近日,伴随着黄金、白银价格屡创新高,有“数字黄金”之称的比特币也没辜负期望,站上一万美元大关。在主流币和山寨币的联动上涨下,加密货币市场持续走强,成为一道靓丽风景线,在这一波牛市表演中,毫无疑问,以太坊走在了队伍最前面。

In recent days, the price of gold and silver has been innovative, with &ldquao; digital gold & & rdquao; and the so-called bitcoin has not failed to meet expectations, standing at the threshold of 10,000 dollars. With the rise in the association of mainstream and bogus currency, the market for encrypted money has continued to grow and become a beautiful landscape, and there is no doubt that, in this bovine performance, Ether is at the forefront of the ranks.

7月25日,ETH开启暴涨,一路领涨主流币,直到7月28日,ETH刷新年内高点,最高触及333美元,距离2019年高点366美元仅差33美元。加密大牛市真的来了吗?以太坊的上涨空间还有多大?能否再次坐实“牛市发动机”的称号?

On July 25, the ETH started a surge, leading the mainstream currency up until July 28, when the ETH hit the height of the update year with a peak of $333, which is only $33 short of the height of $366 in 2019.

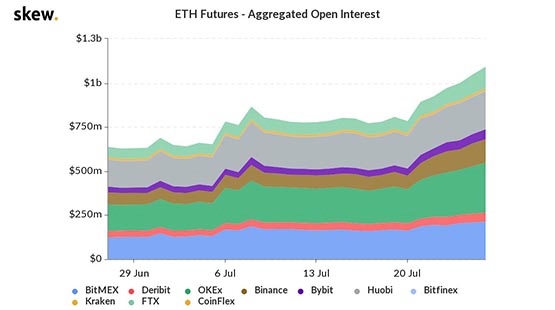

根据市场分析公司Skew的数据,以太坊期货的未平仓合约总价值已超过10亿美元大关,创历史新高。

According to the market analysis company Skew, the total value of the unsettled contracts in the Taiwan futures has reached an all-time high of over $1 billion.

ETH期货在2020年初便开始上涨,总额接近9亿美元。然而在新冠疫情以及美国股市崩盘的影响下,加密货币市场随之“沦陷”。到3月中旬,以太坊期货的未平仓头寸已降至不足4亿美元。但是,在最近以太坊价格上涨的刺激下,以太坊期货的未平仓合约开始持续上涨。

ETH futures began to rise in early 2020, amounting to nearly $900 million. However, under the influence of the new crown epidemic and the collapse of the United States stock market, the encoded currency market followed by “ fall & &rdquao; by mid-March, the unsettled position of the Taiwan futures had fallen to less than $400 million.

自6月20日以来,以太坊期货的未平仓合约增加了近30%,从不到8亿美元增加到近11亿美元。未平仓合约是一项重要指标,因为它衡量的是发行人和买家在期货合约中仍处于到期日的原始金额。相比之下,期货交易量衡量的是在给定时期内正在交易的现有期货合约(可以像任何其它衍生工具一样互换)的价值。加密货币交易所OKEx目前保持着最大的未平仓头寸,超过2.9亿美元。

Since June 20, there has been an increase of nearly 30%, from less than $800 million to nearly $1.1 billion, in the unsettled futures contract. An important indicator, because it measures the original amount that issuers and buyers are still on maturity in futures contracts.

以太坊期货累计未平仓权益 来源:Skew

期货合约是双方在未来预定的时间点,以固定价格买卖给定资产的协议。合约买方期望资产(如ETH)的价格与执行时的合同价格不同,从而在履行义务时获得即时利润。而合同发行人从他们出售的合同中赚取一笔费用,称为溢价,预期该费用将大于购买或出售资产以履行其义务的损失。

The futures contract is an agreement between the parties to purchase and sell a given asset at a fixed price at a predetermined point in the future. The buyer expects the asset (e.g. ETH) price to be different from the contract price at the time of execution, thereby earning an immediate profit at the time of performance.

尽管以太坊期货正在上涨,但与比特币相比,还有很长的路要走。比特币期货未平仓头寸在7月21日突破了40亿美元大关,但有一点值得注意的是,自最近价格开始上涨以来,以太坊期货未平仓合约涨幅达到了比特币期货的2倍。随着以太坊开始引领新的市场周期,以太坊期货未平仓合约价值可能很快就会超过比特币,成为更值得关注的资产。

Although the futures are rising, there is still a long way to go compared to that of Bitcoin. The price of the futures of Bitcoin has broken the $4 billion mark on 21 July, but it is worth noting that since the recent price rise, the price of the futures of Taiya has increased twice as much as the price of the futures of Bitcoin.

伴随着ETH价格的暴涨和近期以太坊2.0的顺利进展,投资者对去中心化协议的长期潜力充满信心,这是一个里程碑。期货合约是属于更复杂更专业交易者的领域,这表明“聪明的钱”(Smart Money)对于以太坊下一步的发展方向非常看好。

With the boom in ETH prices and the recent successful progress of Etheria 2.0, investors’ confidence in the long-term potential of decentralisation agreements is a milestone. Futures contracts are an area of more complex and professional traders, indicating that & ldquo; smart money & & rdquo; and Smart Money is very good for Ether’s next course.

那么,以太坊能否一路高歌猛进,成为这波牛市之王?

So, is it possible for Etherto to go all the way to be king of this bovine?

“牛市之王”涨势能否延续?

& ldquao; King of the Cattle & rdquao; can the boom continue?

尽管投资者们对这一轮牛市行情期待已久,但不得不说,以太坊的价格表现超出了大多数人的预期。

Although investors have long been looking forward to this bull market, it has to be said that performance at too much price has exceeded most expectations.

ETH/USD K线图 来源:OKEx

根据OKEx ETH/USD行情显示,截至7月28日,以太坊价格最高触及333美元,距离2019年高点366美元仅差33美元。以太坊在过去7天里暴涨了40%,不免令人想起以太坊在2017年牛市时的强劲。

According to OKEx ETH/USD, as of July 28, the highest price was US$ 333 as far as US$366 from 2019. In the last seven days, the Etherwood skyrocketed by 40%, reminiscent of Ether’s strength at the cattle market in 2017.

不过,在暴涨背后,不可避免地,某些指标也已经发生了显著的变化。

However, behind the surge, certain indicators have inevitably changed significantly.

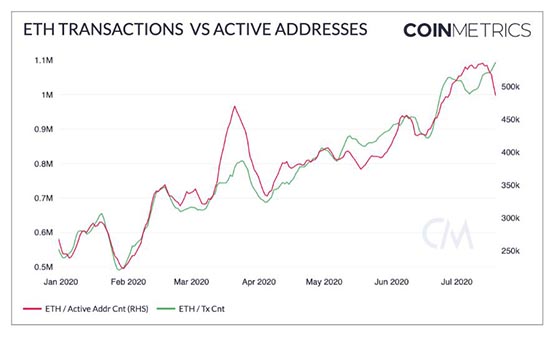

据Santiment分析,以太坊的价格上涨导致6月17日以来首次出现每日活跃地址不足的情况,而每日活动地址不足通常意味着可能出现回调。不过,以太坊目前如此强劲的势头也可能预示着更高位置的盘整。

According to Santiment, the price increase in Etheria has led to the first shortage of active daily addresses since 17 June, which usually means that there may be a backsliding. However, the current momentum in Ether is likely to portend a higher profile.

需要注意的是,每日活跃地址的不足并不意味着活跃地址的减少,而是表明以太坊的价格远高于活跃地址进入网络的速度。几周前,以太坊的活跃地址数超过了50万(7天移动平均数),这是2017年ICO热潮以来的首次突破。

It is important to note that the lack of a daily active address does not mean a reduction in the number of active addresses, but rather indicates that the cost of an active address is much higher than the rate of access to the network. A few weeks ago, the number of active addresses in an active location exceeded 500,000 (an average of 7 days of movement), the first breakthrough since the ICO boom in 2017.

2020年以太坊交易量&活跃地址数 来源:Coinmetrics

无论是以太坊价格的强劲走势还是以太坊网络使用量的猛增,不可否认DeFi是背后巨大的推手。但同时由于网络出现拥堵,伴随着交易费用的飙升,以太坊上的活跃地址有所下降。

Whether it is the strong trend in the prices or the dramatic increase in the use of the network, it cannot be denied that DeFi is a huge pusher. At the same time, there has been a decline in the active location of the family as a result of the network’s congestion, which has been accompanied by a sharp rise in transaction costs.

根据全球加密货币资产披露平台Xangle对DeFi的最新研究,以太坊网络的交易量和费用在2020年第二季度出现巨大增长,每日ETH的成交量飙升61.7%,交易量超过100万;另一方面,交易费飙升了687.9%。Xangle表示,这种波动与2017年末和2018年初牛市期间的峰值极为接近。

According to the latest study of DeFi by the Global Encrypted Monetary Assets Disclosure Platform Xangle, the volume and cost of transactions on the Taiwan network increased dramatically in the second quarter of 2020, with 61.7 per cent of daily ETH transactions and more than 1 million transactions; on the other hand, transaction costs rose sharply by 687.9 per cent, Xangle said that the volatility was very close to the peak of the cattle market in late 2017 and early 2018.

以太坊期货未平仓合约创历史新高,以太坊网络交易量持续飙升,这一切是否是大牛市的预兆?此外,根据此前媒体报道,以太坊2.0有望在11月启动,再加上DeFi市场的加持,ETH能否再次刷新牛市纪录?摆在我们眼前的市场想象空间无限大。

Is it a sign of the New Year’s New Year’s worth of futures contracts and the ever-highest increase in the number of deals on the Taiyo network? Moreover, according to previous media reports, it is expected that the New Year’s Day 2.0 will be launched in November, and with the increased ownership of the DeFi market, ETH will be able to refresh the cattle market record again?

以上就是期货未平仓合约创历史新高,以太坊能否再成牛市之王?的详细内容,更多关于以太坊期货未平仓合约创历史新高的资料请关注脚本之家其它相关文章!

This is a record high for futures and futures contracts. Is it possible to become the king of cattle? For more information on futures and contracts in the futures, please pay attention to other relevant script house articles!

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

发表评论