苹果股票与比特币,有区别吗? 聊之前还是友情提示,一切基于个人理解,如果与你想法不同,以你为准 。我们先说说比特币吧。目前市场上能看到的,个人认为对比...

资讯 2024-06-21 阅读:291 评论:0聊之前还是友情提示,一切基于个人理解,如果与你想法不同,以你为准 。

Before talking about friendship, everything is based on personal understanding, and if you do not think like you do.

我们先说说比特币吧。

Let's start with bitcoin.

目前市场上能看到的,个人认为对比特币分析最合理的模型是存量流量模型。

As can be seen in the current market, individuals consider the best model for the analysis of bitcoin to be a stock flow model.

所谓存量流量模型,理论基础就是稀缺带来价值。

So-called stock flow models are based on the theory that scarcity brings value.

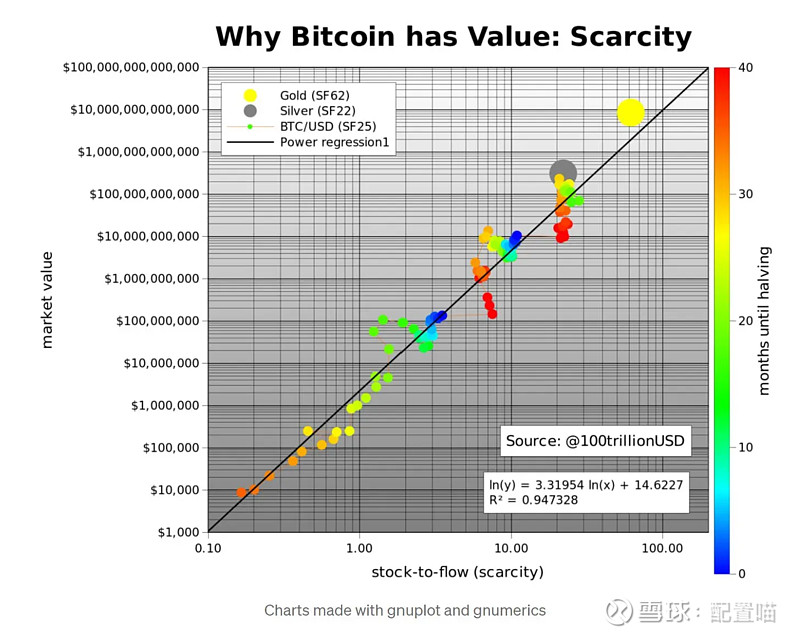

问题在于,如何衡量稀缺,存量流量模型用一种很简单的表述,就是存量(目前一共有多少)除以流量(每年新增加多少)来表达稀缺性。例如,我们可以用比特币的市值与SF值和其他比如黄金,白银作比较,最后形成下图。

The question is how to measure scarcity, and the stock flow model uses a simple expression, namely, stock (currently total) divided by flow (new annual increases). For example, we can compare the market value of bitcoin with the value of SF and other gold, such as silver, and finally form the following figure.

下面那些小点是随着时间变化,比特币存量流量值对应的比特币市值,而上面两个大点,一个是黄金,一个是白银。数据非常线性。

The following small points are the bitcoin market value of the bitcoin stock flow values over time, and the two big points above, one gold and one silver. The data are very linear.

由于比特币承诺的供应量周期性减半,所以按照这个模型,最后存量流量值可以无限大,而比特币市值同样具备无限上涨空间。

As the cyclical nature of the Bitcoin commitment is reduced by half, the final stock flow value under this model can be unlimited, and the market value of Bitcoin also has unlimited scope for escalation.

当然,我们知道,万物由供需决定,供给只是一方面,另一方面,我们还要看需求。

Of course, we know that everything is determined by supply and demand on the one hand and demand on the other.

比特币在需求端的竞争是非常激烈的,因为它不仅仅要击败其他民间加密货币,还需要击败法定加密货币。

Bitcoin's competition on the demand side is intense, as it is necessary to defeat not only other civilian encrypted currencies, but also legal encrypted currencies.

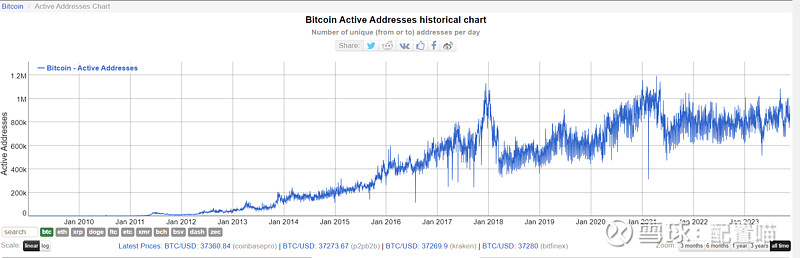

上图数据为比特币活跃地址数量图,我们可以看到,21年之后,比特币活跃地址已经停滞不前,需求端单来巨大压力。

The figure above shows the number of active Bitcoin addresses, and we can see that after 21 years, the Bitcoins active addresses have stagnated and the demand sheets are under great pressure.

当然,价格也忠实的反应出来。

Of course, prices also respond faithfully.

了解完比特币,大家应该会问了,这跟苹果股票有什么关系?

What does it have to do with stocks?

大家要明白,人为的创造稀缺性是一种非常普遍的商业模式,从老钱的豪车,名表,名包,到新钱的运动鞋,手办,集卡。无一不遵循这种商业模式。

You have to understand that man-made creation of scarcity is a very common business model, from old money cars, names lists, bags, to new money sneakers, handmade cards, cards. No one doesn't follow this business model.

苹果做为市值最大的企业,甚至这方面玩的比比特币还要好。

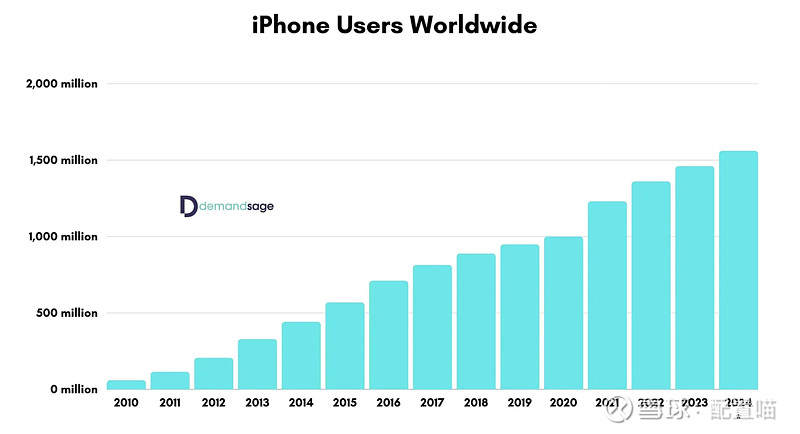

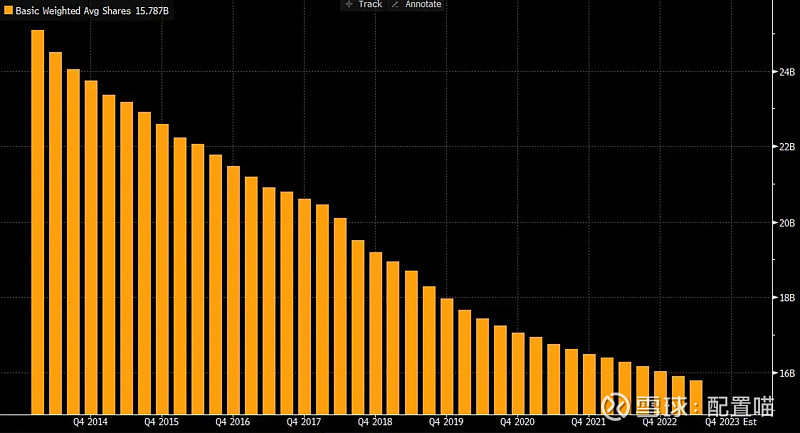

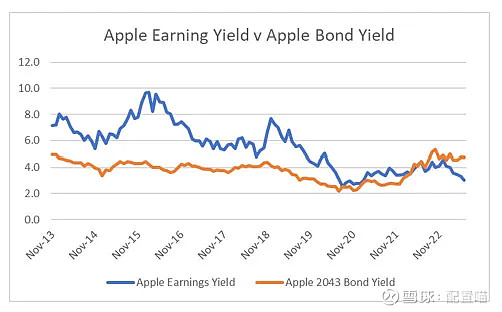

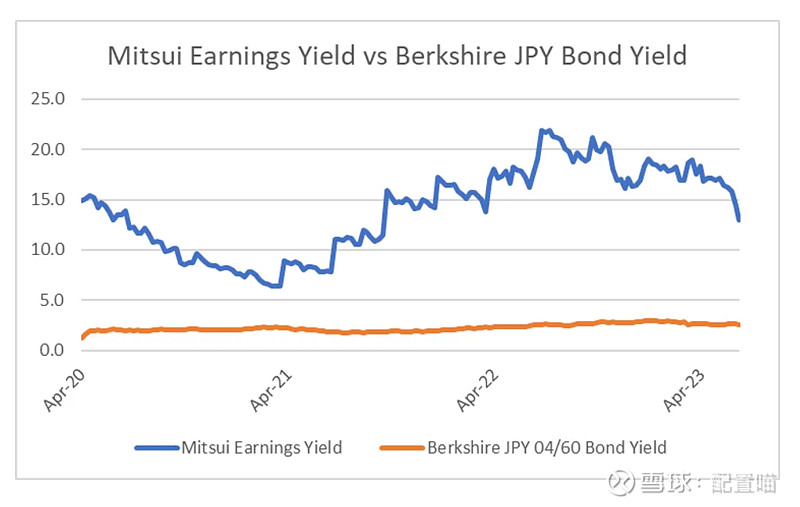

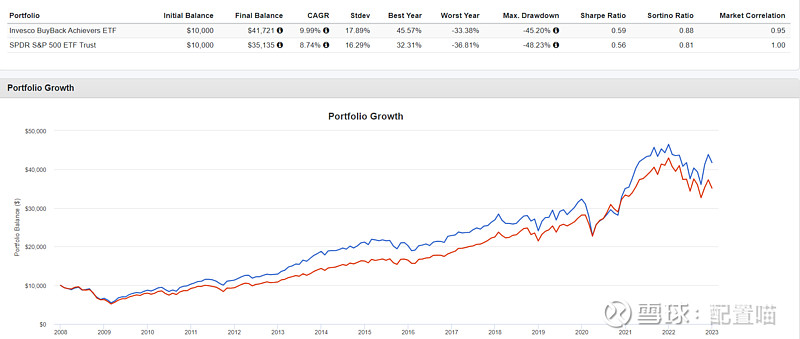

需求端讲,虽然比特币的活跃地址停滞不前,但是苹果的用户却一直增长,随着印度零售店开业,这个数据大概率会继续上行。 On the demand side, although the active address of Bitcoin has stagnated, users of 那么供给端呢? What about the supply side? 苹果的回购造成苹果股票的稀缺,在存量流量模型中,苹果的流量甚至为负,所得理论上估值没有限制。 为什么苹果如此热衷于回购,一张图可能就可以解释: Why is 当债券收益率远低于股票收益率时,回购本质上一种套利行为。 Repurchase is essentially a arbitrage when the return on bonds is much lower than the return on equities. 这就是我最近反复在讲的,即使强如苹果,依然在遵循宏观力量行事。 That's what I've been saying all along, even if it's strong like 由于长期低利率的宏观力量存在,促进了回购浪潮,回购提升股票收益率,进而推升股价。 The presence of a macro-strength with long low interest rates has facilitated the repurchase wave, which boosts equity returns and, in turn, boosts equity prices. 这套玩法集大成者为巴菲特。 This set of games is made up of Buffett. 上图为巴菲特日本之行最主要的成果,股票收益率我用的是三井,其他商贸公司也差不多,伯克希尔用自己的信用低价发行日本债券并购买日本商贸公司股份,赤裸裸的套利。 The top result of Buffett’s trip to Japan was that I used three wells in the stock rate, as did other commercial and trading companies, and Birkhshire issued Japanese bonds and purchased shares in the Japanese Merchant and Trade company with his own credit at a low price, with a naked arbitrage. 回购的力量有多大呢? What's the power of buyback? 在低利率的环境下,美股回购ETF,跑赢了标普500年化1.25%。 In an environment of low interest rates, the United States shares bought back ETF and won 要知道,回购ETF可是持有了一大堆你不认识的,千奇百怪的股票,竟然跑赢了根红苗正,一堆大牛股的标普500。 You know, buying back ETFs is a bunch of stock that you don't know, and it's a bunch of weird stock, and it's a bunch of big cattle rule 500 /a. 回到苹果,我们看到,当前债券收益率已经明显的高于股票收益率,这意味着,当前的回购等于烧钱。 Back to 宏观发生了边际变化,游戏可能也会发生边际变化 。 There has been a marginal change at the macro level, and there may be a marginal change in the game. 我不知道未来是什么样子的,但是我知道 ,推动比特币交易价格上涨与推动苹果交易价格上涨的力量是趋同的。 I don't know what the future looks like, but I know that the forces that drive the price increase in bitcoin transactions to 当你想要分析未来的时候,不妨用上述模型多去想想。 When you want to analyse the future, you might want to think more about it with the above models.

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论