1.引言

数字稳定币是数字资产世界的重要资产类别,本文对数字稳定币的历史及设计逻辑等进行了简要介绍,并以泰达币为案例分析其权属确定和定价原理。最后,总结了数字稳定币近期监管动态及未来市场发展趋势。

Digital stabilizers are important asset classes in the world of digital assets. This paper provides a brief overview of the history and design logic of digital stabilizers, and analyses the principles of tenure determination and pricing in the case of Tedar.

2.数字稳定币的“前世今生”

> > strong>2.1 Introduction to Digital Stable Currency

国际清算银行认为,数字稳定币可被定义为一种加密的数字货币,其目的是相对于特定资产或一篮子资产保持稳 定的价值。稳定币是基于代券的 (token-based); 其有效性是基于代券本身来验证的,而不是基于交易对手的身份,即基于账户(account-based)的支付。

According to the Bank for International Settlements (BIS), a digital stabilization currency can be defined as an encrypted digital currency whose purpose is to maintain a stable value relative to a particular asset or basket of assets. A stable currency is based on vouchers (token-based); its validity is based on the voucher itself and not on the identity of the counterparty, that is, payments based on accounts (account-based).

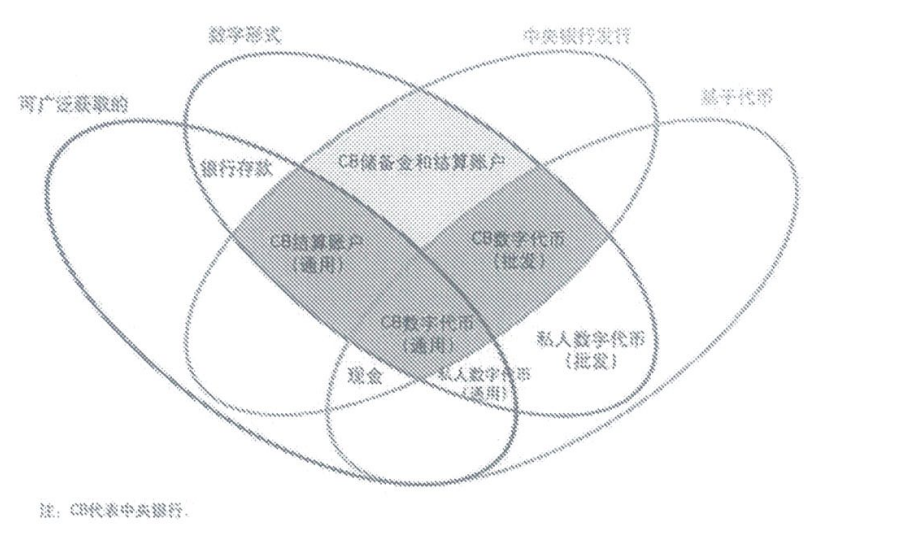

根据“货币之花”模型(图1),稳定币与比特币和其他加密货币处于同一领域,因为它们是电子货币,可以点对点交易,不需经中央银行清算。此外,需注意数字稳定币是指通过价格机制保持稳定价值的具有匿名性、去中心化、不可篡改等加密特征的加密货币。近期,G7 、IMF 和BIS成立工作组,专门负责稳定币相关业务,把由以科技或金融机构为代表推出的、以目前已有大型和(或)跨境客户为基础、有可能在全球应用的数字货币称为全球数字稳定币。而数字法定稳定币是指基于法币抵押担保的数字稳定币。

According to the “Flower of Currency” model (figure 1), stable currencies are in the same field as Bitcoins and other encrypted currencies, because they are electronic currencies that can be traded point-to-point and are not subject to liquidation by the central bank. Moreover, it needs to be noted that digital stabilizers are cryptic currencies with anonymous, de-centralized, non-roguable features that maintain their value through price mechanisms.

图1. 货币之花模型

资料来源:BIS清算银行、清华大学五道口金融学院

数字稳定币的价格稳定机制分为两种:一种是基于算法;另一种是基于抵押担保物。一是基于算法的数字稳定币没有任何资产作为背书,而是仅有利用算法根据稳定币的当前价格调节供需平衡,从而保持稳定币的汇率稳定,例如Basis对标1美元以此调节供需。二是基于抵押担保的数字稳定币,法定货币、黄金、数字资产等资产作为抵押的稳定机制,其稳定机制相较于前者有更高的确定性。

There are two types of price stabilization mechanisms for digitally stable currencies: one based on algorithms and the other on collateral guarantees. The first based on algorithms does not have any assets as endorsements, but uses algorithms only to balance supply and demand against the current price of a stable currency, thereby stabilizing the exchange rate of a stable currency, such as Basis against the dollar. The second based on mortgages is digitally stable currencies, and assets such as legal currency, gold, digital assets are used as collateral stabilization mechanisms with a higher degree of certainty than the former.

> > > strong > 2.2 History of digital stability currency development

数字稳定币最早出现于2014年7月,全球著名加密货币交易平台Bitfinex组建的泰达(Tether)公司发行了以1:1 比率锚定美元的泰达币(USDT),Tether公司承诺流通中的USDT由100%美元存款背书且已通过第三方审计泰达币最 初是为无法直接使用美元进行数字货币交易的人群设计的。由于中国在2017年清退了数字货币交易所,中国的数字货 币用户成为了USDT最重要的用户群体之一。此后,各种稳定币陆续问世。截至2023年5月,全球加密数字货币有 24071 个,总市值为 11170 亿美元,稳定币总市值约为 1318 亿美元,占加密数字货币市场份额约为 11.84%。,其中排名前两位的USDT和USDC,市值分别为828亿美元 和300亿美元,均以美元法币作为抵押,占稳定币市场的近90%。其他项目中,天秤币、摩根币等备受关注。

As a result of China’s departure from the digital currency exchange in 2017, China’s digital currency users became one of the most important users of the USDT. Since then, stable currencies have been raised at a rate of 1:1 anchoring the dollar (USDT). As of May 2023, there were 24,071 United States dollars in worldwide encrypted digital currencies, with a total market value of $111.7 billion, and the total market value of stable currencies was approximately $131.8 billion, representing about 11.84 per cent of the market share of the encrypted digital currency. Of these, the top two USDTs and USDCs, respectively, are valued at $82.8 billion and $30 billion, all of which are mortgaged in United States dollar French currency and account for nearly 90 per cent of the stable currency market.

3.案例分析:泰达币的权属确定及资产定价

> > > strong > 3.1 Thai currency profile

数字稳定币泰达币(USDT)是全球出现最早的稳定币,由泰达(Tether)公司发行。该公司是依靠世界最大数字资产交易所之一比特币交易所(Bitfinex)组建的,以1:1的美元存款抵押实现锚定。每出售一枚泰达币,泰达公司需在银行账户增加1美元作为准备金;而当客户需要兑换美元时,相应的泰达币将自动销毁,泰达公司也会收5%手续费。

Digital stability is the first stable currency in the world, issued by Tether, a company that relies on the Bitfinex, one of the world’s largest digital asset exchanges, and is anchored on a $1:1 dollar deposit collateral. For each Thai dollar sold, the company is required to increase its reserves by $1 in its bank account; and when customers need to exchange United States dollars, the corresponding Thai currency will automatically be destroyed, and the company will charge a 5% fee.

自发行以来,泰达币市场交易价在0.92-1.05美元之间波动,价格稳定的目的基本实现。其发行方式和抵押方式由发行稳定币的私人机构操作,稳定币的信用无法得到充分保证。泰达币政最初缺乏政府监管,市场对其有超发的怀疑,后期也引起了监管的关注。

Since its issuance, the Thai currency market has fluctuated between $0.92 and $1.05 and the purpose of price stability has been largely achieved. Its issuance and collateral are operated by private institutions issuing stable currency, whose credit for stabilizing the currency cannot be fully guaranteed.

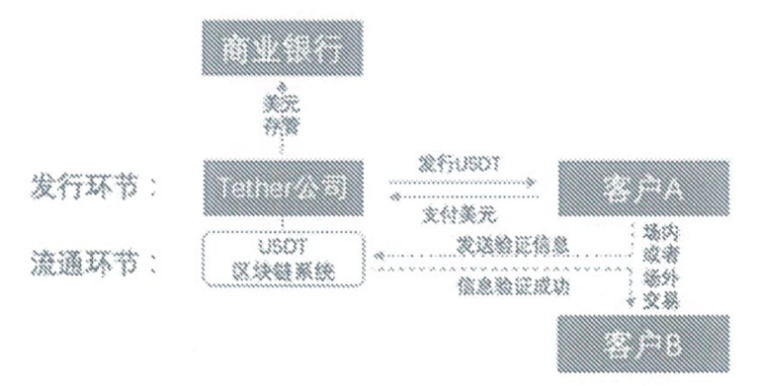

图2:USDT发行与流通示意图

资料来源:北京大学金融法研究中心

图2为具体的发行和流通流程:客户向泰达公司银行账户汇入美元,泰达公司确认收到相应资金后,从泰达公司的核心钱包向该客户的钱包转入与美元数量等同的USDT,此环节即为USDT的发行。如客户希望赎回美元,在其持有的USDT转入泰达公司核心钱包并支付手续费之后,泰达公司会向该客户的银行账户汇入与USDT数量相同的美元, 并销毁对应数量的USDT。 在货币调控层面,泰达公司自身无法通过日常的发行与赎回行为实现对USDT的价格进行干预,也不存在外部关联机构对USDT的价格操控。

Figure 2 shows the specific distribution and circulation processes: when a customer transfers the United States dollar to a bank account of Tedda, when the company acknowledges receipt of the corresponding funds, it transfers the same amount of USDT to the client’s wallet as the United States dollar. If the client wishes to redeem the dollar, when the USDT in its possession is transferred to the firm’s core wallet and paid for the transaction, the company will transfer the same amount of US$ to the customer’s bank account and destroy the corresponding amount of USDT. At the monetary control level, the company cannot itself intervene in the USDT’s price through daily distribution and foreclosure, and there is no external affiliated agency’s control over the USDT’s price.

> > > strong > 3.2 Thai currency title

每发行一个泰达币进入流通,泰达有限公司都会以1:1的比例,用等值的法定货币作为储备支持。作为支持资产的托管方,泰达有限公司扮演着一个值得信赖的第三方,负责管理这些资产。通过一个简单的实施方式,这个风险被降低了,这个方式集体减少了进行法定货币和加密货币审计的复杂性,同时增加了这些审计的安全性、可证明性和透明度。

As a custodian of supporting assets, Teda is a trusted third party responsible for managing those assets. Through a simple implementation approach, the risk is reduced, which collectively reduces the complexity of legal currency and encrypted currency audits, while increasing the security, evidencability and transparency of these audits.

整体的购买、登记、产生回报的流程可以总结为如下几步[1]:第一步:用户将法币存入泰达公司的银行账户。第二步:泰达公司生成并记入用户的Tether账户。泰达币进入流通领域。用户存入的法币数量=发行给用户的泰达币数量。第三步:用户使用泰达币进行交易。用户可以通过基于比特币的 p2p 开源伪匿名平台转移、交换和存储泰达币。第四步:用户将泰达币存入泰达公司以兑换成法定货币。第五步:泰达公司销毁泰达币并将法币发送到用户的银行账户。

The overall process of purchasing, registering and generating returns can be summarized as follows [1]: the first step: the user deposits the French currency into the bank account of Tedda. The second step: the Tether account of the user is created and recorded by Tedda. The Tidal currency enters the circulation area. The amount of French currency deposited by the user = the amount of Thai currency issued to the user. The third step: the user deals with the Thai currency. Users can transfer, exchange and store the Thai currency through a p2p platform based on bitcoin. The fourth step: the user deposits the Thai currency into the company to convert it into legal currency. The fifth step: Tedda destroys the Thai currency and sends it to the bank account of the user.

用户可以通过交易平台或其他个人在上述流程之外获得泰达币。一旦泰达币进入流通领域,任何企业或个人都可以自由交易。例如,用户可以从Bitfinex购买泰达币,后续还会有更多交易平台跟进。泰达币的储备证明配置是新颖的,因为它简化了证明流通中的泰达币总数始终由持有的等量法定货币完全支持。

Users can obtain Thai currency outside the process through a trading platform or by other individuals. Once Thai currency enters the circulation area, any enterprise or individual can trade freely. For example, users can buy Thai currency from Bitfinex, and there will be more trading platforms to follow.

> > > strong > 3.3 Tedar pricing principles

流通中的每个泰达币USDT代表我们的储备中持有的一美元(即一对一比率),这意味着当所有存在的泰达币USDT的总和(在任何时间点)正好等于我们的储备中持有的美元余额时,系统是完全储备的。

Each Titanic USDT in circulation represents a dollar (i.e. a ratio of one to one) held in our reserve, which means that the system is fully stored when the sum (at any point in time) of all that exists corresponds to the dollar balance held in our reserve.

由于泰达币存在于比特币区块链中,因此在任何给定的时间点,泰达币的可证明性和计数都是微不足道的。相反,通过公布银行余额并由专业人士进行定期审计,可以证明我们储备中持有的相应总量的美元。实现方式为:Tether Limited 通过Omni Layer协议发行所有泰达币USDT。Omni在比特币区块链之上运行,因此所有发行、赎回和现有的泰达币USDT,包括交易历史,都可以通过 Omnichest.info提供的工具公开审计。

Since tedar is present in the Bitcoin block chain, at any given point in time, the probative and numeracy of the Tedar currency is insignificant. On the contrary, it can be demonstrated by publishing bank balances and conducting periodic audits by professionals of the United States dollar of the corresponding amount in our reserves. This can be achieved by: Tether Limited issuing all Titanic USDTs through the Omni Layer agreement. Omni operates on the Bitco block chain, so that all distributions, redemptions and existing Titanic USDTs, including the history of transactions, can be publicly audited through the tools offered by Omnichest.info.

泰达币USDT的定价机制如下:泰达币USDT的价值等于通过Omnichest.info协议中约定的全部价值。钱包中会显示每日美金账户余额,当Tether Limited中的美金账户余额大于等于泰达币USDT的余额时,泰达币USDT完全受保障。Tether Limited并不能立即创建一个完全去信任化的加密货币系统。主要是因为用户必须信任Tether Limited 和相应的传统银行机构作为储备资产的托管人。然而,几乎所有的交易所和钱包(假设他们持有美元/法币)都存在同样的弱点。这些服务的用户已经面临这些风险。

The price-fixing mechanism for Titanic USDT is as follows: the value of the Titanic USDT is equal to the full value agreed through the Omnichest.info agreement. The wallet shows the balance of the daily dollar account. However, almost all exchanges and wallets (assuming that they hold dollars/dollars) have the same weaknesses. Users of these services are already exposed to these risks.

泰达币USDT构成了目前存在的第一种基于比特币的法定挂钩加密货币。泰达币USDT基于比特币区块链,这是现有的最安全和经过充分测试的区块链和公共账本。泰达币USDT以1:1的比率完全保留,完全不受市场力量、定价或流动性限制的影响。泰达币USDT具有简单可靠的储备金证明实施机制,并定期接受专业审计。基础银行关系、合规性和法律结构作为储备资产托管人和泰达币USDT发行人提供了安全的基础。

The Titanic USDT constitutes the first legally established and encrypted currency based on bitcoin. It is based on the Bitcoin block chain, which is the safest and well-tested chain of blocks and public accounts available. The Titanic USDT is retained at a ratio of 1:1 in its entirety, completely independent of market forces, pricing or liquidity restrictions.

4.数字稳定币的发展趋势

> > strong> 4.1 Regulatory movement

整体而言,自2019年,世界各主要国家和地区对稳定币的监管才逐渐重视。而在此之前,稳定币一般与其它的数字资产一起受到统一监管,而不是独立监管。目前,世界各主要国家和地区在加密货币(包括稳定币)的监管上持有不同的立场,各主要国家和地区的监管框架和立法阶段也不一致。以下简要总结稳定币在美国、新加坡、中国香港、和欧盟[2]的主要监管动态:

Overall, since 2019, the regulation of currency stability in major countries and regions of the world has come to the fore. Until then, it has generally been regulated together with other digital assets, rather than independently.

美国方面,2019年6月,Libra的推出引起了监管机构对稳定币监管的重视。监管机构担心其所带来的比如洗钱、金融稳定风险等一系列问题 。2021年11月,美国总统金融市场工作组(PWG),美国联邦存款保险公司(FDIC)和美国国家银行监察署(OCC)发布了一份关于稳定币的报告(PWG报告),呼吁迅速采取立法行动,限制向受保险存款机构发行稳定币,并实施稳定币的审慎监管,以应对对更广泛金融体系的风险[3] 。2022年3月,参议员 Bill Hagerty在参议院提交《The Stablecoin Transparency Act》;该法案旨在为储备资产设定储备标准,并要求稳定币发行者报告其储备情况[3]。2022年4月6日,参议员Pat Toomey发布了《Stablecoin TRUST Act》的讨论草案。该法案将为银行和非银行公司提供三种许可选项,以在新的监管框架下发行“支付稳定币”[3]。2022年5月,美国财政部长Janet Yellen出席参议院听证会时发表了对稳定币的看法,并敦促国会在年底之前通过对稳定币的联邦监管[4] 。2022年12月21日,美国引入了《Stablecoin TRUST Act of 2022》,该法案提供了关于稳定币发行以及相关消费者保护的监管框架[5] 。2023年7月,国众议院金融服务委员会批准了《Clarity for Payment Stablecoins Act》,如果生效,该法案将为支付稳定币的发行和监督建立监管框架[6] 。

For its part, in the United States, the launch of Libra in June 2019 drew the attention of regulators to the need for stable currency regulation. Regulators are concerned about the range of problems they pose, such as money laundering, financial stabilization risks, . In November 2021, the President of the United States Financial Markets Working Group (PWG), the United States Federal Deposit Insurance Corporation (FIDC) and the United States National Banking Inspectorate (OSBC) issued a report (PWG report) calling for prompt legislative action to limit the issuance of stable currency to insured deposit institutions and to implement prudent regulation of stable currency to address the risks to the wider financial system. In March 2022, Senator Bill Hagerty presented the Senate with the Stablecoin Transparency Act, which aims to set reserve standards for reserve assets and requires stable currency issuers to report their reserves

新加坡方面,2022年10月,新加坡金融管理局(MAS)发布了一份关于稳定币相关发行的整体监管方法的公开咨询文件,重点强调了将强加给这类活动的关键要求;该咨询截止于2022年12月。在2023年7月,MAS宣布了旨在隔离客户的加密资产并增强客户保护的措施[7] 。2023年8月MAS宣布了最终版的监管框架,旨在确保在新加坡受监管的稳定币具有高度的价值稳定性。新加坡的稳定币框架使其成为全球首批具有此类规定的司法辖区之一。

Singapore, for its part, in October 2022, the Singapore Financial Authority (MAS) issued a public consultation paper on the overall regulatory approach to the stabilization of currency-related issuances, highlighting the key requirements that would be imposed on such activities; the consultation was until December 2022. In July 2023, MAS announced measures aimed at segregating customer encryption assets and enhancing customer protection. . MAS announced the final version of the regulatory framework in August 2023, aimed at ensuring a high level of value stability in Singapore’s regulated stable currency.

中国香港方面,2022年1月,香港金融管理局发布了一份有关将香港监管框架扩展至稳定币的讨论文件,邀请业界和公众就加密资产和稳定币的监管模式提供意见。该讨论文件阐述了香港金管局就加密资产,尤其是作为支付工具的稳定币,监管模式的构思[8] 。2023年1月,香港金融管理局发布了加密资产和稳定币讨论的咨询总结,提议将涉及稳定币的相关活动纳入到监管范围,对预期监管的范围和要求做出了陈述[9] 。2023年12月,香港财政司和香港金融管理局联合发布了一份有关香港监管稳定币发行方的立法提案的公开咨询文件,邀请公众和利益相关方提供反馈。其中的重点包括引入新法规实施许可制度,并规定只有特定持牌机构才能向零售投资者销售法定货币挂钩的稳定币(法币稳定币)。香港金融管理局计划提供为期6个月的过渡期安排[10] 。

In Hong Kong, China, in January 2022, the Hong Kong Financial Authority issued a discussion paper on the extension of the Hong Kong regulatory framework to currency stability, inviting industry and the public to comment on the regulatory model for cryptographic assets and currency stability. The discussion paper set out the Hong Kong Monetary Authority’s conceptualization of the regulatory model [8] for cryptographic assets, in particular as a payment tool. In January 2023, the Hong Kong Financial Authority issued an advisory summary of the discussion on cryptographic assets and currency stability, proposing that activities related to currency stabilization should be included in the regulatory framework, with statements on the scope and requirements of expected regulation.[9]

欧盟方面,2020年9月,欧洲执行委员会提出了欧盟首个针对包括稳定币在内的加密资产全面监管的框架:Markets in Crypto-Assets Regulation(MiCA)草案。2021年2月,欧洲央行、欧洲经济和社会委员会对MiCA法案提出了一些意见和建议意见。2021年6月,欧洲数据保护监督员意见、欧洲议会和理事会达成临时协议。2022年10月, 欧洲议会委员会通过MiCA法案。2023年6月,MiCA生效[11] 。MiCA为加密资产制定了统一的欧盟市场规则。该法规涵盖了目前未受现有金融服务立法监管的加密资产。对于发行和交易加密资产的主要规定涵盖了透明度、披露、交易的授权和监管。新的法律框架将通过监管加密资产的公开发行和确保消费者更好地了解其相关风险,从而支持市场的完整性和金融稳定[12]。

For its part, in September 2020, the European Executive Committee presented the first EU framework for comprehensive regulation of cryptographic assets, including currency stability: the draft Markets in Crypto-Assets Regulation (MiCA). In February 2021, the European Central Bank and the European Economic and Social Council made a number of observations and recommendations on the MiCA Act. In June 2021, the European Data Protection Supervisor agreed on an interim agreement between the European Parliament and the Council. In October 2022, the European Parliament Commission adopted the MiCA Act. In June 2023, MiCA came into force .

> > > strong > 4.2 Market outlook

数字稳定币一直备受市场和监管的关注。2023年,硅谷银行倒闭引发的一系列金融风险事件,使得超过1200亿美元的稳定币市场格局重塑。目前,最大的法定稳定币Tether和USDC与其供应趋势相反。以Tether为例,其业务因2023 年利率上升而大幅增长,同时还计划在日本和巴西等地进行海外扩张。这体现并且巩固了其价值主张和与数字资产生态系统的强大产品市场契合度。此外,各大金融机构也开始发行稳定币,争抢市场,例如, PayPal的PYUSD、法国兴业银行发行的欧元支持的EURCV以及Aave的GHO等协议原生稳定币。这种趋势不仅体现了挂钩法币或加密货币稳定币的多样性,也体现了发行机构的多元化。另外,代币化国库券等链下资产和ETH和流动质押代币(LST)等链上抵押品支持的计息稳定币也将获得更多关注。

In 2023, the collapse of Silicon Valley Bank triggered a series of financial risk events that allowed more than $120 billion in stable currency market patterns to be reshaped. Currently, the largest statutory stabilizers, Tether and USDC, are contrary to their supply trends. For example, Tether, whose business grew significantly as interest rates rose in 2023, and plans to expand overseas, such as in Japan and Brazil.

[1]Tether: Fiat currencies on the bitcoin blockchain.Available at: https://assets.ctfassets.net/vyse88cgwfbl/5UWgHMvz071t2Cq5yTw5vi/c9798ea8db99311bf90ebe0810938b01/TetherWhitePaper.pdf (Accessed: 24 January 2024).

[2]浅谈全球稳定币监管(二):美国、新加坡、香港稳定币立法趋势比较. Available at: https://www.junhe.com/legal-updates/2163 (Accessed: 25 January 2024).

[3]浅谈全球稳定币监管. Available at: https://www.junhe.com/legal-updates/1812 (Accessed: 25 January 2024).

[4]对比各国稳定币监管现状,展望未来政策走向.Available at: https://new.qq.com/rain/a/20230925A054RR00 (Accessed: 25 January 2024).

[5]United States of America: Introduced Stablecoin TRUST Act of 2022.Available at: https://digitalpolicyalert.org/event/8202-introduced-stablecoin-trust-act-of-2022 (Accessed: 25 January 2024).

[6]S.5340 - 117th Congress (2021-2022): Stablecoin Trust Act of 2022. Available at: https://www.congress.gov/bill/117th-congress/senate-bill/5340?s=1&r=2 (Accessed: 25 January 2024).

[7]浅析虚拟资产全球主要监管发展格局. Available at: https://www.techflowpost.com/article/detail_14099.html (Accessed: 26 January 2024).

[8]加密资产和稳定币讨论文件的总结 (2023) 香港金融管理局. Available at: https://www.hkma.gov.hk/gb_chi/news-and-media/press-releases/2023/01/20230131-9/ (Accessed: 26 January 2024).

[9]加密资产和稳定币的讨论文件 (2022) 香港金融管理局. Available at: https://www.hkma.gov.hk/gb_chi/news-and-media/press-releases/2022/01/20220112-3/ (Accessed: 25 January 2024).

[10]Hong Kong Monetary Authority (2023) Eddie Yue on stablecoins – regulating issuers to accord protection to users, Hong Kong Monetary Authority. Available at: https://www.hkma.gov.hk/eng/news-and-media/insight/2023/12/20231227/ (Accessed: 25 January 2024).

[11]详解欧盟 MiCA 法案:将成为全球加密监管“示范法”(2022). Available at: https://new.qq.com/rain/a/20221130A09F8400 (Accessed: 25 January 2024).

[12]Markets in crypto-assets regulation (MICA). Available at: https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica (Accessed: 25 January 2024).

[13]一文读懂:深度解析全球稳定币2023现状与监管. Available at: https://www.qianba.com/news/p-441745.html (Accessed: 25 January 2024).

[14]Navigating the global crypto landscape with PWC: 2024 outlook, PwC. Available at: https://www.pwc.com/gx/en/industries/financial-services/fintech-survey/crypto-services/navigating-the-global-crypto-landscape-with-pwc-2024-outlook.html (Accessed: 24 January 2024).

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论