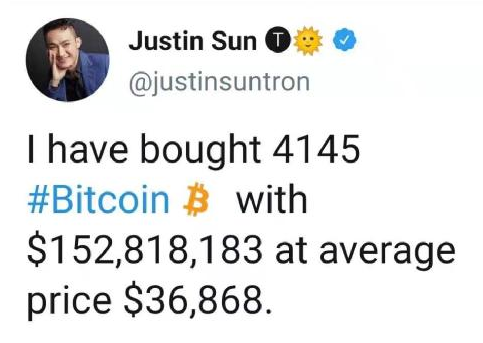

波场币创始人孙宇晨抄底

>

豪掷18.5亿

{\bord0\shad0\alphaH3D}1.85 billion {\bord0\shad0\alphaH3D}

在比特币价格大跌之际,波场币(TRON)创始人孙宇晨在社交平台上发文支持这一加密货币。

, at a time when bitcoin prices were falling, Sun Woo, founder of Tron, wrote on social platforms to support this encrypted currency.

他表示自己已经“逢低买入”,用36868美元的平均价格购买了价值1.53亿(约合人民币9.8亿)美元的比特币,用2509美元的平均价格购买了价值1.35亿(约合人民币8.68亿)美元的以太坊。

he said he had & & ldquo; bought & rdquo at a low buy-in; purchased $153 million (approximately RMB 980 million) in bitcoins at an average price of $3686868, and purchased $135 million (approximately RMB 868 million) at an average price of $259.

如果其言论属实,这意味着他已斥资9.8亿人民币抄底比特币,斥资8.6亿人民币抄底以太坊,总共斥资约18.5亿人民币抄底加密货币。

if his statement is true, this means that he has already spent 980 million RMB on a copy of the Debit, 860 million RMB on a copy of the bottom and a total of about 1.85 billion RMB on a copy of the encrypted currency.

“女巴菲特”:比特币仍将涨至50万美元

马斯克也发声了!

当地时间周三,加密货币市场大幅震荡之际,有“女巴菲特”、“牛市女皇”之称的Cathie Wood表示,仍然对比特币充满信心,依然预期比特币能涨到50万美元。

但她还表示,尽管拥有长期看好的信念,但在反弹前,比特币和其他数字货币可能还有更大下行空间;当市场非常情绪化时,你永远不知道低点有多低。

马斯克也发声了。

他在推特上发布了一句十分简短的话,被不少人解读为,特斯拉手中拥有钻石,而钻石大概率在暗示比特币的价值。

, with a very brief tweet, was interpreted by a number of people as Tesla's possession of diamonds, which probably implied the value of bitcoin.

美股也现大逆转

道指反弹400点

比特币价格大逆转之际,美股也出现大逆转。开盘后不久,三大股指均跌超1%,但盘中震荡上行,收盘跌幅均收窄至0.5%以内。

At a time when the price of bitcoin is reversible, the United States shares are also reversible. Soon after the opening, the three fingers fell by more than 1%, but the middle swings were reduced to within 0.5%.

其中,道指盘中一度触及33473点的低点,但收盘报33896点,距离日内低点反弹423点。

截至收盘,道指跌0.48%,报33896.04点;纳指跌0.03%,报13299.74点;标普500指数跌0.29%,报4115.68点。

dropped by 0.48 per cent, reporting 33896.04; 0.03 per cent, reporting 13299.74; and 0.29 per cent, reporting 4115.68, the standard 500 index.

三大股指盘中走势受拖累的原因,除加密货币价格的震荡外,还包括美联储会议纪要的发布。

北京时间凌晨两点左右,美联储最新会议纪要发布,会议纪要暗示美联储官员将讨论收紧政策,道指随即跳水,再度跌超1%,但临近尾盘跌幅缩小。

Beijing time, at about 2:00 a.m., the Federal Reserve's latest minutes were published, which suggested that Fed officials would discuss tightening policies and then jumped again by more than 1 per cent, but that the fall near the tail was reduced.

4月27-28日的美联储会议纪要显示,官员们在4月会议上对国内经济复苏持谨慎乐观态度;部分与会者认为,如果经济继续朝着联邦公开市场委员会的目标迅速发展,在未来几次会议上的某个时候开始讨论调整资产购买速度的计划可能是适宜的做法;系统公开市场账户(SOMA)管理者指出未来几个月隔夜利率的下行压力可能导致需要考虑适度调整管理利率。

The minutes of the Federal Reserve Meeting of 27-28 April indicated that officials were cautiously optimistic about the domestic economic recovery at the April meeting; some participants felt that it might be appropriate to start discussing plans to adjust the speed of asset purchases at some point in the coming meetings if the economy continued to move rapidly towards the objectives of the Federal Open Market Committee; and the managers of the System Open Market Account (SOMA) pointed out that downward pressure on overnight interest rates in the coming months might lead to the need to consider moderate adjustment of management interest rates.

但也有与会者指出,经济可能还要一段时间才能向着充分就业和物价稳定目标取得进一步的实质性进展。

值得注意的是,美联储的这份会议纪要反映的是美联储馆员4月27日至28日的观点,而在这之后,不及预期的4月就业数据和零售数据才发布,当时官员的观点显然没有考虑上到这些数据所反应的经济复苏复杂性,因而观点有些“过时”。这或许是市场对这份美联储纪要没有做出过多反应的重要原因。

分析师Chris Anstey认为,到目前为止,美联储似乎还没有足够的理由或证据支撑它在6月份发出缩债即将到来的强硬信号。考虑到4月份令人失望的就业和零售数据,情况更是如此。

分析师Cameron Crise认为,讨论缩减购债是正常的。他表示,美联储会议纪要反映的是在最近的非农就业和通胀报告发布之前召开的一次会议,因此从某种意义上说,会议的观点已经有点旧了。有关缩减购债时机的新闻标题正在引起一连串反映,但对于市场来说这不应是出人意料的。你仔细想想,如果他们不在即将到来的会议上开始讨论这个问题,那才是不寻常的。

特斯拉再收跌,已回调37%

“女巴菲特”出手加仓

持有大量比特币的特斯拉,股价未能随着比特币价格的反弹而收涨。

holds a large bitcoin Tesla, and shares have not recovered with the rebound of bitcoin prices.

周三,特斯拉再收跌,截至收盘,特斯拉跌近2.5%,股价报536.46美元,距离年内900.4美元的股价高点已回调37%。与股价触及年内高点时相比,特斯拉市值已回调3176亿美元,约合2万亿人民币。

Wednesday, Tesla fell again, and as of the closing, Tesla fell by nearly 2.5 per cent, with a stock offer of $536.46, a return of 37 per cent from the high stock price of $900.4 a year. The market value of Tesla has returned $317.6 billion, or about RMB 2 trillion, when the stock price reached the high point of the year.

消息面上,当地时间本周二,Electrek援引知情人士报道称,特斯拉有超过10000辆从弗里蒙特(Fremont)工厂出厂的电动汽车,因缺失零部件而无法交付给用户。

知情人士称,有1万至2万辆汽车因缺少未知部件而被密封保存,部分Model 3和Model Y下线时仍然保留密封保存标签;这个问题很小,可以由服务团队解决,但会造成车辆交货延迟;最坏的情况是,部分车辆的交付时间可能推迟到第三季度,特斯拉第二季度的业绩将受影响。

据富途,ARK Investment Management旗下旗舰基金ARK创新ETF和ARK自主技术与机器人技术ETF周二增持超过47000股特斯拉。虽然价值仅仅2700万美元,但这是Ark自4月以来首次购买特斯拉。

is rich, with ARK Investment Management's flagship funds ARK Innovation ETF and ARK AutoTechnology and Robotic Technology ETF gaining more than 47,000 shares of Tesla on Tuesdays. Although worth only $27 million, this is the first time Ark has purchased Tesla since April.

特斯拉是美股最大做空目标

Tesla's the biggest goal of the U.S.

空头头寸接近亚马逊和微软之和

/span

据雅虎财经,特斯拉目前是美股市场上最大的做空目标,分析公司S3 Partners的预测分析董事总经理Ihor Dusaniwsky表示,这是近年来全球规模最大的空头目标。

According to Yahoo Finance, Tesla is currently the biggest target in the US stock market, and Ihor Dusaniwsky, Managing Director of Prediction Analysis for Analysis Company S3 Partners, states that this is the largest goal in recent years.

S3 Partners的数据显示,截至5月13日,特斯拉的空头头寸达到225亿美元。正如Dusaniwsky所指出的,这几乎相当于亚马逊与微软加起来的空头头寸。

《大空头》原型也在做空特斯拉。本周,电影《大空头》原型迈克尔伯里旗下基金Scion Asset Management发布最新13发报告,该报告显示,该基金持有价值逾5亿美元的特斯拉空仓。

综合每日经济新闻、和讯网、观察者网

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论