比特币持仓量指标是用于分析比特币市场参与者的持币情况和投资行为的指标,这些指标可以帮助分析比特币市场的供需关系和投资者情绪,有助于形成更全面的市场理解。因此学会看比特币持仓量指标非常重要,但对于很多刚进入币圈的新手来说并不清楚比特币持仓量指标怎么看?一般来说这些指标是可以在交易所内就能够查看的,下面小编帮助大家全面搞懂比特币持仓量指标。

bitcoin holding indicators are indicators used to analyse currency holdings and investment behaviour of the Bitcoin market participants, which can help to analyse supply-demand and investor sentiment in the Bitcoin market and contribute to a more comprehensive market understanding. Therefore, it is important to learn how to look at the bitcoin holding stock indicators, but for many who have just entered it is not clear how to look at the bitcoin indicators.

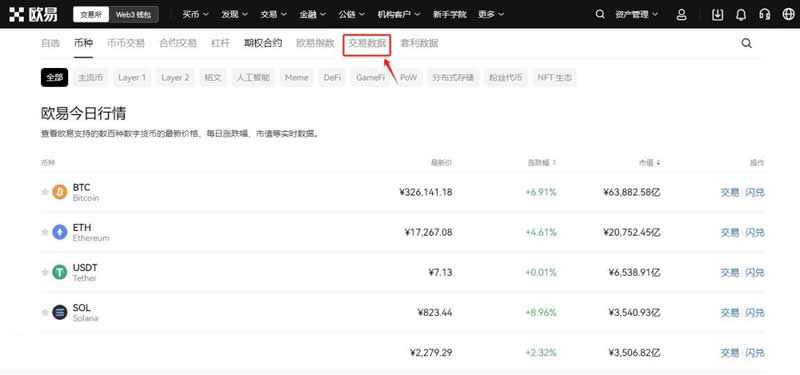

比特币的交易数据在很多比特币交易平台都提供实时查看功能,用户搜索一个就可以查看实时行情,现在很多平台还列出了比特币的持仓量,以及已经被开采了多少,还有多少没有被开采的,这些信息都是可以查看到的。以下是在欧易交易所查看比特币持仓量指标的教程:

Bitcoin transaction data provide real-time viewing functions in many bitcoin , which allows users to search one for real-time transactions, and now many platforms list how much bitcoin holdings and how much has been mined and how much has not been mined, and this information can be found. The following are

1、打开欧易OKX交易所(没有账号的投资者可以点此注册账号进行交易),点击首页导航栏【发现】进入【市场】页面

1. Open the OLEOKX exchange (an investor without an account can count this registered account for a transaction) and click on the first page navigation bar [discovery] into the [market] page

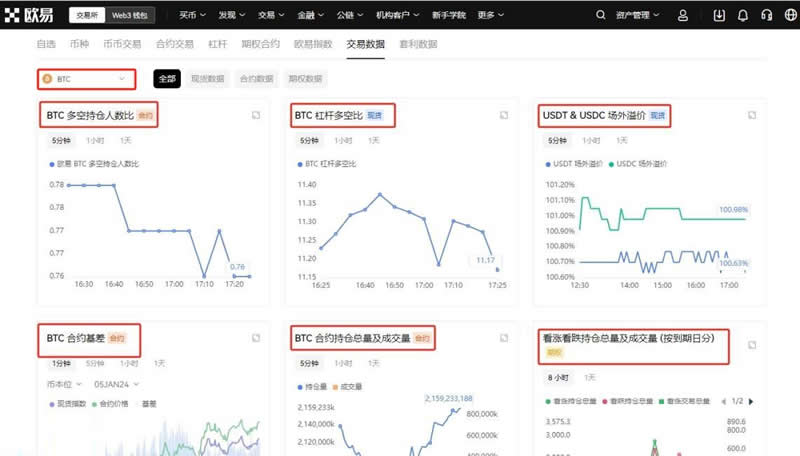

2、跳转页面后点击上方菜单栏【交易数据】进入交易数据页面

2. Click the top menu bar to enter the transaction data page after jumping the page

3、在左上角红框处可搜索币种,下方为该币种相关数据

3. Currency can be searched at the top left corner of the red frame, below which data are relevant

在比特币合约交割到期之前,用户可以根据市场行情和个人意愿,自愿地决定买入或卖出期货合约。用户(买多或卖空)没有作交割时间和数量相等的逆向操作(卖出或买入)而持有期货合约,称之为“持仓”。

Before the expiration of the bitcoin contract , users can voluntarily decide to buy or sell futures contracts according to market conditions and personal will. Users (many buys or sells empty) hold futures contracts without the same timing and quantity of reverse operations (sales or buys) and are called “silos”.

比特币持仓量就是一个可以知彼的数据,如果我们知道持仓量是怎样变化的,就会侦测到市场对某一个资产是追捧还是抛售。

Bitcoin holdings are data that can be understood, and if we know how the holdings change, we will detect whether the market favours or sells a particular asset.

持仓和价格也具有一定的相关性,一般情况持仓的增加都会引起趋势行情变化。比如在行情上涨的初期,会有行情进一步上涨的预期引起持仓变化;而当行情走到尽头时,又会有下跌预期,空单持仓则会增加。

Possession and prices are also of some relevance, and an increase in the general situation can lead to a change in trends. For example, in the early stages of an upturn, expectations of further upswings could trigger a change in holdings, while expectations of falling again and of an increase in stockholdings when they reach the end.

总之持仓的增减与市场预期是相符的。不能单纯地分析持仓增加就是行情上涨,持仓减少就是行情下跌,因为持仓增加只是趋势开始的信号,持仓减少只是趋势结束的信号,一般大的行情真正出现,一定是有很多人入场时或入场后才会发生。

In any case, the increase or decrease in warehousing is consistent with market expectations. The failure to simply analyse the increase in warehousing is a rise in behavior, and the decline in warehousing is a fall in behavior, because the increase in warehousing is only a sign of the beginning of the trend, the reduction in warehousing is only a sign of the end of the trend, and the larger movement in general is likely to occur when a large number of people are on the ground or when they are on the ground.

以上就是比特币持仓量指标怎么看?一文搞懂比特币持仓量指标的详细内容,更多请关注php中文网其它相关文章!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论