全漏洞可能會損害市場的信任。 Medium-term warning factors include surveillance policies and other competing encryption currencies, including the Central Bank Digital Currency (CBDC). A hacker attack and other security loopholes could undermine market confidence. 在接下來的1-2 年裡,比特幣也可能因閃電網路的改進和其作為價值儲存工具的加強地位而上漲。 In the next 1-2 years, the bitcoin may also rise as a result of the evolution of the lightning network and its enhanced status as a value-saving tool. 比特幣減半2024 年和礦工 只要經濟誘因足夠,礦工將繼續保護區塊鏈的安全。因此,比特幣價格必須足夠高,以抵消減半期間和減半後的成本。 As long as the economic incentives are sufficient, the miners will continue to protect the chain. Thus, the Bitcoin price must be high enough to offset the cost of half-time and half-time. 大型礦工正在積極儲備比特幣,根據SunnySide Digital 的創始人Taras Kulyk 的說法,「減半已經被大多數公司考慮在內了”,因為「多年來,他們一直在預期和將減半價格納入他們的預測中」。 Large miners are actively saving bitcoins, which, according to Taras Kulyk, the founder of SunnySide Digital, “have already been taken into account by most companies” because “for many years, they have been expected and are expected to cut half their price”. 同時,那些電費更高、設備效率較低的礦工可能最終不得不關閉運營,考慮到他們的硬體投資和日常開支。提高營運效率對於繼續經營並在減半後獲得收益至關重要。 At the same time, more expensive and less equipped miners may eventually have to shut down their operations, taking into account their hard-core investment and day-to-day spending. Improving the efficiency of their operations is essential to continue running and to reap the benefits after a reduction of half. 提高效率的方法包括購買更先進的設備、在鏈上出售持有的比特幣以及進行股權發行。例如,總部位於加拿大的Hut8 正在透過客製化軟體提高礦場效率,並希望收購更多的發電廠。在與USBTC 最近的合併之後,其哈希率幾乎增加了兩倍,達到7.3 艾哈/ 秒(exahashes per second)。 For example, Hut8 based in Canada is improving mine efficiency through passenger software and hoping to buy more power plants. After the recent merger with USBTC, the Hashi ratio almost tripled, reaching 7.3 al-Ah/sec (exahashes per second). Marathon Digital,根據實際哈希率排名第一的上市礦工,推出了一個總額為7.5 億美元的混合股權發行。 Core Scientific 最近完成了一個超額認購的5,500 萬美元股權融資輪,以恢復償債能力。該公司還專注於保持其硬體在線,充分利用可用設備。 Marathon Digital, the number one listed miner with a real Hashi rate, has launched a mixed equity issue of $750 million. Core Scientific has recently completed a 55 million-dollar equity equity loan to restore its ability to repay its debt. 然而,CEO Adam Sullivan 認為比特幣網路具有「自我修復的特性」,並將持續激勵礦工。隨著更多的礦機關閉和哈希率下降,工作量證明的難度也會下降。這可以彌補不斷增長的速度和波動的節點運行興趣。 However, CEO Adam Sullivan believes that the Bitcoin network has "self-repair features" and will continue to inspire miners. As more mining shut downs and Haship drops, so will the workload prove less difficult. 挖礦難度是平均區塊數量的移動平均值,當區塊生成速度過快時,難度會增加。因此,網路自動調整,離開者釋放出更大的區塊份額來獎勵留下的人。對於留下來的參與者來說,挖礦變得更加有利可圖。 The difficulty of mining is the average moving of the average number of blocks, and the difficulty increases when the blocks are generated too quickly. As a result, the network adjusts automatically, releasing larger blocks to reward those left behind. For those left behind, mining becomes more profitable. 2024 年的減半在Bitcoin Ordinals 推出後進行。這個支持比特幣NFT(紀念品)的協議帶來了新的使用案例,推動了交易費用和開發者活動的增加。這些效應為對挖礦的獲利能力和永續性提供了額外的樂觀理由。 This agreement to support the Bitcoin NFT (Memorality) has brought about new cases of use, prompting an increase in transaction costs and developers’ activities. These effects provide additional grounds for optimism about the profitability and sustainability of mining. 2023 年11 月,Ordinals 的熱潮將比特幣交易費用推至兩年來的最高點(超過37 美元),使其超過了以太坊的燃氣費用。自那時以來,紀念品費用一直佔礦工收入的20% 以上。 In November 2023, the trend of Ordinals pushed the bill to its highest level in two years (more than $37), exceeding the gas bill in Etheria. Since then, the price of souvenirs has been more than 20% of the miner’s income. 截至2024 年2 月22 日,比特幣是NFT 交易量排名前三名的區塊鏈之一。在2023 年12 月,它成為了領導者。因此,Ordinals 活動是透過更高的交易費用來激勵礦工並維持網路安全的一種新穎方式。 By February 22, 2024, Bitcoin was one of the top three chains in the NFT trade volume. In December 2023, it became a leader. Thus, Ordinals was a new way to stimulate miners and maintain Internet security through higher transaction costs. 高交易費用導致上市礦工公司的股價飆漲。在2023 年末,這些公司因礦工的收入幾乎是兩年平均的四倍而獲得了巨大的利潤。 High transaction costs have led to high stock prices for listed mining companies. At the end of 2023, these companies gained huge profits by earning almost four times the average of two years. 從那時起,費用已經下降到略高於4 美元。然而,像Marathon Digital(MARA)和Cleanspark(CLSK)這樣的挖礦股在過去三個月中表現優於比特幣,分別上漲了116.57% 和231.28%。它們也可能對穩定的股市表現作出正面的反應。 Since then, the cost has fallen slightly above $4. However, mining units such as Marathon Digital (MARA) and Cleanssk (CLSK) have outperformed bitcoins over the past three months, with a difference of 116.57% and 231.28%. They may also react positively to stable stock market performance. 頂級挖礦地點 top mining site 根據《世界人口評論》的數據,以累積哈希率來衡量,在2023 年,美國以35.4% 的比例領先,其次是哈薩克(18.1%)、俄羅斯(11.23%)、加拿大(9.55%)和愛爾蘭(4.68%)。中國曾是第二大挖礦地點,但在2021 年禁止了比特幣挖礦,導致礦工紛紛遷往哈薩克。 According to the World Population Review, in 2023, the United States led by 35.4 per cent in terms of accumulation rates, followed by Kazakhstan (18.1 per cent), Russia (11.23 per cent), Canada (9.55 per cent) and Ireland (4.68 per cent). China was the second largest mining site, but prohibited bitcoins in 2021, causing miners to migrate to Kazakhstan. 環境限制的擔憂 比特幣挖礦仍然存在著極高的不可持續性——在2023 年,比特幣挖礦消耗的能源相當於整個澳大利亞,或者是谷歌年度能源消耗的七倍(91 太瓦時)。 Bitcoin mining remains extremely unsustainable — in 2023, bitcoin mining consumed as much energy as Australia as a whole, or seven times as much energy consumption in Google the year (91 watt-hours). 在美國,比特幣挖礦對電力需求的份額在0.6% 至2.3% 之間,相當於整個州的用電量,如猶他州。今年早些時候,美國能源資訊署要求所有美國礦工詳細報告他們的能源使用。該機構的報告指出: In the United States, between 0.6 and 2.3 per cent of the demand for electricity in bitcoin mining is equivalent to electricity use in the state as a whole, as in Utah. Earlier this year, the United States Energy Information Agency asked all American miners to report on their energy use in detail. 「對美國能源資訊署提出的擔憂包括在電力需求高峰期對電力網路造成壓力,潛在的電力價格上漲,以及對能源相關二氧化碳(CO2)排放的影響。」 “The concerns raised about the US Energy Information Agency include the stress on the electricity network during periods of high demand for power, the potential increase in electricity prices, and the impact on energy-related carbon dioxide (CO2) emissions.” 《紐約時報》等主要新聞媒體已經引起了人們對大型挖礦場所造成的「公共危害」的關注。拜登政府對加密貨幣持批評態度,美國能源資訊署強調價格飆升激勵了更多的挖礦活動,導致電力消耗增加。 Major news media, such as the New York Times, have drawn attention to the “public hazard” caused by large mining sites. The Biden government is critical of encryption currency, and the US Energy Information Agency (IEA) has strongly encouraged more mining activity, leading to increased electricity consumption. 同時,紐約州實施了為期兩年的禁止新的礦場投入運營,除非它們完全依賴再生能源。在德州,礦工在能源需求高峰期間削減營運時可以獲得報酬,這是「需求響應」計畫的一部分。 At the same time, New York has introduced a two-year ban on new mining sites unless they are completely dependent on renewable energy. In Texas, miners are paid for cutting operations during periods of peak energy demand, as part of the Demand Responsive project. 最後,讓我們來看看兩個技術指標,提供比特幣的整體看法和潛在價格走勢。 And finally, let's look at two technical indicators that provide a whole picture of bitcoins and potential price movements. MVRV Z-score MVRV 是一個振盪器,將比特幣的市場價值與實現價值進行比較,或將其現貨價格與實現價格進行比較。這張圖表可視化了市場週期和獲利能力,有助於發現硬幣被低估和高估的時期。 MVRV is an oscillator that compares the market value of the Bitcoins with the real value, or the current price with the real price. This chart visualizes the period of the market period and profitability and helps to identify times when the coins are undervalued and overestimated. 隨著市場的成熟,比特幣的高峰、波動性和回報變得不那麼激烈。在這個開創性數位貨幣日益被採用的背景下,其實現價格成長速度較過去的周期放緩。因此,漸進式的上漲比爆發性的飆升更有可能出現,並具有更好的長期成長潛力。 As the market matures, Bitcoins’ peaks, waves, and returns become less intense. Against the backdrop of the growing use of this innovative digital currency, prices are actually growing at a slower rate than in the past. 同時,一大部分比特幣已被持有者累積。長期持有者的供應在2023 年底達到了歷史最高水平,而鯨魚仍然在本月表現出對該資產的信心。 At the same time, a large portion of the Bitcoins has been accumulated by the holders. The supply of long-term holders reached its highest level in history at the end of 2023, and whales continue to show confidence in the assets this month. 權力法則走廊將關注點從當前價格轉移到比特幣是否被過度買入或賣出。這個圖表工具創建了一個通道,包括價格範圍的下限和上限兩條平行線。 The power corridor shifts the focus from the current price to whether bitcoins are overpurchased or sold. This chart tool creates a corridor, including a lower price range and two parallel lines. 超過中線意味著超買狀態,而相反情況則表示超賣狀態。向上突破底線預示著進一步增長的可能,通常比特幣會在1-2 個月內達到中線水平。 Beyond the median means a state of overpurchase, while on the contrary it means a state of oversale. Breaking the bottom line upwards suggests the possibility of a further increase, with bitcoins usually reaching midline levels within one to two months. 根據詹姆斯·布爾(James Bull)的說法,超買狀態通常持續約1.5 年(強勁的牛市),而龐大的熊市週期則延續2.5 年。然而,該模型也有其批評者。正如其創作者哈羅德·克里斯托弗·伯格(Harold Christopher Burger)所述: According to James Bull, the state of overpurchase usually lasts about 1.5 years (a strong cattle market), while the length of the Great Bear Week lasts 2.5 years. However, the model also has its critics. As its founder Harold Christopher Burger said: 「承認比特幣遵循冪律是臨時性的。此外,除了時間之外,還有其他因素應該影響比特幣的價格,例如其稀缺性,」但是,「在對數- 對數圖中,冪律擬合的效果越來越好,這表明這個模型可能是成立的。」 "Accepting that bitcoins follow the law is temporary. In addition, there are other factors besides time that should influence the price of bitcoins, such as their scarcity, but, "In logarithm-logarithmic charts, the effect of simulation is getting better, which suggests that the model may be established." 在每次減半之前和之後,比特幣的價格受到多個因素的驅動,超過了稀缺性。 2024 年的減半事件發生在大規模比特幣ETF 流入、鏈上活動增加、勢頭強勁和整體市場成熟的背景下。 The price of Bitcoins was driven by a number of factors before and after the reduction. The reduction occurred in 2024 against the backdrop of large-scale Bitcoins ETF inflows, increased activity on the chain, strong positions, and full market maturity. 隨著宏觀環境的改善,包括預期的聯準會降息,比特幣似乎注定會在權力法則走廊中脫穎而出。它已經經歷了最長的熊市,大型礦工已經做好了減半獎勵的後果。 With the improvement of the environment, including the expected reduction of interest rates in the association, the bitcoin seems to be destined to come out of the power-and-law corridors. It has been through the longest bear city, and the large miners have done half the reward. 我們對比特幣2024 年減半的價格預測 We're predicting a half price reduction for bitcoins in 2024. EarnBIT 的分析團隊認為比特幣在減半前將上漲至55,000 美元至60,000 美元,全年範圍為32,000 美元至85,000 美元。過去的表現並不預示未來,新的黑天鵝事件總是可能發生,但迄今為止,整體環境似乎有利於成長。 EarnBIT’s analysis team believes that Bitcoins will rise up to US$ 55,000 to US$ 60,000 by half, ranging from US$ 32,000 to US$ 85,000 a year. Past performance does not predict the future.哈希率在2023 年達到歷史最高點。來源:Glassnode。

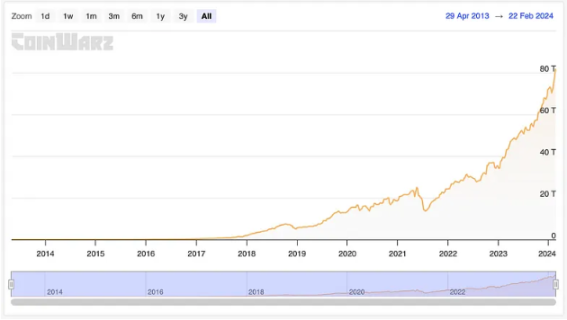

比特幣挖礦難度圖表。來源:CoinWarz。

比特幣紀念品費用的成長。來源:Glassnode。

前十個比特幣挖礦股的市值。來源:companiesmarketcap.com

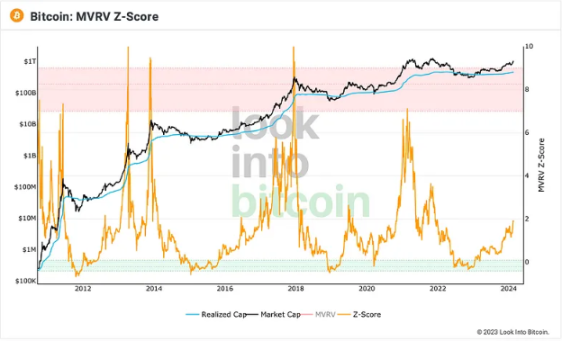

比特幣的MVRV Z-score 圖。來源:lookintobitcoin.com

比特幣2024 年減半價格預測:2025 年2 月17 日的權力法則走廊投影。資料來源:bitcoin.craighammell.com

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论